| The Wagner Daily ETF Report For June 12 |

| By Deron Wagner |

Published

06/12/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For June 12

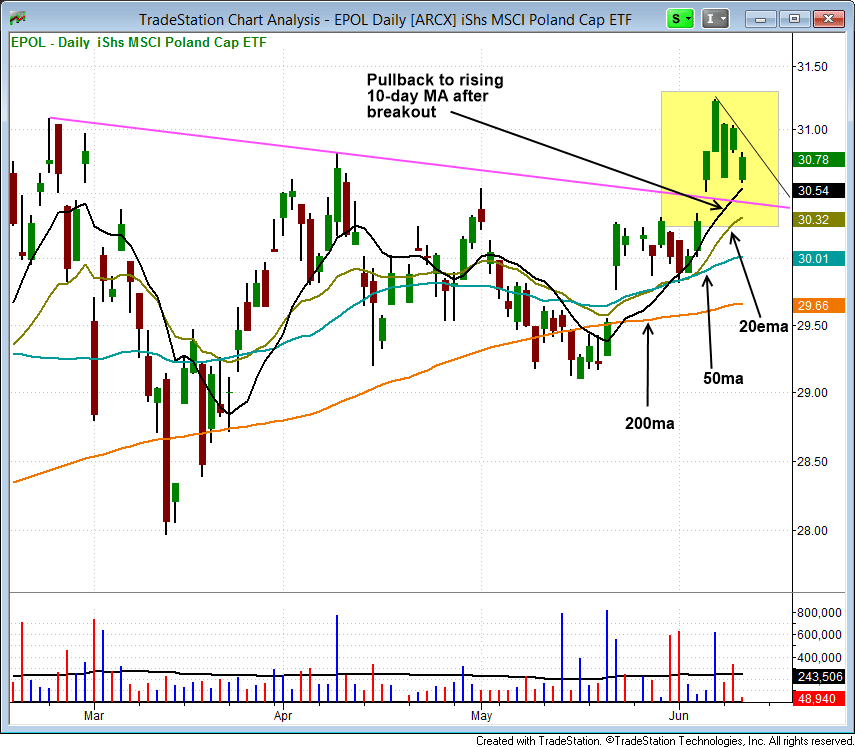

We have one new setup on today's ETF watchlist in iShares Poland ($EPOL), which cleared the downtrend line of a six-month long base last week on an uptick in weekly volume.

$EPOL has pulled back in the past few days with the rising 10-day MA just below to provide support.

The moving averages are now all in order on the daily chart and pointing in the same direction, with the 20-day EMA recently crossing above the 50-day MA. There is quite a bit of support just below the 10-day MA, with the 20 and 50-day MAs in the $30 - $30.30 range

Please see trade details on the watchlist above.

Natural Gas ETF ($UNG) may look a little sloppy on the daily chart, but the weekly and monthly charts are in good shape so far. If the weekly chart of $UNG below can hold above the last swing low ($23.85) and chop around for a week or two, then a break above the weekly downtrend line could potentially lead to a strong breakout.

Volume has tapered off the past two weeks (not including this week), which is a bullish sign. As volume dries up, traders forget about $UNG since it isn't going anywhere. Eventually, the volatility contraction will lead to a volatility expansion (but not always in the direction we want).

On the stock side we have one new setup in $SYMX, and a few changes to the $TSLA buy setup. $SYMX blasted through the $1 level and 50-day MA last February on massive volume. We are looking for the current consolidation to move out above the 10-week MA and follow through to the upside. There is no set target for now, but with a 12% stop, a 30-40% projected gain would be ideal.

As always, newsletter subscribers should note our exact buy trigger, stop, and target prices for this trade setup in today's report.

The Nasdaq Composite and Nasdaq 100 are correcting more by time than price, chopping around near Monday's high. As long as the market is able to rotate into new names, the current pullback should be short-term and eventually lead to higher prices in all the major averages.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|