| The Wagner Daily ETF Report For February 27 |

| By Deron Wagner |

Published

02/27/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For February 27

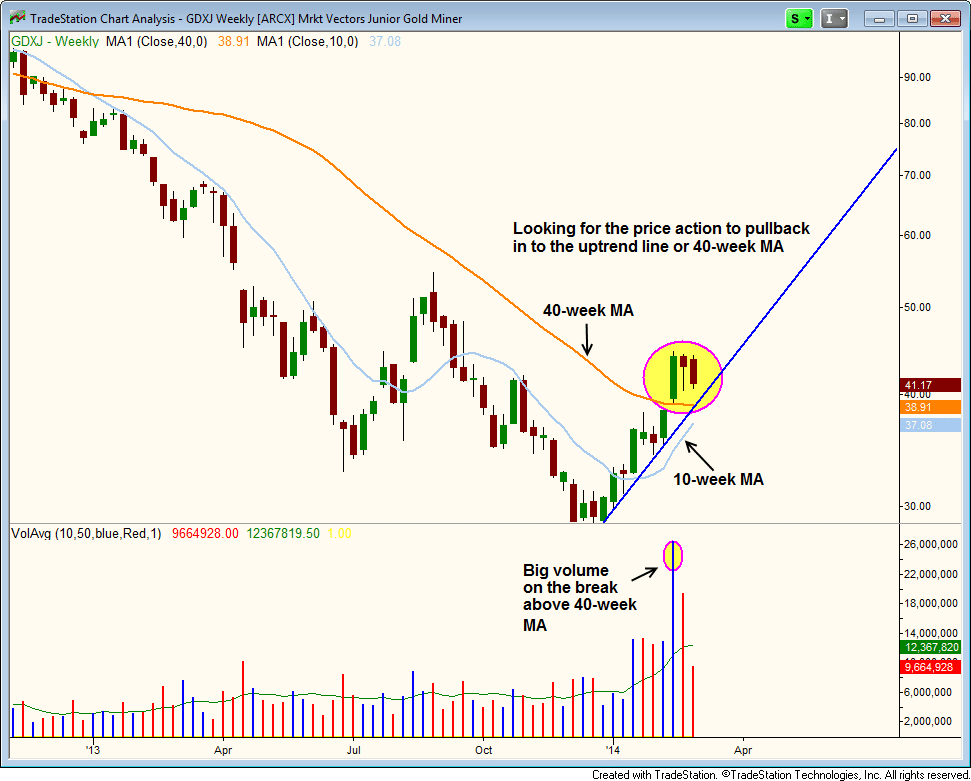

After breaking above the 40-week moving average on huge volume, Junior Gold Miners ETF ($GDXJ) has been pulling back on lighter volume the past two weeks. We are patiently waiting for a pullback entry around $40, where there is support from the 40-week moving average and uptrend line (blue). The 10-week moving average is catching up quickly and could also provide support, depending on how the action unfolds:

Ideally, we'd like to see an undercut of the 40-week moving average to produce a shakeout candle, but that is not a requirement to make the setup actionable.

Continuing with the commodity theme, $UNG is also in pullback mode this week after stalling out once again at $27. There is support from the highs of the last base around $24, as well as the rising 10-week moving average (currently at $23.31 and climbing):

The 10-week moving average is well above the 40-week moving average, and the 40-week moving average is just beginning to turn up, so $UNG is starting to show signs of bullish momentum.

Leading solar stock SolarCity ($SCTY) broke out to new highs this week, helping out our current long position in Guggenheim Solar ETF ($TAN), which is up about 10% from our Feb. 14 entry.

We are also long $SCTY in our Wagner Daily stock portfolio from an entry on Dec. 19, which is now up 59%.

Similarly, Tesla ($TSLA) is showing an unrealized gain of 70% since our newsletter's December 31 buy entry.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|