| The Wagner Daily ETF Report For January 16 |

| By Deron Wagner |

Published

01/16/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For January 16

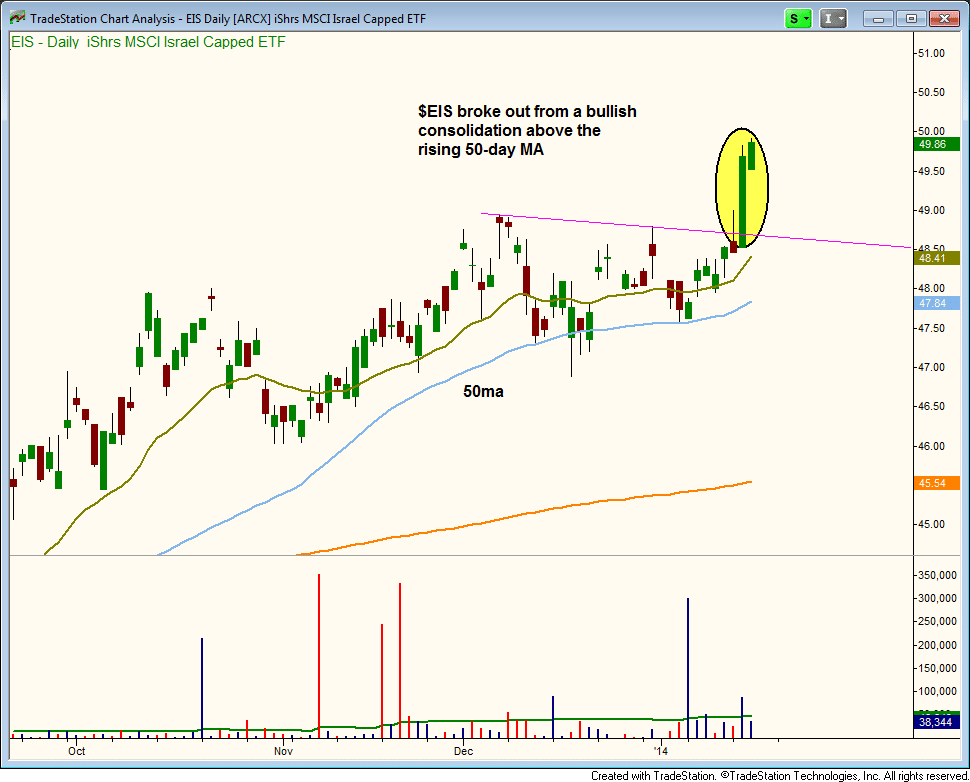

In the chart below, iShares Israel ETF ($EIS) broke out from a tight, five-week base above a rising 50-day moving average. We are looking for a three to five bar pullback as the entry. The target is around the $54 - $55 area, where there is resistance on a weekly chart:

Our current long position in First Trust ISE Revere Natural Gas ($FCG) has yet to prove itself, as it remains range-bound, but looking at the monthly chart below it clearly has potential.

The first hurdle to clear for $FCG is the two-week high and the 10-week MA (around $19.40).

The next step would be to take out this month's high (around $19.70) and attract some momentum buyers.

If $FCG is able to clear the 4-month high, the target on the move out would be around $24.00 (prior highs of 2011).

In yesterday's Wagner Daily, we listed $GWL as a buy setup above $29.25. $GWL triggered for us on the open and closed near the highs of the day with a solid 1.1% gain.

Our current long position in $SEA broke out to new swing highs after a few weeks of rest. We remain long from our entry point around $20.50 on 12/20.

There are no new setups for tonight; however, we are monitoring a recent breakout in iShares MSCI Israel Capped ($EIS) for a potential pullback entry next week.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|