| The Wagner Daily ETF Report For June 11 |

| By Deron Wagner |

Published

06/11/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For June 11

iShares Germany ETF ($EWG) broke out to new highs from nearly a 6-month long base two weeks ago. Since then, the price action has bounced off support of the rising 10-day MA once, and could potentially do so again because it touched the 10-day MA on Tuesday.

The breakout should be in good shape as long as it continues to hold above the 20-day EMA, which is generally our line in the sand on new breakouts. The 20-day EMA has also crossed above the highs of the last base, which is a positive sign.

With 20-day EMA above the breakout pivot, the odds of the breakout surviving increases, as there is more support:

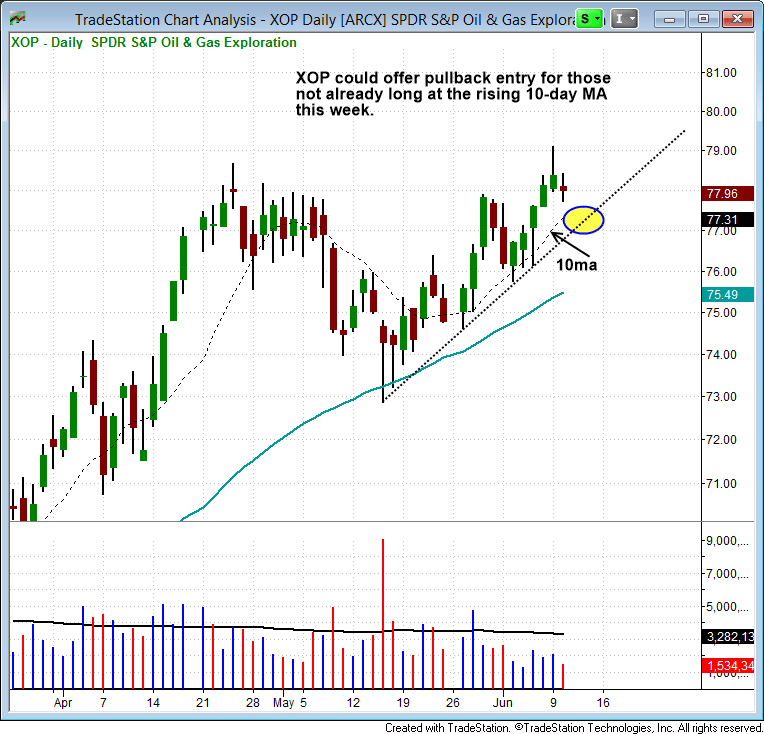

For those who missed our initial Wagner Daily entry in S&P Oil & Gas ETF ($XOP), a potential pullback to the rising 10-day MA could offer a low risk buy point.

The 20-day EMA is also just below (at 76.64), as is the rising 10-week moving average on the weekly chart (at $76). So, there is quite a bit of support in the $76 to $77 area:

The stock market basically put in a consolidation day, with the price action pulling back into the 20-period EMA on the hourly charts of most major averages. Looking at the past two days in the S&P 500, the price action may simply chop around in a tight range for a few days while the 10-day MA catches up. So far, so good.

As long as current breakouts continue to consolidate in bullish fashion, holding above 10 or 20-day EMAs on light volume pullbacks, then the market should continue to push higher.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|