| The Wagner Daily ETF Report For January 6 |

| By Deron Wagner |

Published

01/6/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For January 6

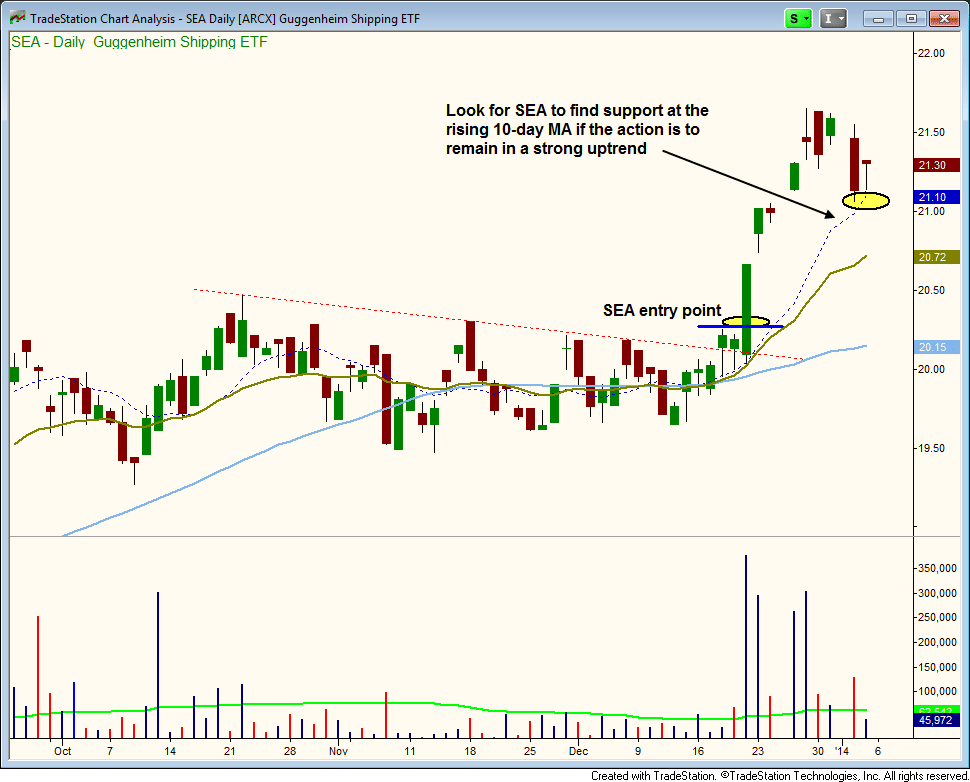

Guggenheim Shipping ETF ($SEA) is in pullback mode after a breaking out from a base on big volume two weeks ago. The first touch of a rising 10-day moving average is often a decent buy point when the initial breakout entry is missed. The 10-day moving average should provide support if the strong uptrend is to remain intact. We are still long from our breakout entry above the two-day high on December 20:

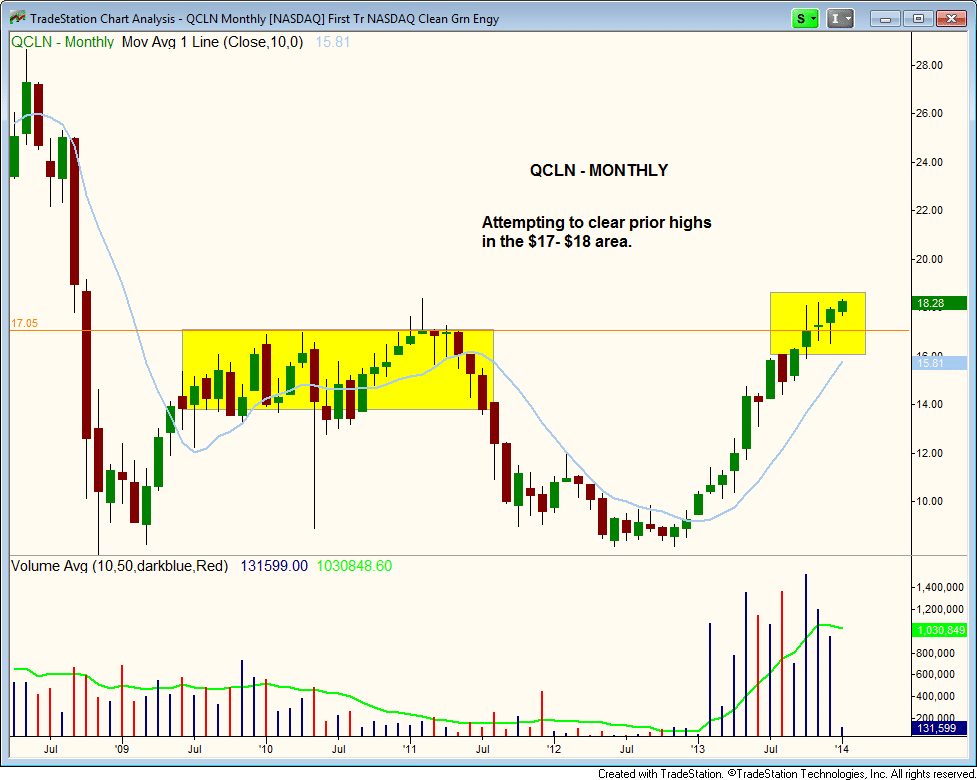

First Trust NASDAQ Clean Edge ETF ($QCLN) is attempting to breakout above prior highs on the monthly chart. The volume was quite impressive during the rally in 2013, so the price action should eventually follow through to the upside:

Dropping down to the shorter-term daily chart, wee see that $QCLN is back above the 50-day MA and is testing the highs of the current range. Ideally, we would like to see the price action back off the highs and chop around for a week or two above the 20-day exponential moving average (form a tight handle). Also, the 20-day exponential moving average is now back above the 50-day moving average, which has remained in an uptrend through the correction:

The stock market remains vulnerable to more short-term selling, especially if the 10-day moving averages on the daily charts of the main averages fail to provide support. But overall, market conditions remain strong and our timing model is still in buy mode.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|