| The Wagner Daily ETF Report For March 11 |

| By Deron Wagner |

Published

03/11/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 11

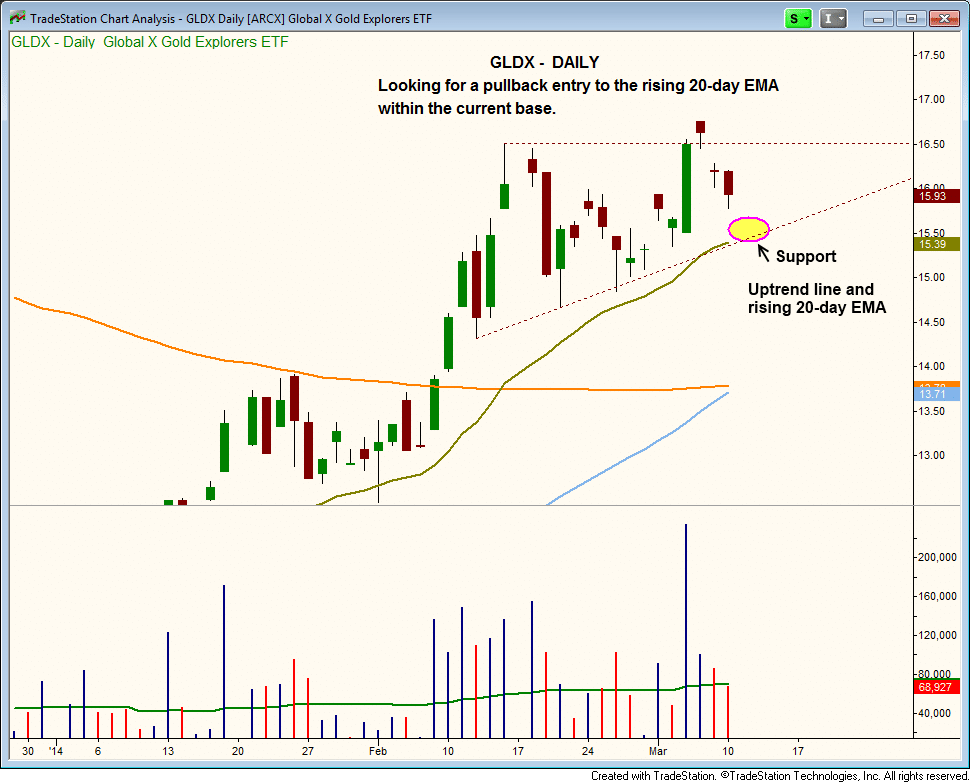

Our weekend and Monday night ETF scans did not produce much in the way of actionable setups. There isn't much out there on the long side, other than potential pullback entries in commodity related ETFs. This brings us to our first chart in Global X Gold Explorers ETF ($GLDX).

We first established partial size in $GLDX over the high of 3/4 on 3/5. Since the price and volume action was strong on 3/5, we do not mind adding to the position on weakness IF it pulls back in to the 20-day EMA. The 20-day EMA is currently around $15.40, which is also where the short-term uptrend line is:

With clear support at 15.40, we are placing $GLDX on today's Wagner Daily watchlist using a buy limit order (regular subscribers should please note our exact trigger, stop, and target prices in today's report).

If $GLDX does not pull in to the 20-day EMA and chops around in a tight range, then we will add to the position on strength.

Last Friday, we sold partial size of $TAN on the open to lock in a 21% gain from our entry on 2/14. We are still holding on to the remaining shares, looking for the price action to continue to hold the rising 10-day MA and short-term uptrend line. A break below the 10-day MA could suggest that the price action needs a few weeks of rest:

It's a little late in the current rally to establish new stock or ETF core positions and expect these trades to become monster winners (to be held 3 months or more). True market leaders have already sailed out to sea, so unless one is buying a pullback in a monster leader, most new trades should be of the swing trade variety.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|