| The Wagner Daily ETF Report For July 28 |

| By Deron Wagner |

Published

07/28/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 28

Stocks gapped lower last Friday morning and continued to sell off during the first 90 minutes, then found traction and settled into a range for the rest of the day. The good news is that Friday's selling failed to produce a distribution day in the S&P 500 or Nasdaq, as total volume finished well below Thursday's pace.

The gap down could certainly lead to more weakness early this week, but right now we would view any pullback in the market as a buying opportunity...just as long as low-risk setups develop.

Short term support levels in a few of the major averages are:

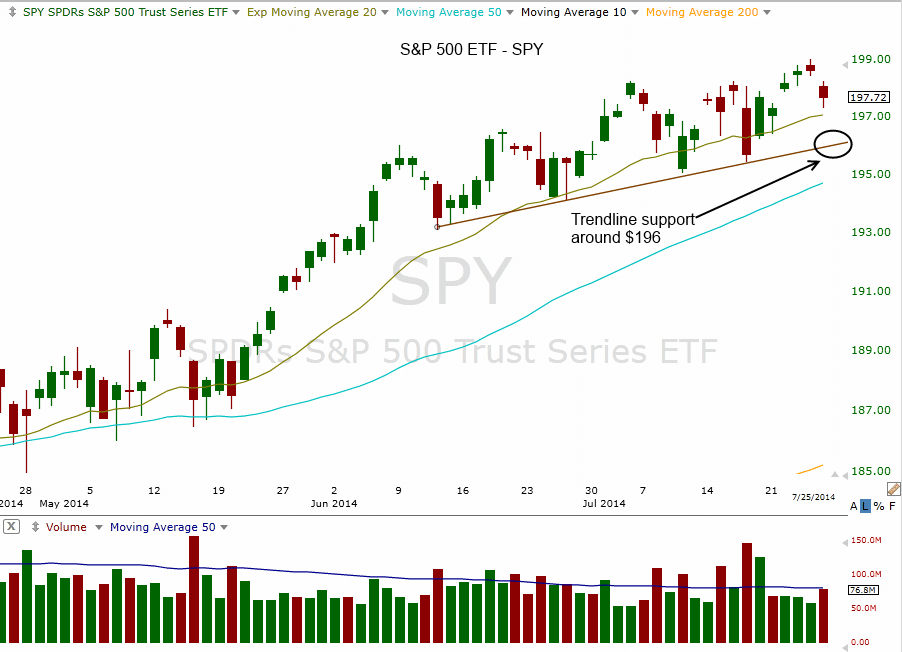

S&P 500 ETF ($SPY) has support from the rising 20-day EMA around $197, but if that does not hold then a test of the uptrend line around $196 is likely.

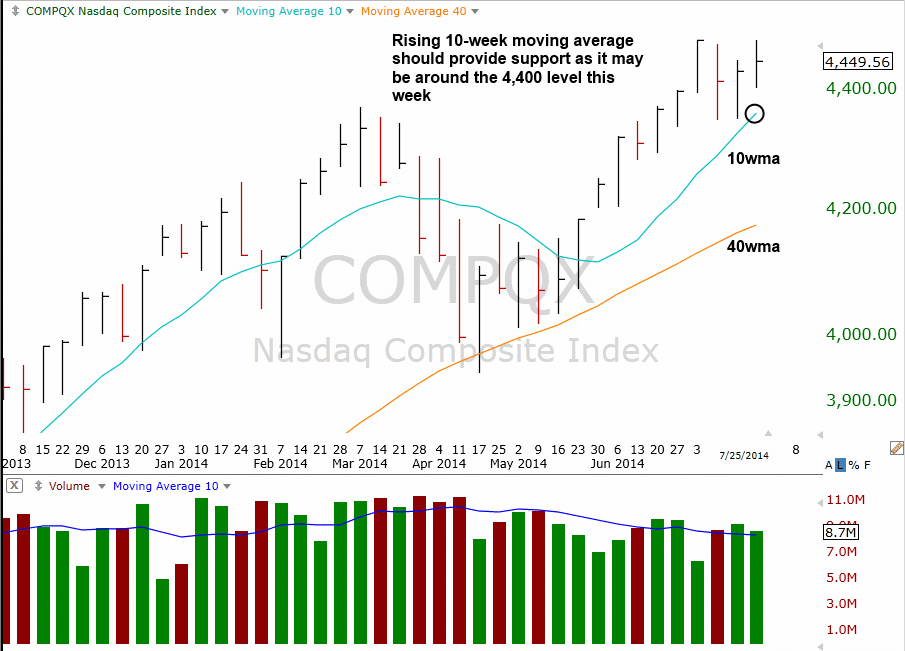

Last week's stalling action at the prior swing high in the the Nasdaq Composite suggest more range-bound price action. If support from the 20-day EMA does not hold, then a test of the current range low would likely be the next move.

