| The Wagner Daily ETF Report For December 18 |

| By Deron Wagner |

Published

12/18/2013

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For December 18

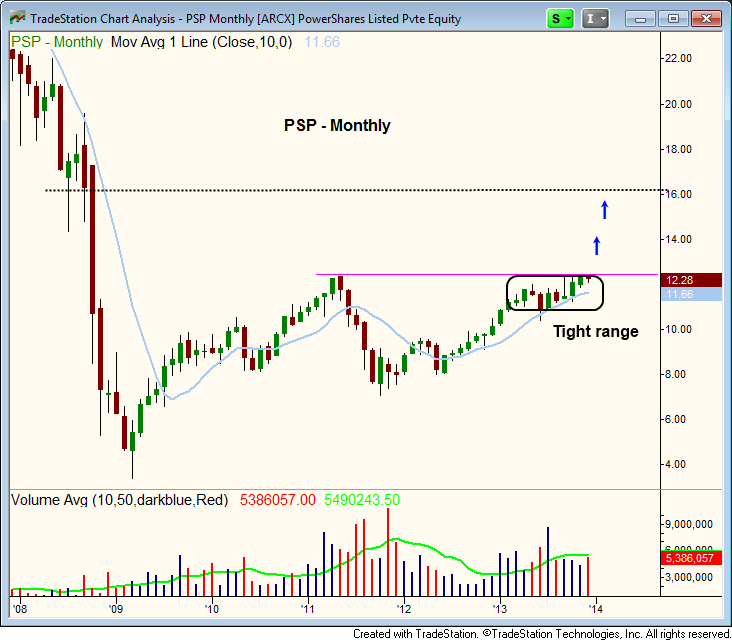

Since stalling out at the prior highs of 2011, PowerShares Listed Private Equity ($PSP) has been consolidating in a tight range. If $PSP can clear the highs of 2011, it could potentially run to $16 with little overhead resistance. This is shown on the long-term monthly chart below:

On the shorter-term daily chart below, we see a pretty tight range has developed above all the major moving averages. The price action has tightened up nicely, along with higher lows in the base. The 20-day EMA has crossed back above the 50-day MA (bullish moving average crossover) and both indicators are trending higher. The 50-day MA is also above the 200-day MA, with the 200-day MA in a clear uptrend:

$PSP can be purchased on a breakout above the high of it range, but we prefer to buy a little early in anticipation of follow-through from the breakout. Regular subscribers of our stock and ETF pick newsletter should note our preset, exact entry, stop, and target prices for this trade setup in the "watchlist" section of today's report.

Over the past two days, the small cap Russell 2000 has shown relative strength while the S&P 500 has struggled. This subtle shift (if it continues) could suggest that small cap stocks are ready to lead the broad market higher after taking a back seat to the S&P 500 and Dow in October and November. However, the upcoming week between Christmas and New Year is typically the slowest of the year.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|