- Market: May 2006 Corn (CK6)

- Tick value: 1 cent = $50.00

- Option Expiration: 04/21/06

- Trade Description: Bull Call Guts Credit Spread

- Max Risk: $900.00

- Max Profit: unlimited

Buy one May Corn 240 call, buy one May Corn 220 put, and sell one May 2006 Corn 240 put, on the same ticket, for a combined credit of 2 cents ($100.00) or more to open a position.

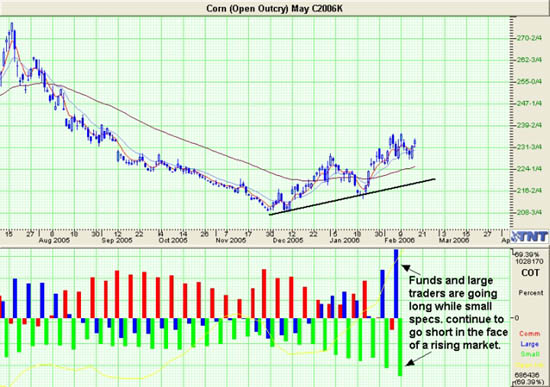

Technical/Fundamental Explanation

The grain complex has had a strong start to 2006. Wheat has led the way with corn following close behind. COT data shows small specs. are building an ever increasing short position as this market moves higher. Strong demand continues to push this contract up. Funds are taking notice of this strong demand and buying long as well. As in all trading, it is best to follow the "smart" money and in the case of grains funds are what we consider the smart money. We are selling an in-the-money put to pay for the other options we are buying and therefore this trade is a credit spread.

Profit Goal

Max profit is unlimited but the goal is to catch a move in May corn above 260. If corn ends up at 240 we simply keep our credit. For each cent corn is above 240 we make $50 per trade. So at 250 we would have a 12 cent($600) profit (2 cent credit +10 cent move in market = 12 cents) at 260 the profit would be $1100 and so on.

Risk Analysis

Max risk assuming a 2 cent credit is 18 cents ($900.00). This occurs at expiration with the Corn trading below 220. Break even point at expiration is 238.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.