| The Wagner Daily ETF Report For April 21 |

| By Deron Wagner |

Published

04/21/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 21

Although the main stock market indexes are in bounce mode, we expect the current advance in the market to be short-lived and not lead to a sustainable rally. It is tough to get excited about a market when there is no clear leadership.

Yes, there are some pockets of strength, as energy related stocks and ETFs put up solid gains last week (our current long position in energy ETF $XOP also did well, gaining more than 6% on the week). Nevertheless, it is typically not a good sign when market leadership is in "defensive" sectors such as energy, utilities, and REITs.

Both the Internet ETF ($FDN) and Biotechnology ETF ($IBB) were hit hard over the past few weeks, plunging heavily on big volume. We expect both of these ETFs to eventually be in play as potential short selling setups, but both ETFs may need a few more weeks to present us with low-risk entry points.

First, let's look at the chart of $IBB, which sliced through the 10-week MA (similar to the 50-day MA) on huge volume a few weeks ago.

On the weekly chart below, we have the ideal price action drawn out over the next several weeks, as we look for any potential bounce in $IBB to fall short of the declining 10-week MA. $IBB put in a bullish reversal candle last week and is probably due for some sort of bounce:

The action in $IBB certainly doesn't have to play out this way for us to take action on the short side, as there alternatively may be a steep bounce into the 100-day moving average within the next week or two that could provide a low-risk entry point.

In general, we always have a pattern in mind that the stock or ETF could follow, but the goal is to remain flexible with our analysis in order to go with the flow .

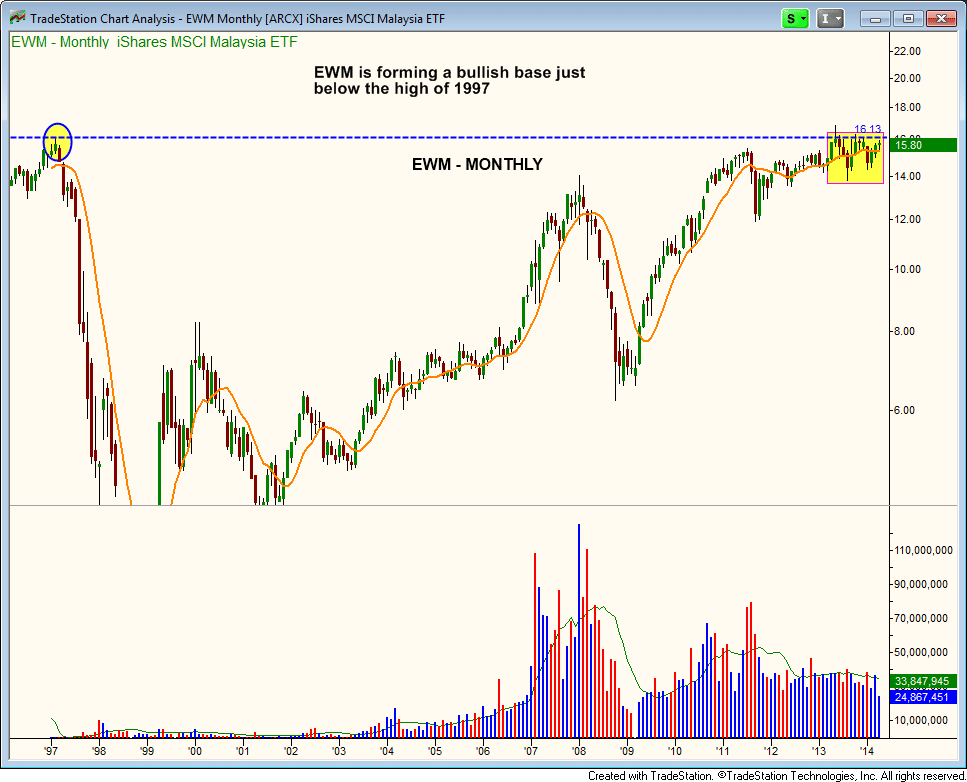

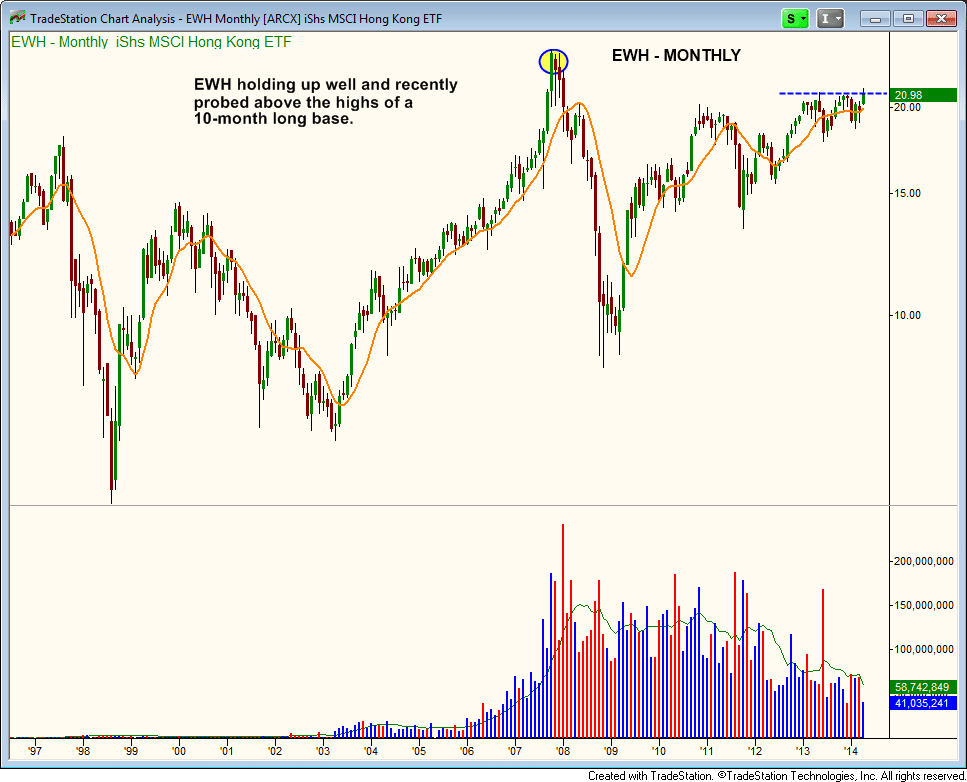

In terms of what is holding up, our weekend stock scans have located decent price action in a few Asian-Pacific ETFs, such as Malaysia ($EWM) and Hong Kong ($EWH).

$EWM is consolidating in a bullish range just below the prior high of 1997, and appears to be marching to the beat of its own drum the past few weeks (ignoring the price action in the S&P 500).

$EWM is also trading above the two major averages, the 50 and 200-day MA, but the 50-day MA is still below the 200-day MA, so the chart will need some more time to develop:

$EWH is also trading in a fairly tight range so far in 2014, and like $EWM, has ignored the action in the S&P 500 the past few weeks:

Charts of New Zealand ($ENZL) and Philippines ($EPHE) are also looking pretty good.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|