| The Wagner Daily ETF Report For April 23 |

| By Deron Wagner |

Published

04/23/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 23

Looking at yesterday's percentage gains in the major averages, the small cap Russell 2000, Nasdaq 100, and NASDAQ Composite closed with a 1.0% gain. These averages were hit the hardest when the market sold off, so the fact that they are outperforming on the way up is no surprise.

Tuesday's rally was more about stocks bouncing from deeply oversold levels than new setups breaking out from quality basing patterns, which doesn't inspire much confidence in the current move off the lows.

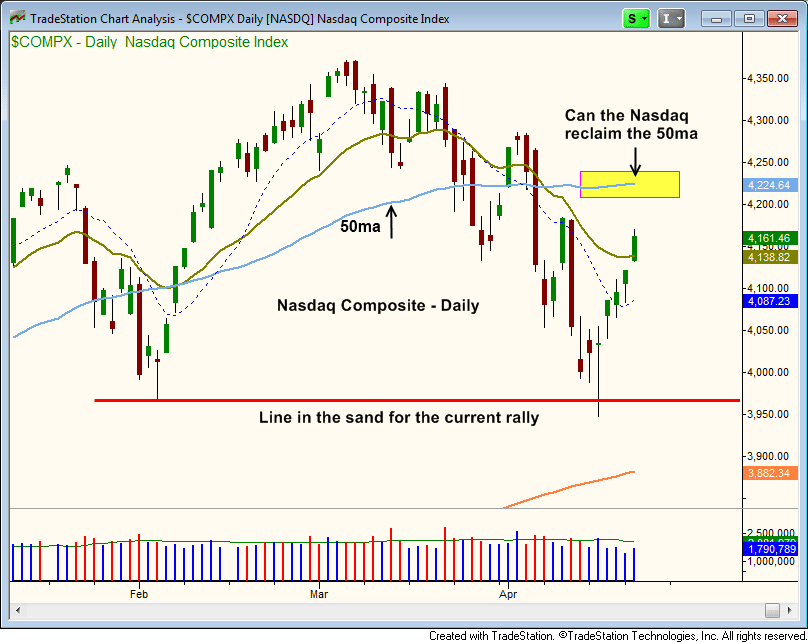

We would not be surprised to see the Nasdaq test the 50-day MA before selling off. Our "line in the sand" for the longer-term uptrend in the Nasdaq is the prior swing low in February around 3,950. If the Nasdaq is unable to hold this level, then conditions could turn quite ugly.

There is also the possibility that the Nasdaq doesn't do much of anything for several weeks while chopping around in the $3,950 to $4,250 area:

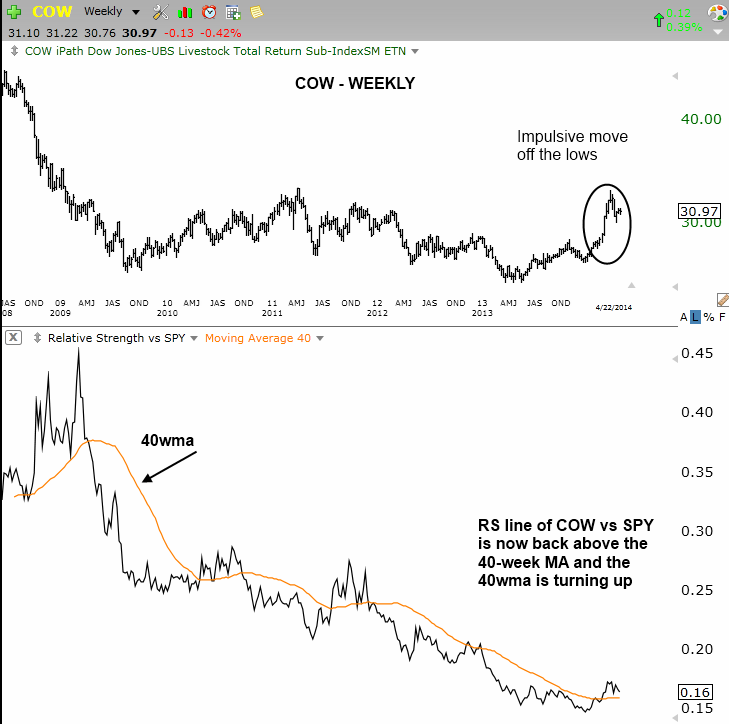

Commodities continue to form the best patterns on the ETF side. iPath Livestock ETN ($COW) is in correction mode after a strong rally during the first quarter of 2014.

Since stalling out at $32.50, the price action pulled back in to the rising 50-day moving average, where it found support on 4/9.

The first pullback to the 50-day MA after a strong advance is usually a low risk spot to climb aboard a strong rally (with a great reward to risk ratio):

One must be patient entering a stock or ETF on a pullback off the 50-day MA, as the price action may need to chop around for a few weeks or more before heading significantly higher.

On the weekly chart below, we first see the impulsive move off the lows in $COW. The strong advance sent the relative strength line (RS line) of $COW vs $SPY above the 40-week MA (bottom half of chart below). The last time the relative strength line in $COW was above the 40-week MA was in 2011.

We are placing $COW on today's watchlist. Subscribing members of our swing trading newsletter should note our exact entry, stop, and target prices on the "Watchlist" section of today's report.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|