| The Wagner Daily ETF Report For March 27 |

| By Deron Wagner |

Published

03/27/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For March 27

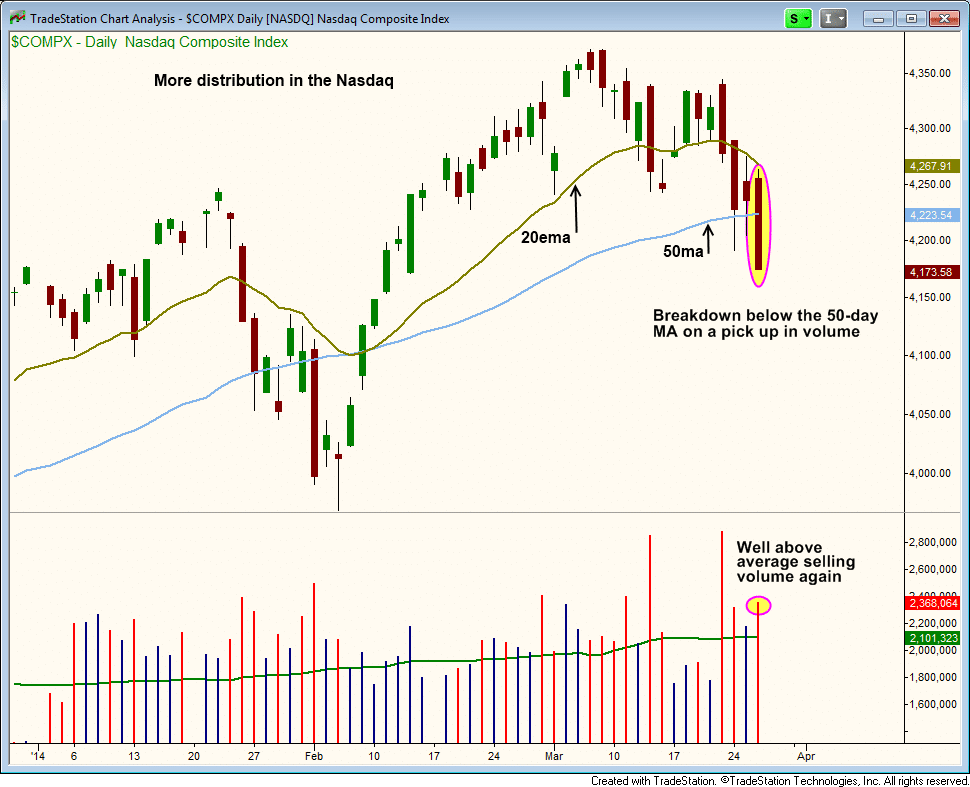

Once again, leading tech stocks and small cap stocks were hit hard on big volume Wednesday. The Nasdaq dropped 1.4%, closing below the 50-day MA and at the lows of the session (ugly!). The small cap Russell 2000 and Nasdaq 100 joined the Composite in breaking the 50-day MA.

The Dow Jones and S&P 500 continue to hold up relatively well versus the Nasdaq, but the majority of leadership during the rally was from the higher beta stocks in the Nasdaq. Also, with the Russell 2000 taking a beating, it looks as though risk is being taken off the table right now with money rotating into safety.

As detailed in yesterday's commentary, our timing model is already sitting on a "sell" signal from last Friday's close. But if we were still in neutral, yesterday's higher volume plunge in the Nasdaq would have surely put the model on a sell:

If the Nasdaq Composite is unable to reclaim the 10-week MA within the next week or so, then a test of the 4,130 area is likely. There is support at this level from the 20-week moving average, as well as the 61.8% Fibonacci retracement level (measured from the low of February to the recent swing high in March, near $4,122):

If the Nasdaq is truly deteriorating, the 20-week MA may offer little support, which leaves the prior swing low in February as a logical target if in fact the market breaks down. A pullback to the prior swing low would be about 9% off the high.

It is possible that the Nasdaq Composite is potentially setting up for a head and shoulders chart pattern over the next few months (this will take some time to play out).

Speaking of head and shoulders patterns (H&S for short), iShares Biotech ETF ($IBB) could potentially be forming such a topping pattern over the next month or two. The breakdown off the potential head of the pattern has come on heavy volume, which is a necessity for a quality H&S topping pattern:

For the H&S pattern to play out properly, we'd like to see symmetry between the left shoulder and right shoulder, as both shoulders should take about the same amount of time to develop. It doesn't have to be exact, but the closer the better.

If/when $IBB bounces off the lows, a three to four week bounce to the $240 - $250 area would be ideal, and where would look for a low-risk short entry to emerge.

In sticking with the H&S pattern theme, Internet ETF ($FDN) has broken down off the head on big volume (like $IBB). We'd like to see the action bottom out near the lows of the left shoulder and bounce higher for several weeks (same as $IBB again). A move into the $60 - $61 area could potentially produce a low risk short entry.

These patterns are several weeks away from setting up and there is no guarantee that the price action will play out this way:

Our short-term plan is to lay low in the ETF and stock portfolio and see how the market closes out the week. If leading stocks continue to breakdown from logical support levels and the major averages start living below the 50-day MA, then we will begin to scan the short side for low risk short entries on a bounce.

We do not mind going short, and had a great summer in 2010 with nice profits on the short side. If the market is truly breaking down, quality short setups will eventually emerge, so there really is no need to catch the first wave down.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|