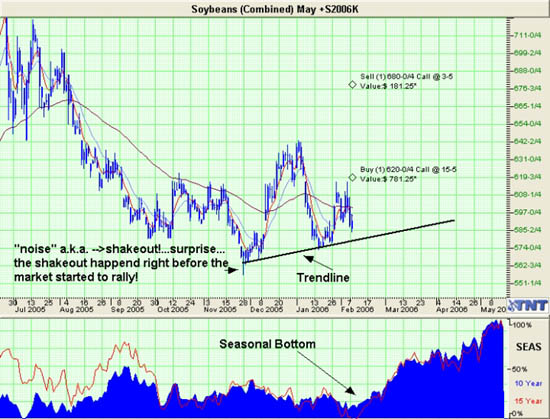

- Market: May 2006 Soybeans (SK6)

- Tick value: 1 cent = $50.00

- Option Expiration: 04/21/06

- Trade Description: Bull Call Spread

- Max Risk: $600

- Max Profit: $2400

- Risk Reward ratio 4:1

Buy one May 2006 Soybean 620 call, sell one May Soybean 680 call, for a combined cost and risk of 12 cents ($600) or less to open a position.

Technical/Fundamental Explanation

Soybeans have been on both sides of 6.00 for some time now. Fundamentals in grains, like most markets, often conflict each other from one report to the next. Technicals, on the other hand, should show similar things no matter what you are looking at. This case is no exception. Soybeans have a very well established seasonal tendency to rally beginning mid February and lasting until about May. This is not an accident. Prices rise due to uncertainty about the current crop that is either in or about to be in the ground. Uncertainty such as weather issues, planting intentions, normal supply demand issues, size of southern hemisphere harvests, to name just a few. Current COT (Commitment of Traders) data show small specs. with a large short position on at this time. This is of often a contrary indicator so look for beans to favor bull moves rather than bear ones while these small under funded traders get blown out. Today's action in beans is a perfect example of this happening in real time. This is a simple bull call spread that buys a near the money option and sells an out of the money option near a resistance point.

Profit Goal

Max profit assuming a 12 cent fill is 48 cents ($2400) giving this trade a 4:1 risk reward ratio. Max profit occurs at expiration with Soybean trading anywhere above 680. The trade is profitable at expiration if Soybeans are trading anywhere above 632.00(break even point).

Risk Analysis

Max risk assuming a 12 cent fill is $600. This occurs at expiration with the Soybean trading below 620.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.