| The Wagner Daily ETF Report For February 13 |

| By Deron Wagner |

Published

02/13/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For February 13

Last night's buy setup in coffee ETF ($JO) triggered and closed up 3.5% on a healthy pick up in volume. The price action should continue to move higher as long as it holds the 10-day MA.

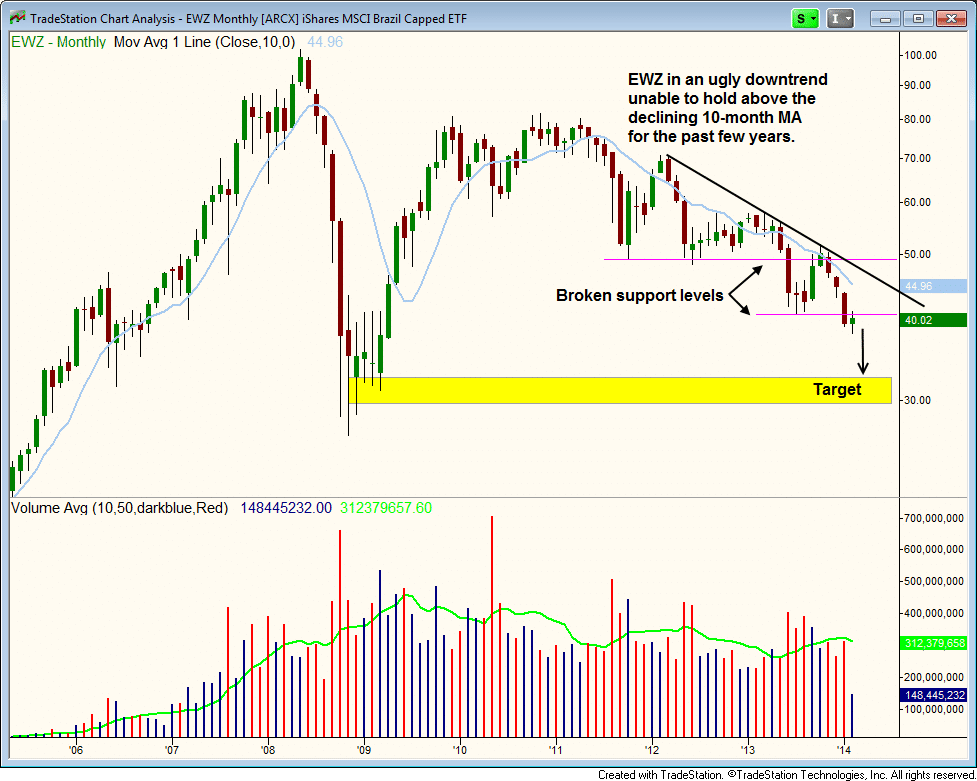

Over the past few years, Brazil ETF ($EWZ) has been relatively weak, heading in the opposite direction of the market since topping out in 2011. After breaking a key support level at $50, $EWZ has spent most of its time trending lower (see monthly chart below).

Rather than shorting $EWZ, we are stalking the inverted UltraShort Brazil ETF ($BZQ) for a buy entry on weakness on the daily chart (Inverted ETFs allow us to short a market by going long).

After a false breakout above the current range high in early February, $BZQ has pulled back to and found support at the rising 20-day EMA. There is also support from the short-term daily uptrend line just below the three-day low.

We are placing $BZQ on today's ETF watchlist for potential swing trade entry. Regular subscribers of The Wagner Daily should note our exact entry, stop, and target prices in today's report.

The broad market averages showed some signs of stalling on Wednesday, with the S&P 500 and Dow closing in the bottom third of the day's range and in negative territory after failing to push higher in the early morning. The Nasdaq Composite closed slightly higher but well off the highs of the session, signaling that stocks were being sold into strength.

The small-cap Russell 2000 continues to lag, as it closed well off the highs of the session, stalling just shy of the 50-day MA.

As mentioned in yesterday's report, the Nasdaq is running into resistance and could be due for a short-term pullback. In terms of how far it could come in we do not know for sure, but a pullback to the 50-day MA is possible and so is a test of the prior swing low. However, with so many leadership stocks holding up, we would not expect the Nasdaq to breakdown below the recent low.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|