| The Wagner Daily ETF Report For July 11 |

| By Deron Wagner |

Published

07/11/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 11

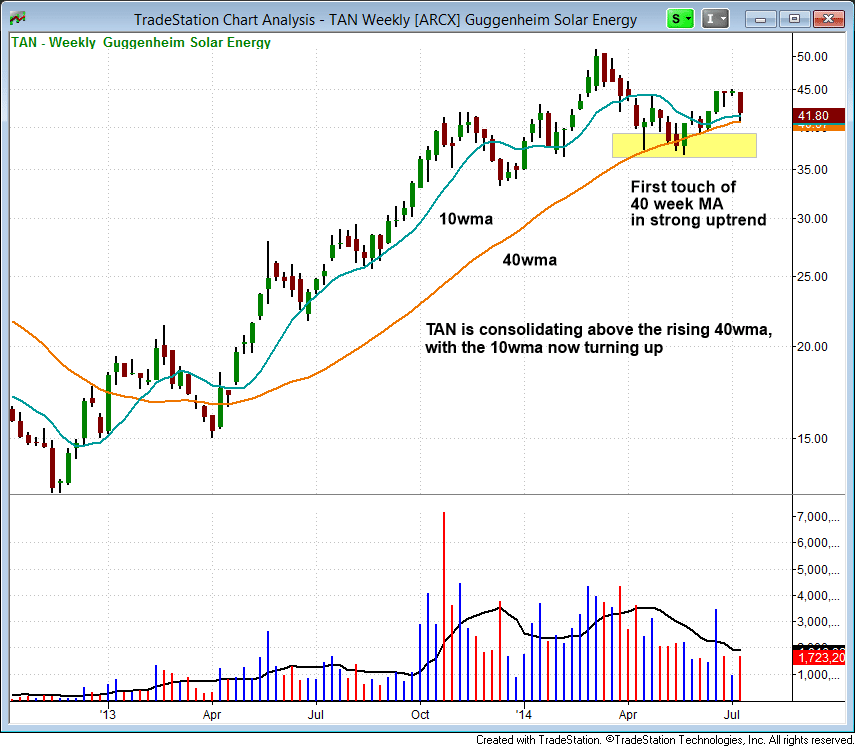

Solar ETF ($TAN) has finally made it back to our buy watchlist, after pulling back to and finding support at the rising 40-week MA this week. The current base in $TAN is the first touch of the 40wma since the strong uptrend began in 2013, which offers a low-risk entry to participate in what should be at least one more significant wave up in solar stocks.

