| The Wagner Daily ETF Report For May 6 |

| By Deron Wagner |

Published

05/6/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For May 6

The main stock market indexes have produced a few bullish reversal candles over the past few weeks, as detailed in the daily chart of the S&P 500 ETF ($SPY) below:

The bullish reversal candle low of April 28 now serves as the "line in the sand" for the current rally in the S&P; a break of this level would also result in a breakdown below the 50-day moving average.

If the price and volume action in the Nasdaq Composite and 100 continue to improve, then we should see a breakout to new highs in the S&P 500 soon.

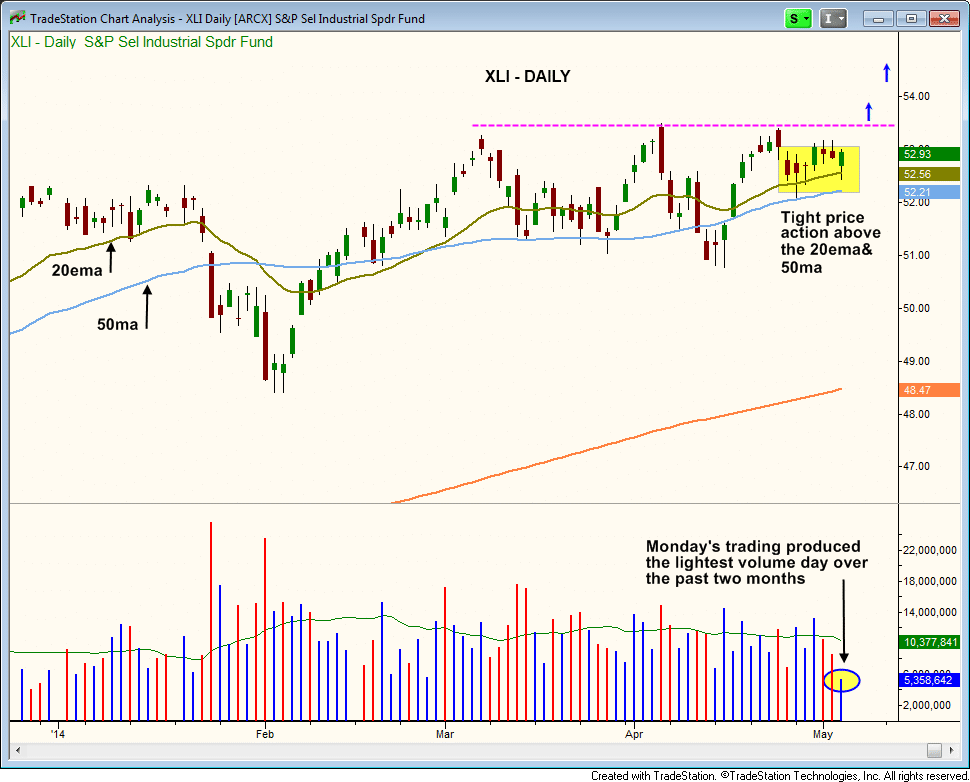

One of the top consolidations on the ETF side in recent weeks has been in Industrial Select Sector SPDR ($XLI).

The price action in $XLI has tightened up nicely the past two weeks above the rising 20-day EMA, which has held above the rising 50-day MA during the consolidation.

We look for $XLI to follow through to the upside within the next week or two, provided that current market conditions continue to improve:

After an explosive rally during the first quarter of 2014, the Coffee ETF ($JO) formed a two-month long base above the rising 50-day MA. The volume has dried up considerably the past few weeks, which means that $JO is no longer on every trader's radar.

The price action has tightened up nicely the past few sessions, as it trades just below the highs of the range:

Both $XLI and $XO have been added to our ETF watchlist as potential momentum trade entries.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|