| The Wagner Daily ETF Report For February 4 |

| By Deron Wagner |

Published

02/4/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For February 4

Tuesday's action was the nail in the coffin for the current rally, forcing our market timing model into sell mode for the first time since last June. In sell mode, we want to avoid establishing new longs, as all major averages are operating well below the 50-day MA and most have broken significant swing lows (an uptrend is no longer in place).

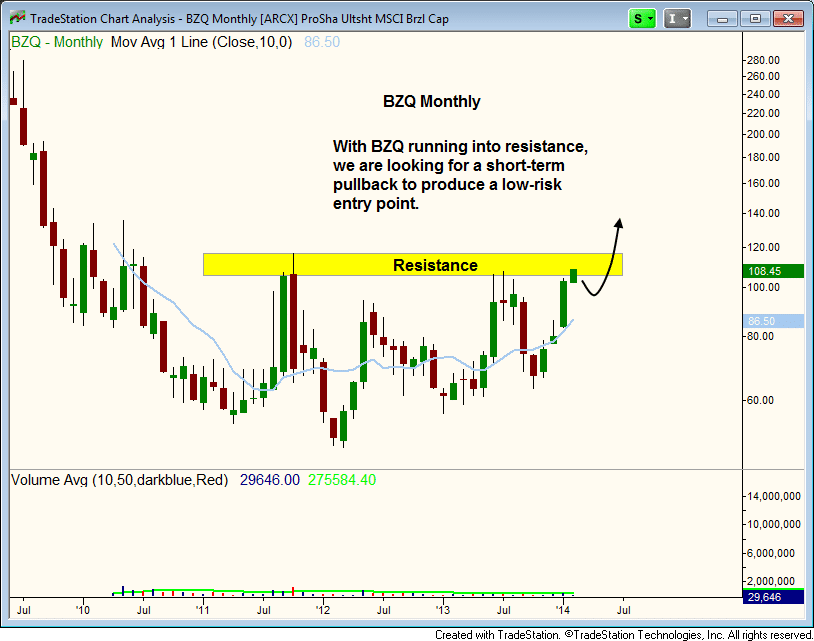

With logical short entries maybe one or two weeks away, it makes sense to list potential short setups all this week. First up this week is the ProShares UltraShort MSCI Brazil Capped ($BZQ), which has reached a significant resistance level just above $100. A slight pullback off these levels within the next few weeks could produce an ideal long entry point in this inverted ETF.

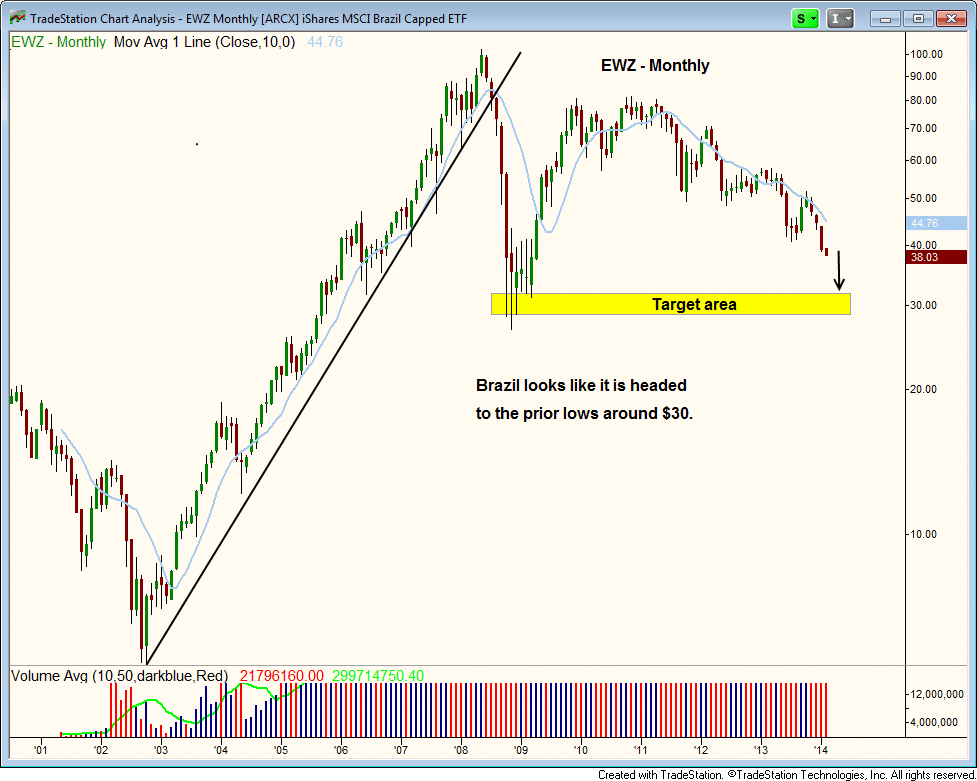

Looking at a chart of iShares MSCI Brazil Index ($EWZ) below, we see that the price action is in a clear downtrend and appears headed for prior lows of 2008-2009 around $30. $EWZ has another 20% to 30% to selloff before hitting support, which means that $BZQ could double this amount since it is an UltraShort.

As with all inversely correlated "short ETFs," it is important to be aware that this class of ETFs has a tendency to underperform the underlying index with longer holding periods. Therefore, this trade is best viewed a short-term momentum trade, rather than a position you would want to stick with for many months.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|