| The Wagner Daily ETF Report For March 4 |

| By Deron Wagner |

Published

03/4/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 4

With our market timing model remaining in "buy" mode, our current focus primarily remains on leading individual stocks.

Tesla ($TSLA), for example, is now showing an unrealized gain of 68% since our December 31 buy entry in The Wagner Daily newsletter. SolarCity ($SCTY) is similarly up 56% since our December 19 buy entry.

However, despite strength in leadership stocks, we have also been noticing a stealth sector rotation of institutional funds flowing into various commodity ETFs.

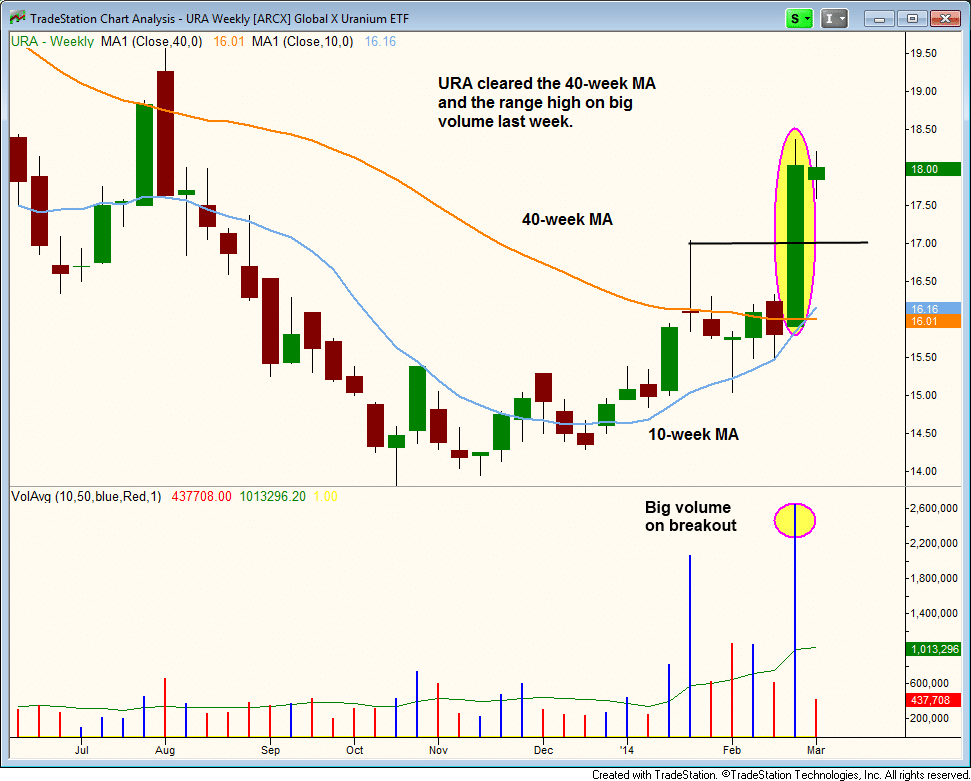

One such ETF we are stalking for potential buy entry in the coming days is Global X Uranium ETF ($URA), which is shown on the weekly chart below:

$URA blasted through the high of its prior trading range and 40-week moving average, on volume that was about 400% greater than average. High volume on a breakout is important because it confirms the presence of institutional accumulation.

Additionally, $URA closed near its high of the most recent week. The 10-week moving average crossed above the 40-week moving average as well, which signals a bullish reversal of trend is under way.

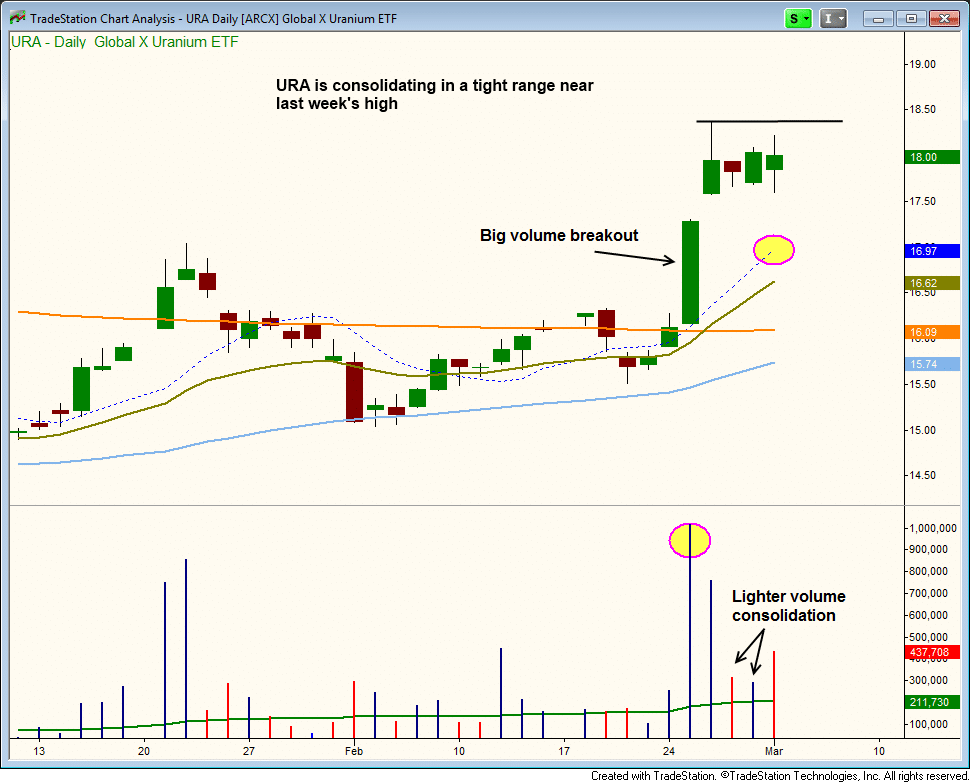

Since breaking out above its recent highs on heavy volume last week, the price has been consolidating for a few days on declining volume. Lighter volume during bullish consolidations is positive because it indicates the sellers are not stepping in while the bulls take a rest. This can be seen on the daily chart pattern:

From here, we now expect about five to ten days of sideways action before $URA resumes its uptrend. Zooming into the shorter-term hourly chart interval, we see the price action is holding above the 20-period exponential moving average:

As detailed in my book, Trading ETFs: Gaining An Edge With Technical Analysis, the 20-period exponential moving average on the hourly chart is usually the first legitimate support level on a pullback after a strong breakout.

The strongest breakouts will hold support at the 20-period exponential moving average and then push higher. But if that moving average fails to hold as support, then a touch of the 10-day moving average is the next logical support level.

Because of the confirmation through multiple timeframe analysis, we are now stalking $URA for potential swing trade buy entry.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|