| The Wagner Daily ETF Report For July 15 |

| By Deron Wagner |

Published

07/15/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 15

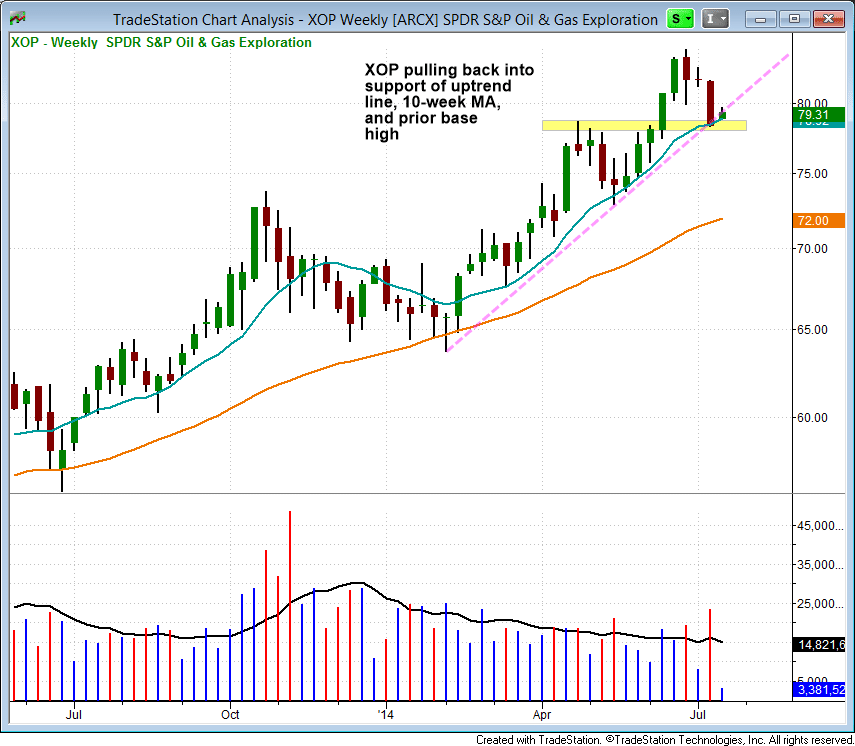

There are no new setups on today's ETF watchlist section of our nightly trading newsletter, but we are monitoring the action in Oil and Gas ETF ($XOP) for an entry point.

As shown below, $XOP has pulled back to a significant support level on the weekly chart, with the 10-week MA, uptrend line, and prior highs of the last base all around $79.

Last week's selling was on heavier than average volume, but if $XOP continues to hold at or above last week's low, then we can assume that the buyers overwhelmed the sellers.

An inside week at or around the 10-week MA here would be ideal.

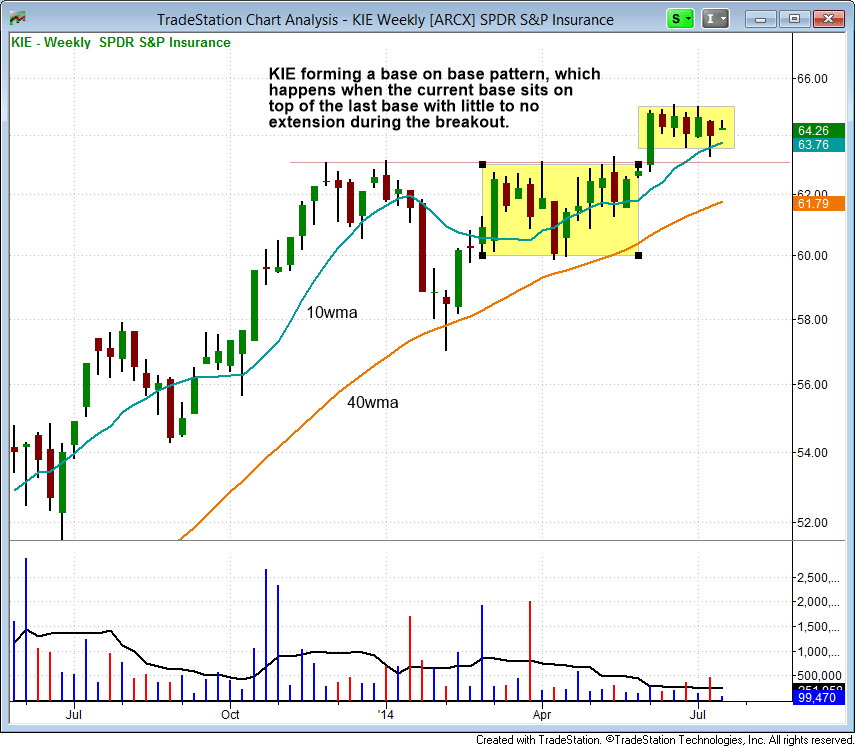

Although the financial sector is lagging, current basing action in banking ETF ($KBE) and insurance ETF ($KIE) are bullish.

$KIE has formed a base on base pattern, which occurs when a current base sits on top of a prior valid base without much extension in price.

The current base is pretty tight and sitting on top of a rising 10-week MA. A move above last week's high or another test of the 10-week MA are potential entry points.

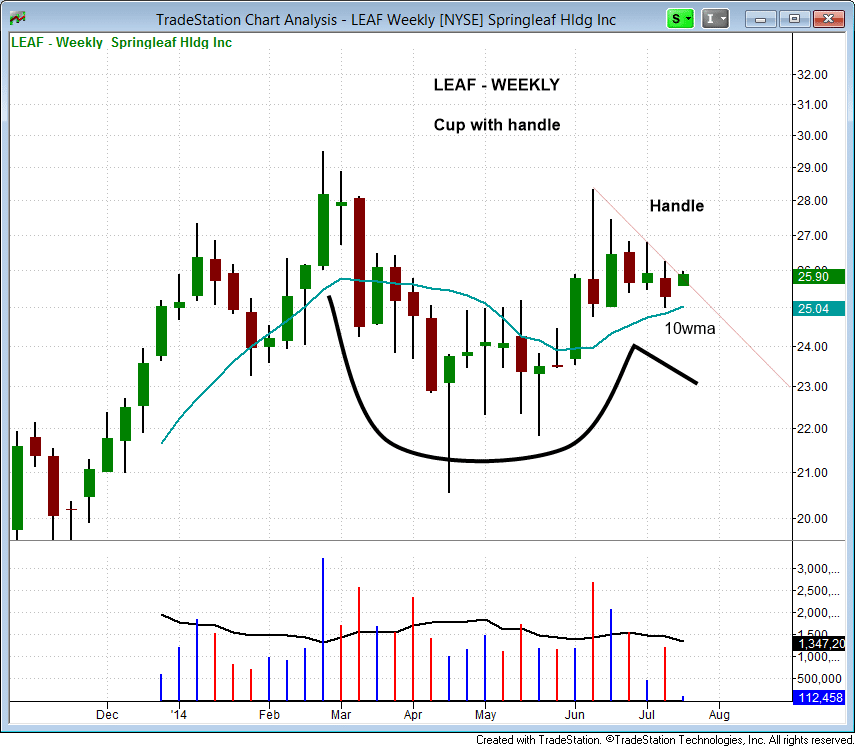

On the stock side we have one new buy buy setup in Springleaf ($LEAF), which is forming a cup with handle pattern on the weekly chart.

$LEAF is currently forming the handle portion of the pattern above the rising 10-week MA. Note the dry up in volume two weeks ago, which is a bullish sign. A break of last week's high is the entry point with a tight stop placed just below the 10-week MA and last week's low:

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|