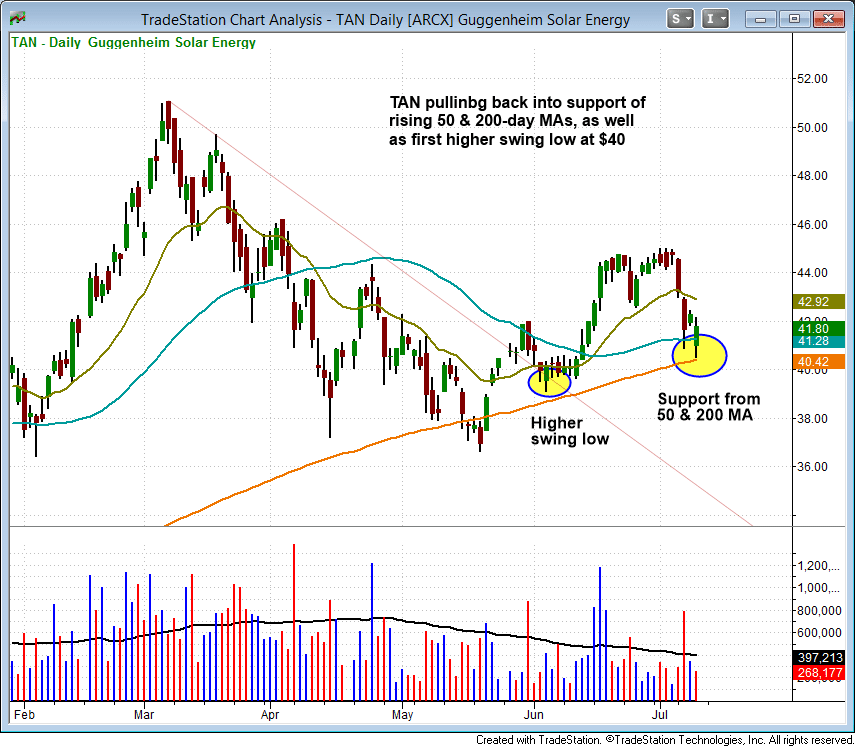

The daily chart shows the higher low in place in early June, with the current pullback attempting to hold a strong support level at $40, where the rising 50 and 200-day MAs and prior swing low converge.

The price action may need to consolidate further before moving out, but with the 50ma near the 200ma, $TAN has the look of a low risk buy setup with a stop below the 200ma.

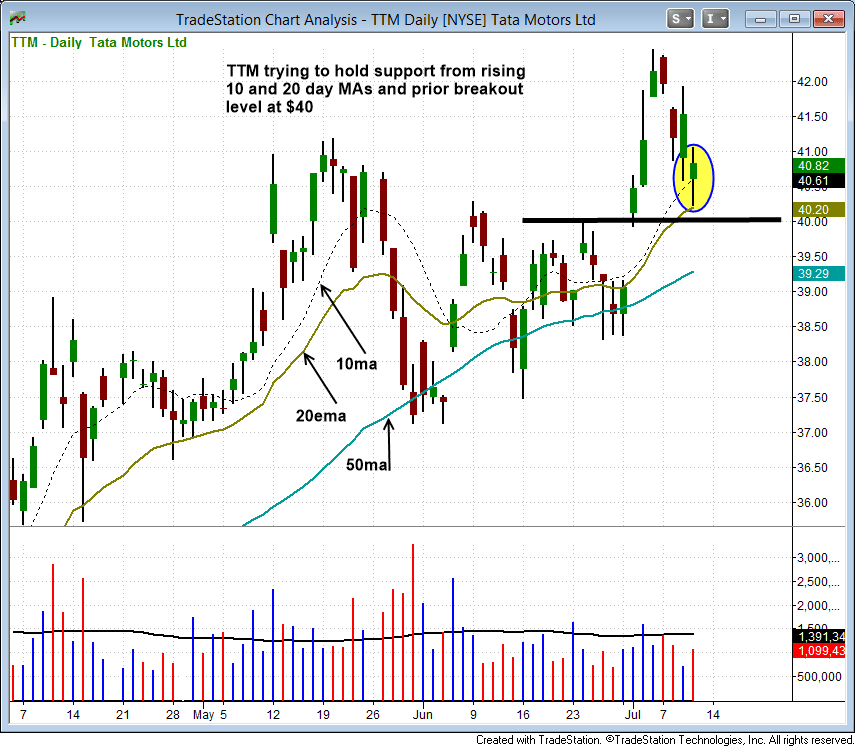

On the stock side, we have one new buy setup to add to an existing position in Tata Motors ($TTM) with a fairly tight stop below the 20-day EMA. $TTM has support from the rising 10 and 20-day MAs, along with the prior breakout pivot at $40.

If $TTM triggers, then we would like to hold for a two to three week advance into earnings, which are due in early August. .

If stocks are able to hold above Thursday's low, we could potentially see a few days of higher prices with a short-term target of the prior swing high in most broad market averages. If the averages stall at the prior high, that would suggest the market will remain range bound into earnings.

If Thursday's low does not hold, then the market could be in for some more ugly selling. Earnings season will hopefully produce a few buyable gap ups to new 52-week highs in A-rated stocks.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|