| The Wagner Daily ETF Report For June 24 |

| By Deron Wagner |

Published

06/24/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For June 24

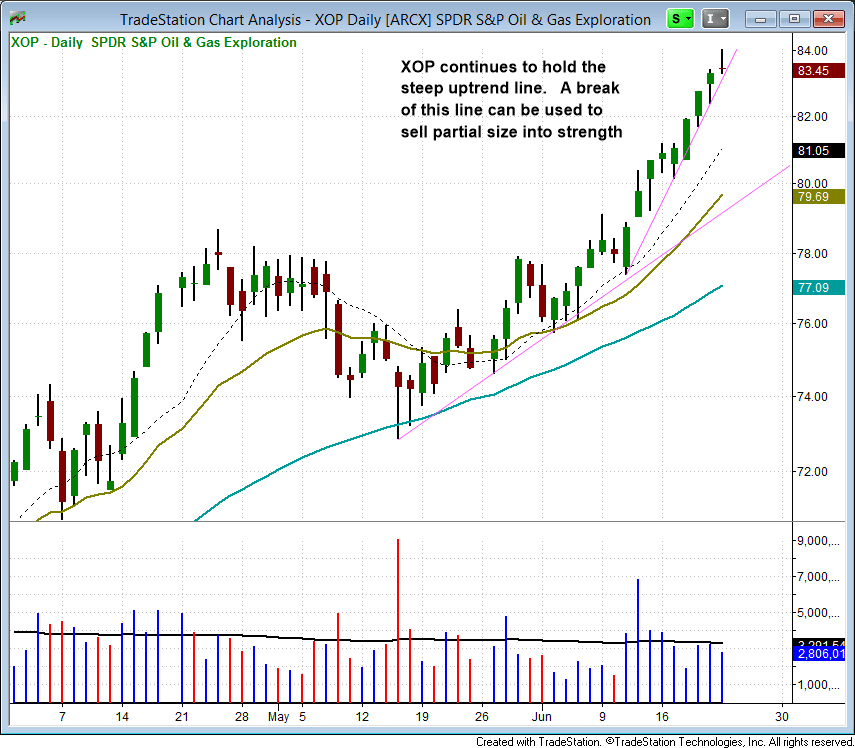

Our current long position in S&P Oil & Gas Exploration ($XOP) from a $77 entry on June 5 continues to push higher, holding on to a short-term and steep uptrend line on the daily chart below.

We have updated our stop price but will continue to hold on to the full position as long as the trendline holds. When the trendline breaks, the 10-day MA will become our selling guide unless we are able to exit into strength.

We have one new ETF setup added to today's watchlist in iPath Coffee ($JO), which has pulled back about 25% off the recent high and undercut a prior swing low on the weekly chart. The past two weeks have printed bullish reversal candles, with last week's candle forming a hammer reversal after slightly undercutting the prior week's low.

The back to back reversal candles presents us with a low risk entry point on the weekly chart, with a clearly defined exit.

The plan is to establish a small position in $JO, as it is too early in the base to grab full or even half size. If the price and volume action is strong, then we will look to add to the position at higher prices.

This is a trade that could take several weeks just to form the right side of the pattern, as there is resistance from a declining 10-week MA at $36 and more resistance at $38.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|