| The Wagner Daily ETF Report For March 13 |

| By Deron Wagner |

Published

03/13/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 13

Although biotech stocks have taken a break, money has been rotating into semiconductors, commodities, and transportation stocks.

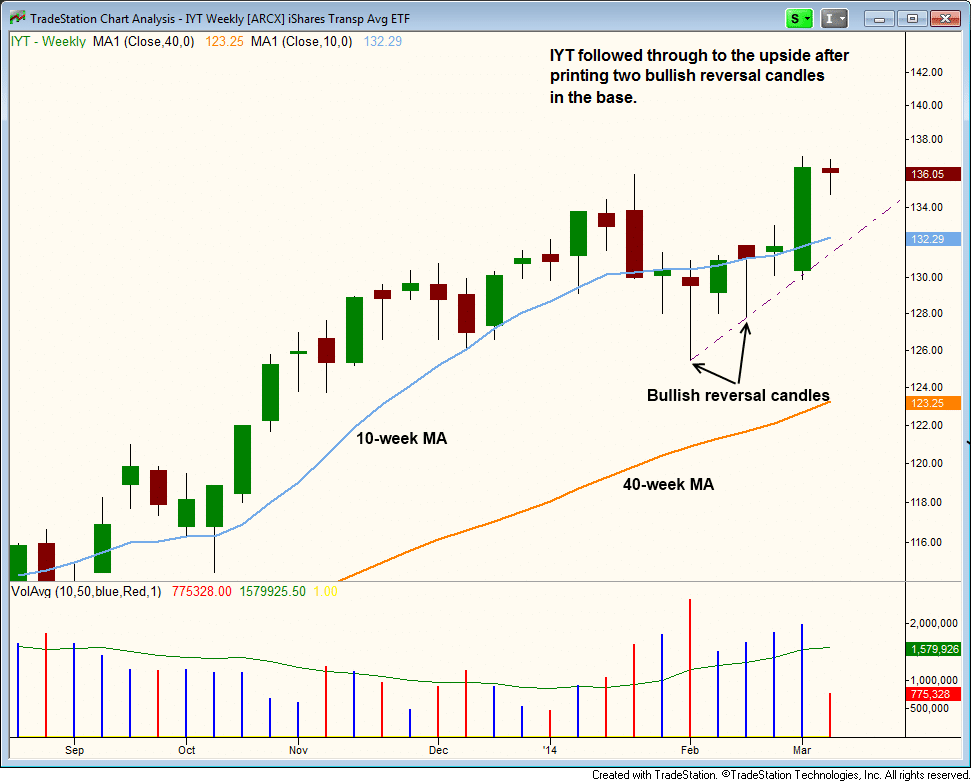

One example of the recent strength in transports can be seen on the weekly chart of Dow Jones Transportation ETF ($IYT), which shows bullish basing action followed by a higher volume advance above the 10-week MA last week:

Notice how the bullish closes on the weekly chart are near the highs of each candle. Volume during the base was also bullish, with the biggest spike in volume coming on a bullish reversal candle in early February that "undercut" prior lows.

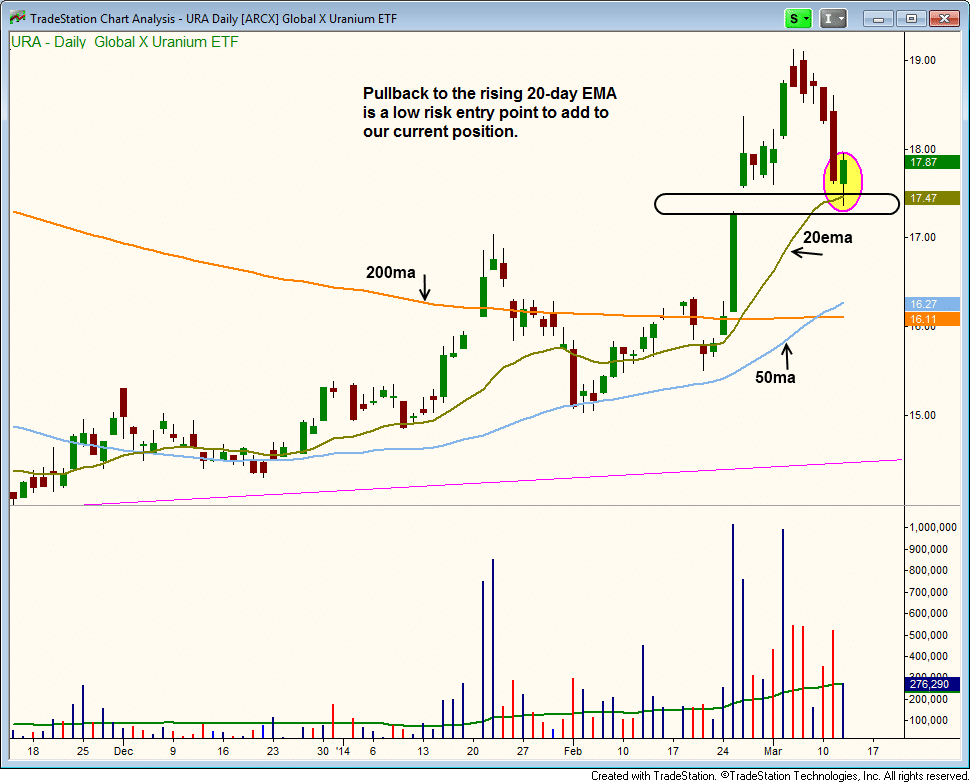

We have one new ETF trade setup on today's Wagner Daily watchlist, which is a pullback entry in Global X Uranium ETF ($URA) to the rising 20-day EMA:

$URA followed through to the upside from our first buy point for a few days, but stalled out and pulled back into support. The $17 - $17.50 area looks to have a cluster of support from the 20-day EMA, a prior swing high, and the high of a big volume accumulation candle on 2/25.

The convincing advancing volume on the daily chart of $URA in 2014 tells us that once the price action settles down the uptrend should resume.

This $URA setup is an add to our existing long position, but for those who missed the first entry point, this is a low-risk buy point for the full position. Subscribers should note our exact trade details on the "Watchlist" section of today's report.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|