| The Wagner Daily ETF Report For January 9 |

| By Deron Wagner |

Published

01/9/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For January 9

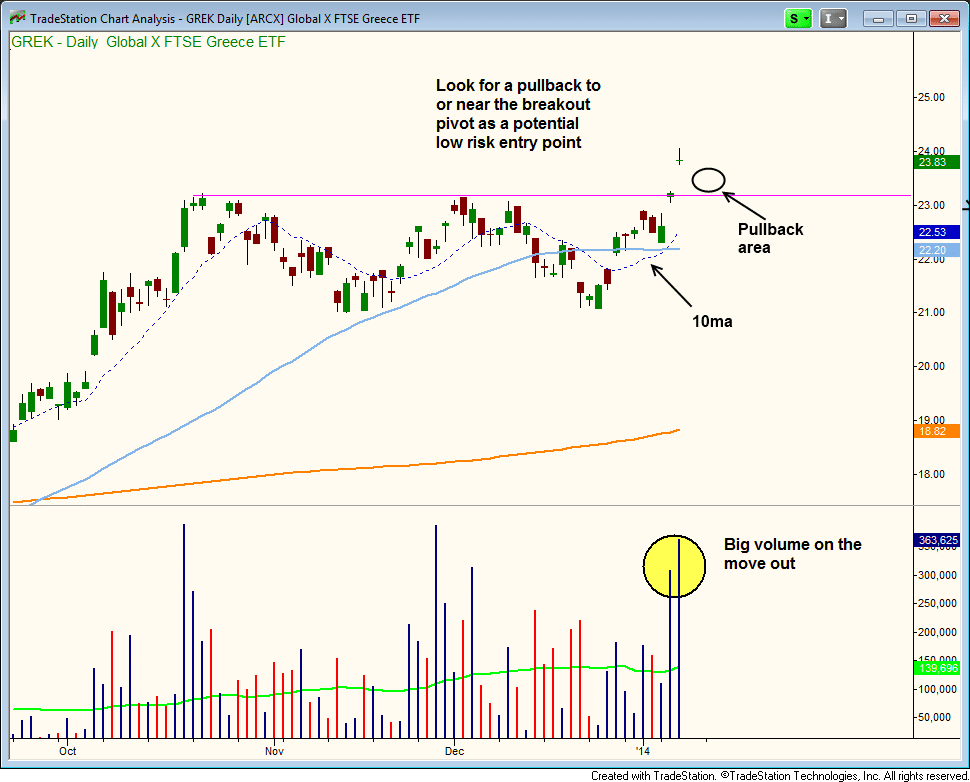

Global X FTSE Greece 20 ETF ($GREK), which we recently highlighted as a potential buy entry, has broken out to new highs this week. Volume has also confirmed the move, as turnover is already well above the 10-week moving average of volume after two days of trading:

The consolidation starting from late October was pretty tight and shallow, giving back less than 33% of the last wave up (from late August to late October).

Rather than chasing the price action higher from here, the plan is to patiently wait for a short-term pullback to produce a low-risk buy point. If the pullback is a sideways pause (like a "bull flag"), then we will probably wait for the 10-day MA to catch up. If the pullback is a bit deeper, then we will look for support at or just above the prior swing highs at $23. Here is the shorter-term daily chart of $GREK:

Our existing long position in PowerShares Golden Dragon China ($PGJ) broke out to new highs yesterday on above average volume:

Look for the rising 10-day MA to provide support on any pullback within the next week or two.

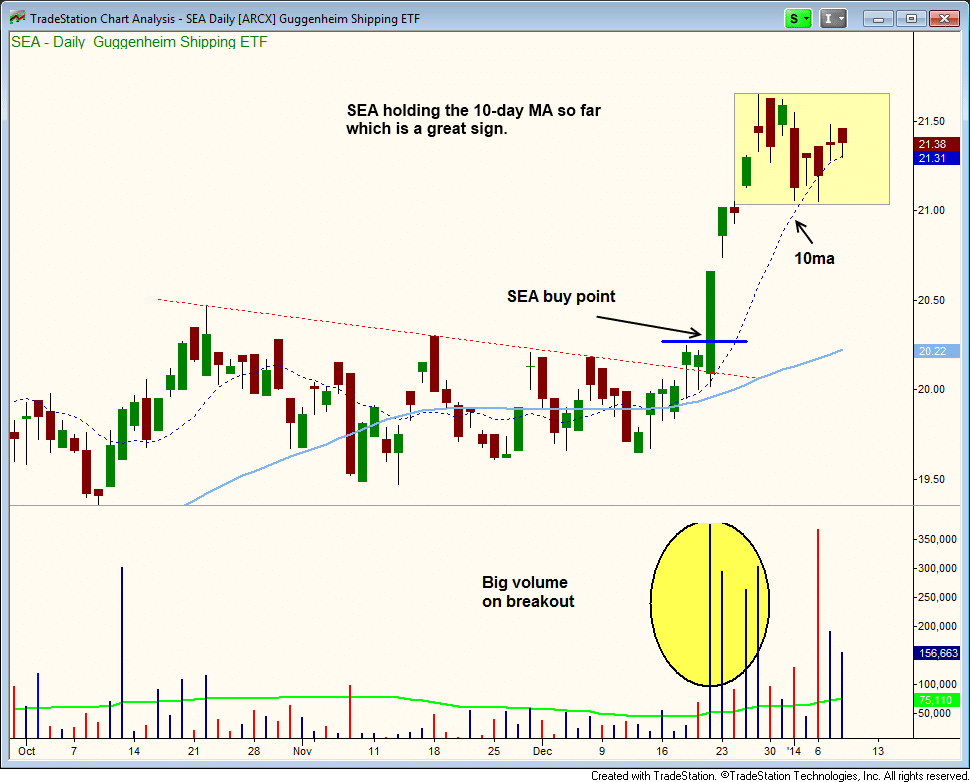

Guggenheim Shipping ETF ($SEA) is in really good shape after a strong breakout. We are alrady long $SEA from a downtrend line breakout entry on 12/20. The price action is holding the 10-day MA, which is exactly what we like to see on a strong breakout:

Overall, the current buy signal in the stock market remains in good shape. Leadership stocks are either breaking out to new highs or forming bullish patterns, while the main averages chop around in a tight range just off the highs.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|