| The Wagner Daily ETF Report For February 25 |

| By Deron Wagner |

Published

02/25/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For February 25

Emerging Markets ETF ($EEM) has rallied into resistance from a broken uptrend line and a declining 50-day MA.

Yesterday's (February 25) price action stalled above 39.70 for the second time in two weeks. There is also resistance from a prior swing low in mid-January at $40:

The stalling action as the ETF bounces into resistance of its 50-day moving average presents us with a low-risk entry point on the short side. However, rather than short selling $EEM, we will look to buy the inversely correlated Direxion Emerging Market Bear ($EDZ), which is a 3x leveraged short ETF:

Going into today, we are stalking $EDZ for potential swing trade entry. Regular subscribers of our nightly ETF and stock trading report should note our exact entry, stop, and target prices for this trade setup in the "Watchlist" section of today's newsletter.

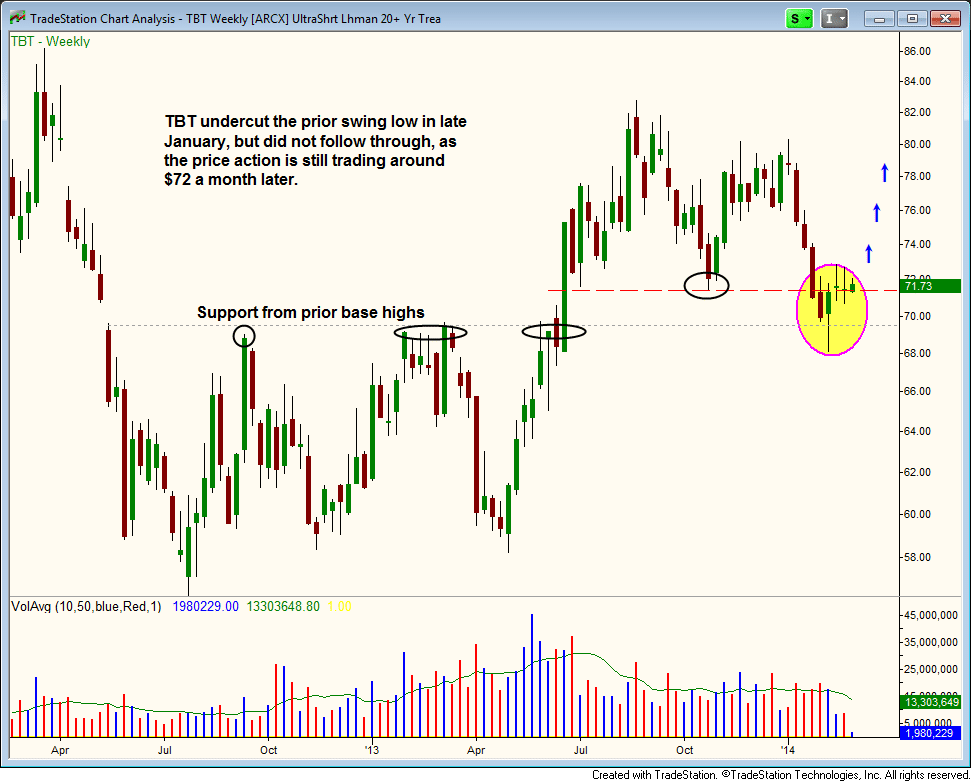

Another "short ETF" we are monitoring for potential trade entry is UltraShort Long-term T-bond ETF ($TBT).

After breaking down below a key swing low in January, $TBT failed to follow through to the downside and formed a bullish reversal candle during the week of February 7.

The false breakdown and reversal formed a double bottom like pattern, with an undercut on the weekly chart below. If the price action clears $73, $TBT might be ready to rip higher over the next several weeks:

Even though our market timing model is currently in "Buy" mode, both of these ETFs have a low correlation to the direction of the US equities markets. That's the nice thing about ETFs -- they can provide opportunities outside of the standard trend trading that comprises the bulk of our trading operations.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|