The 20-day EMA is not alone with support around 4,400, as the 10-week moving average on the weekly chart should open up around 4,400 this week. If this level holds, then we could begin to see the price action tighten up in the Nasdaq over the next two weeks.

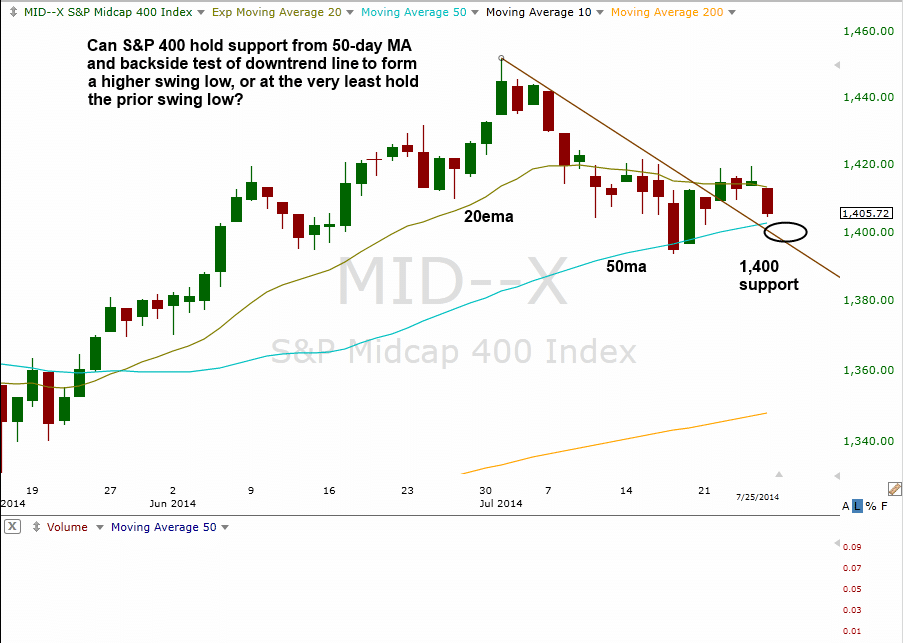

The S&P Midcap 400 recently cleared a short-term downtrend line but failed to generate much momentum and is pulling back to the 50-day MA, which should provide support around 1,400 along with the backside of the downtrend line.

For the pattern to have made any progress the current pullback must at the very least hold the prior swing low. A break of the low would indicate that mid-cap stocks need a bit more time to consolidate before heading higher.

On the stock side we bought Chipotle Mexican Grill ($CMG) on strength above a two-day high, which did follow through on a slight pick up in volume. Our stop triggered below the 10-day MA in $TSEM, enabling us to close the trade with a 10% gain on the remaining shares.

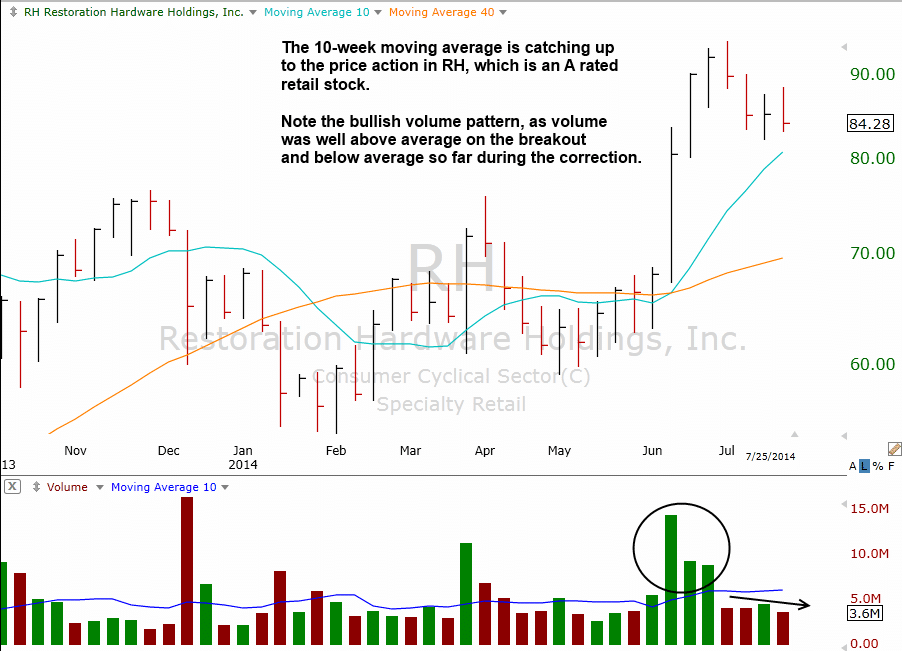

Current A rated retail stock Restoration Hardware ($RH) continues to pullback with constructive price and volume action with the 10-week MA catching up. A touch or undercut of the 10-week MA could produce a low risk entry point in a week or two.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|