| The Wagner Daily ETF Report For June 16 |

| By Deron Wagner |

Published

06/16/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For June 16

Stocks closed out the week with a productive session, with four out of the six major averages we follow able to hold on the rising 10-day MA. The S&P 500 and Dow Jones are the only averages below the 10-day MA, but the S&P 500 could easily reclaim the average within the next day or two.

Last Thursday's selling on higher volume (distribution) looks to have masked some institutional buying on weakness, as the price and volume action in leaderships stocks remains quite bullish.

Market conditions remain solid, so as of right now, we still believe that the the current pullback should be short-term in nature and eventually give way to new swing highs.

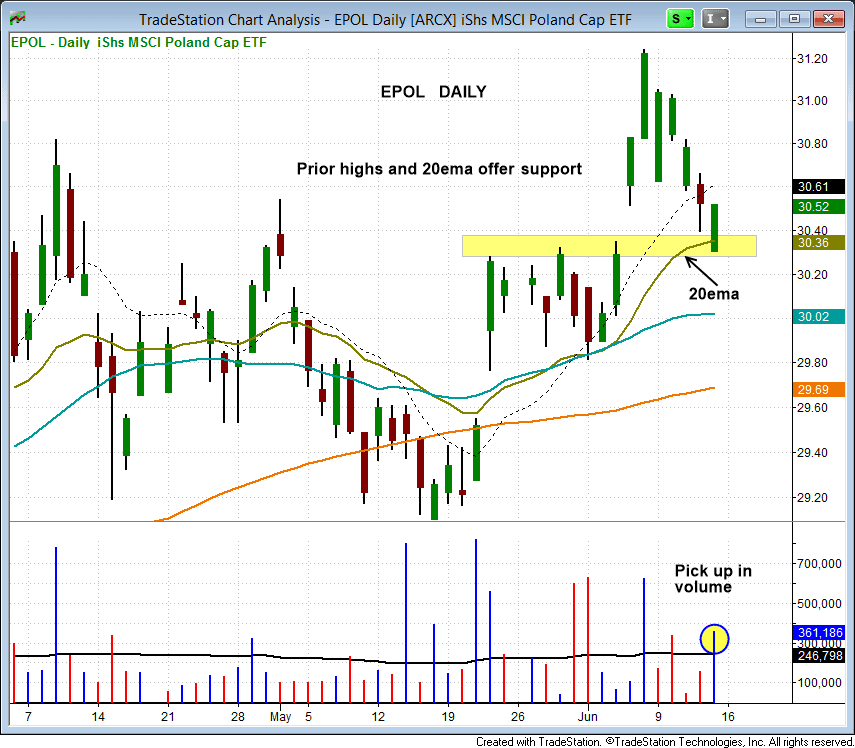

In the ETF world, iShares Poland ($EPOL) put in a bullish reversal last Friday, bouncing off support of the 20-day EMA on a pick up in volume. For the second session in a row, the price action bounced off support around the $30.30 to $30.40 area to close well off the lows of the day. We look for the uptrend to resume within the next few days (subscribing members of our swing trading newsletter should note the trade setup details in the "watchlist" section of today's report):

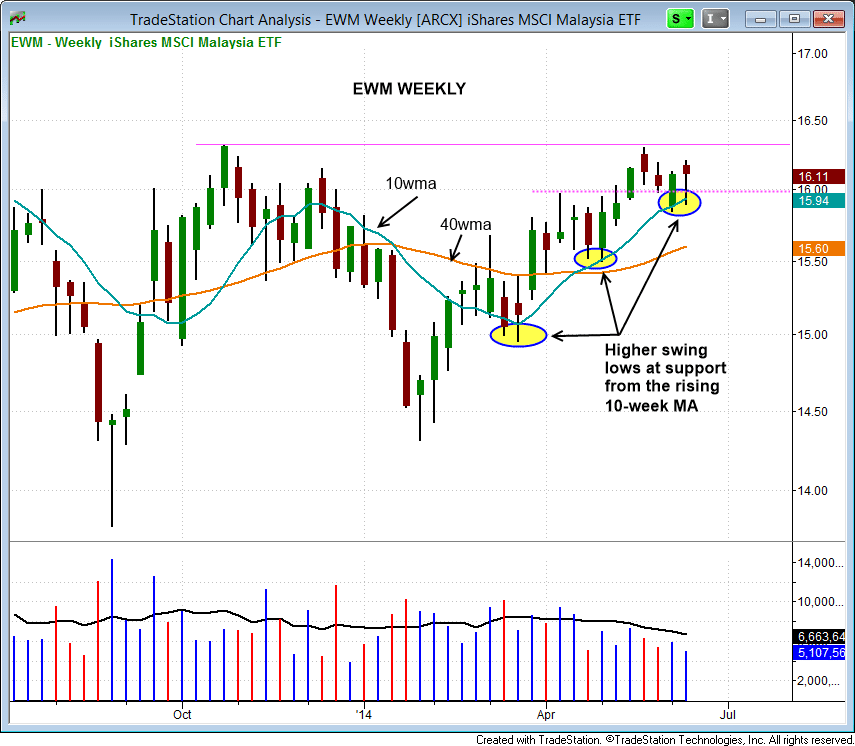

iShares Malaysia ($EWM) has been in consolidation mode since Q4 of 2013, when the price action failed to hold the rising 40-week MA. Since reversing from a sharp selloff in January, the price action has held above the 10-week MA the past four months, with the 10wma crossing above the 40wma. Note that both moving averages are now trending in the same direction.

$EWM has reversed off the 10wma the past two weeks, while holding above the prior breakout pivot at $16. The two week lows appears to be a clear support level, so we are placing $EWM on today's watchlist as an official buy well below the obvious breakout level at the base high.

On the individual stock side, we have a few new swing trade candidates, along with a new core trade setup in A-rated Facebook ($FB). $FB looks pretty good here, as it broke out above $64.50 on a pick up in volume and found support at the prior swing high and rising 10-day MA last Friday.

The daily chart continues to build momentum, with the 20-day EMA recently crossing above the 50-day MA. The 50-day MA is beginning to turn up, as all averages appear to be pointing in the right direction.

We have two potential buy entries in $FB listed in today's Wagner Daily, but only one setup can trigger. Whichever setup triggers first is the one we will take, and the other is to be canceled. Since we do not post trades intraday, this type of order allows us to catch a potential pullback if there is weakness without missing the move if the action is strong all day.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|