| The Wagner Daily ETF Report For June 27 |

| By Deron Wagner |

Published

06/27/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For June 27

Although this week's action in the market has been quite the intraday roller-coaster, as of Thursday's close the S&P 500 was down less than -0.2% for the week.

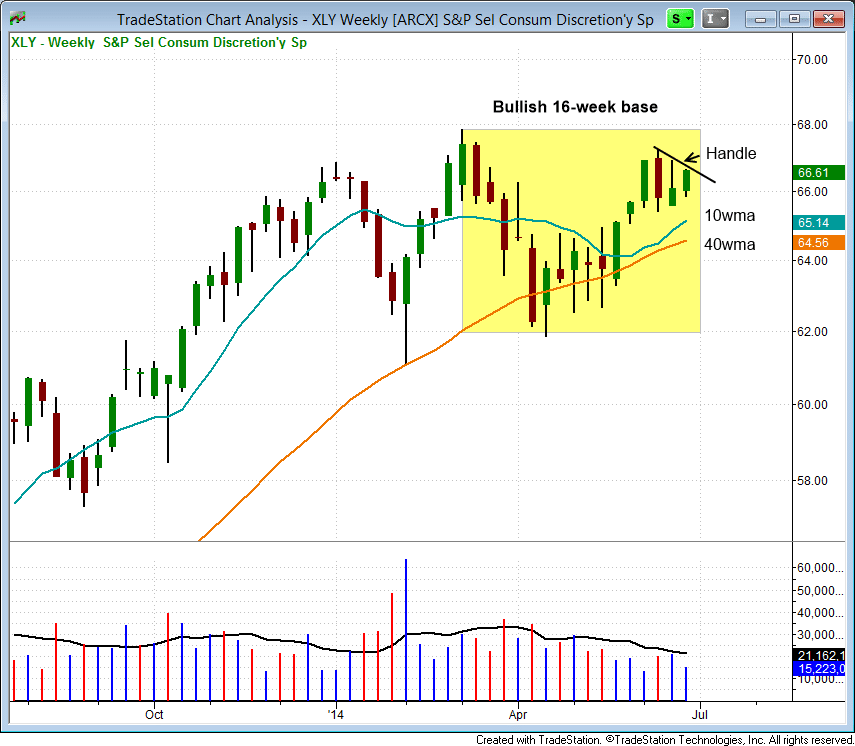

Consumer Discretionary ETF ($XLY) is currently forming the handle portion of a 16-week long cup with handle pattern. Note that both the 10 and 40-week MAs are now pointing in the same direction.

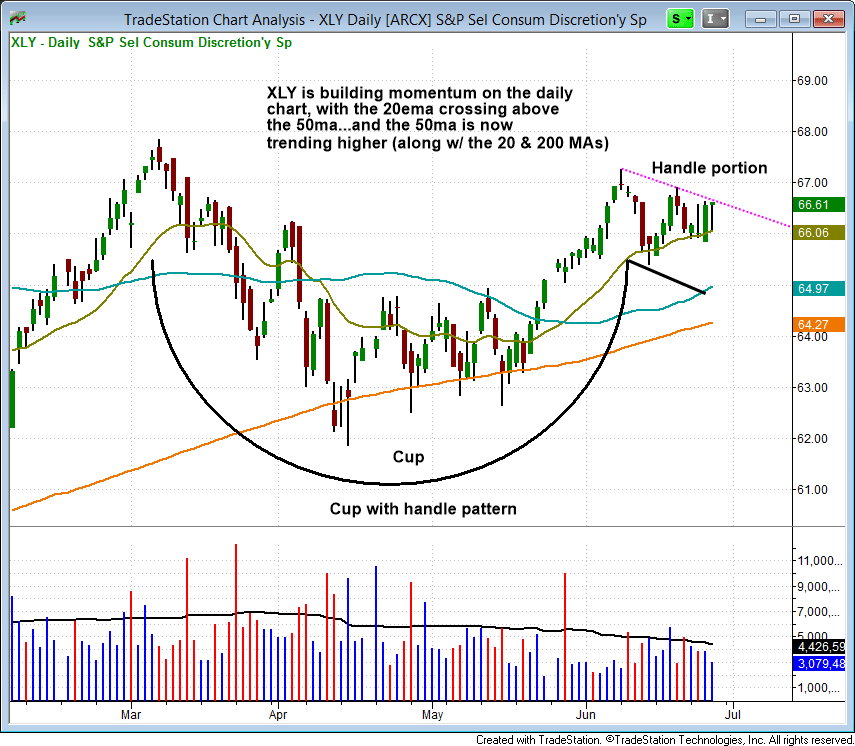

The daily chart shows the price action finding a ton of support at the 200-day MA during the base. $XLY has been building momentum on the daily chart since last May when it:

- Cleared the downtrend line of the base and reclaimed the 50-day MA.

- 20-day EMA crossed above the 50-day MA

- 50-day MA turned up, all three MAs (20,50,200) pointing in same direction

$XLY is forming the handle portion of the pattern, holding support from the rising 20-day EMA. We are monitoring the price action for a potential buy entry. The action should hold above $65 to keep the pattern on track in the short-term. Please see the watchlist above for trade details.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|