| The Wagner Daily ETF Report For May 19 |

| By Deron Wagner |

Published

05/19/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For May 19

Given the lack of direction in recent market action, our weekend stock scanning turned up very little in the way of low-risk buy setups on both the individual stock and ETF side.

One of the few ETFs looking decent is Natural Gas Index ETF ($FCG), which recently broke out from a long term base at $21 and could potentially offer us a pullback entry off the rising 50-day MA within the next week or two.

As shown on the chart below, volume was mostly lighter during the pullback (which is bullish), although it picked up the past two sessions (but both closes were off the lows of the day).

If last week's close was closer to the highs of the week, $FCG could have been an actionable setup going into today. But instead, we will simply monitor the price action for a low-risk buy entry.

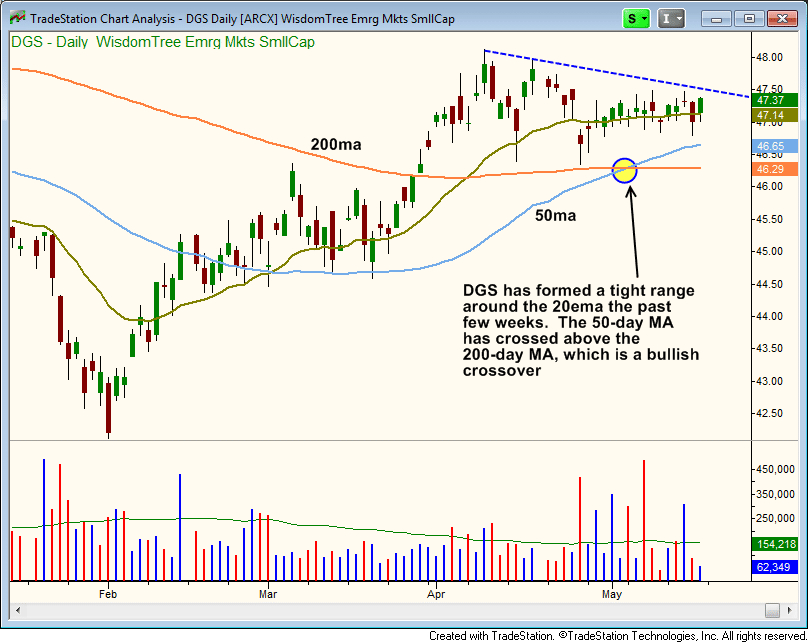

With its 50-day MA crossing back above the 200-day MA, Emerging Markets Small Cap Dividend ($DGS) has formed a tight trading range and base above the 50-day MA. Notice on the chart below that the 200-day MA is no longer sloping lower and has flattened out:

Since $DGS is potentially in play, we have added this ETF trade setup to the "Watchlist" section of today's report. Subscribing members of The Wagner Daily should note our preset buy, stop, and target prices in today's report.

With last week's modest advances in the major indices, the Nasdaq 100 remains just below its 50-day moving average (after probing above it a few days last week), but has been struggling to hold above the 3,600 level in recent weeks. The Nasdaq Composite is further below its 50-day MA, where it has been since April 4.

The S&P 500 closed out the week above the 50-day MA, and is still printing higher swing lows within its current base of consolidation. Until the S&P 500 cracks below the 50-day MA OR breaks out to new highs, we may continue to see choppy market conditions.

Since the market held up in the latter half of last week, we could potentially see a short-term bounce develop. However, there isn't enough evidence right now to suggest that any bounce could lead to a sustainable rally. This means that we will be looking for short selling setups to develop if the market bounces higher and stalls.

The Dow Jones and S&P 500 have been holding up better than the Russell 2000 and S&P Midcap 400, which is NOT a bullish sign for our system in the short-term. However, every trading system will run eventually run into a slow period. That is the nature of trading. Over the years, we have learned that it pays to stick to a system and avoid chasing the action.

The best trade setups will come to us, and we simply walk over and grab them. But when that's not happening, cash (SOH mode) is the best place to be while waiting it out.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|