| The Wagner Daily ETF Report For March 10 |

| By Deron Wagner |

Published

03/10/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 10

Tech stocks underperformed for the second day in a row on Friday, with the Nadsaq Composite and Nasdaq 100 closing down -0.4% and -0.5% respectively. Volume was higher on both exchanges, but the Nasdaq was the only index to suffer a distribution day. Since the breakout above the prior high on Feb. 18, the Nasdaq has produced anywhere from three to five distribution days, depending on how one counts a few days of churning (Feb. 21 & Feb. 24).

Although most broad based averages have raced to new highs and are trading above the 10-day MA, we are beginning to see signs of subtle deterioration in the current rally.

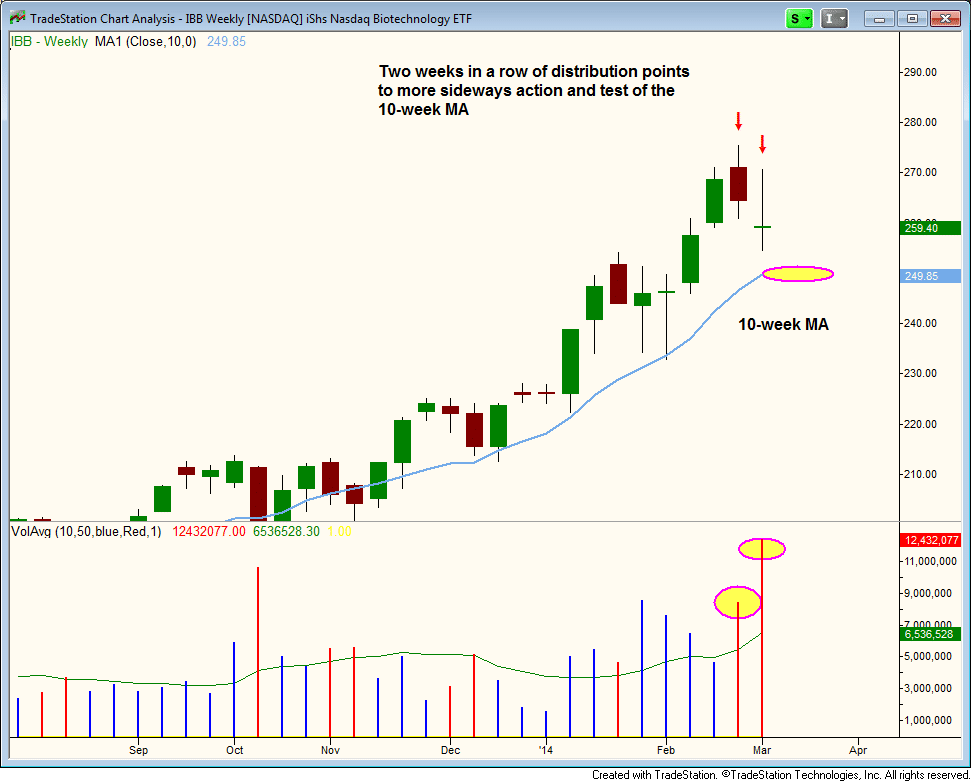

For example, Biotech ETF ($IBB) closed in the bottom third of the week's range on big volume. It was the second straight week of distribution. To be clear, we are not saying $IBB's uptrend is over, but there has been some selling at the highs, and it may need a few weeks of sideways action before moving higher again.

Depending on the price and volume action in $IBB and the market, it may potentially offer a buy point around the 10-week MA, which is where it has found support the past few touches.

Supporting the idea that the Nasdaq is being sold into strength (churning at highs), the weekly chart of UltraShort QQQ ($QID) has produced two straight weeks of big volume with little change in the closing price. In a downtrend, big volume without further selling is bullish. In an uptrend, bigger volume without price appreciation is bearish.

Those who absolutely must get their fix of shorting may be able to do so with $QID for a few days, but we are not in favor of shorting broad market averages at or near highs. We feel that better reward to risk ratio trades will be available on the short side in weeks to come, so for now we are just monitoring the action.

The market remains in a clear uptrend for now, but we are selling a few positions into strength (partial and full), as well as tightening up stops on several other positions to reduce losses or protect gains.

We sold 33% of $TAN into strength last Friday on the open, locking in a 21% gain. We will now use the 10-day MA as a reference point to close out the remaining shares.

On the stock side, we are doing much of the same, looking to protect big gains in $FB and $SCTY.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|