| The Wagner Daily ETF Report For July 30 |

| By Deron Wagner |

Published

07/30/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 30

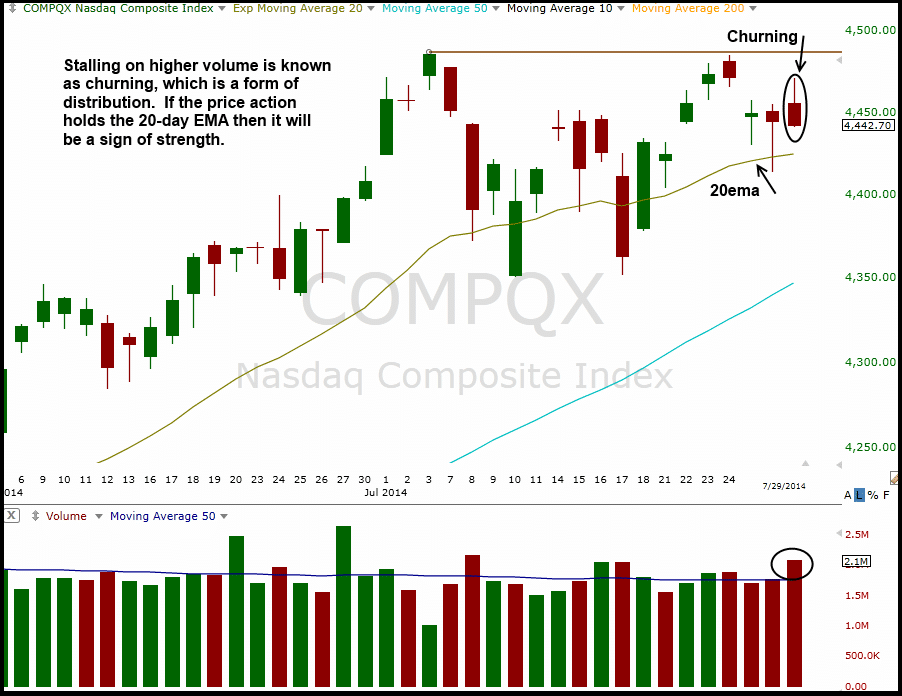

The market responded poorly to Monday's bullish reversal action with a day of stalling or churning. All major averages pushed above the prior day's high but reversed to close near the lows of the session on a pick up in volume. The higher volume produced distribution days in the S&P 500 and Nasdaq Composite.

The chart of the Nasdaq Composite below is a good example of "churning," which is a failed attempt to push higher, followed by a negative close near the lows of the day. The stalling action represents professional selling into strength and is bearish (volume must be higher than the previous day to confirm):

A close below Monday's lows in the S&P 500 and Nasdaq Composite would suggest further short-term weakness.

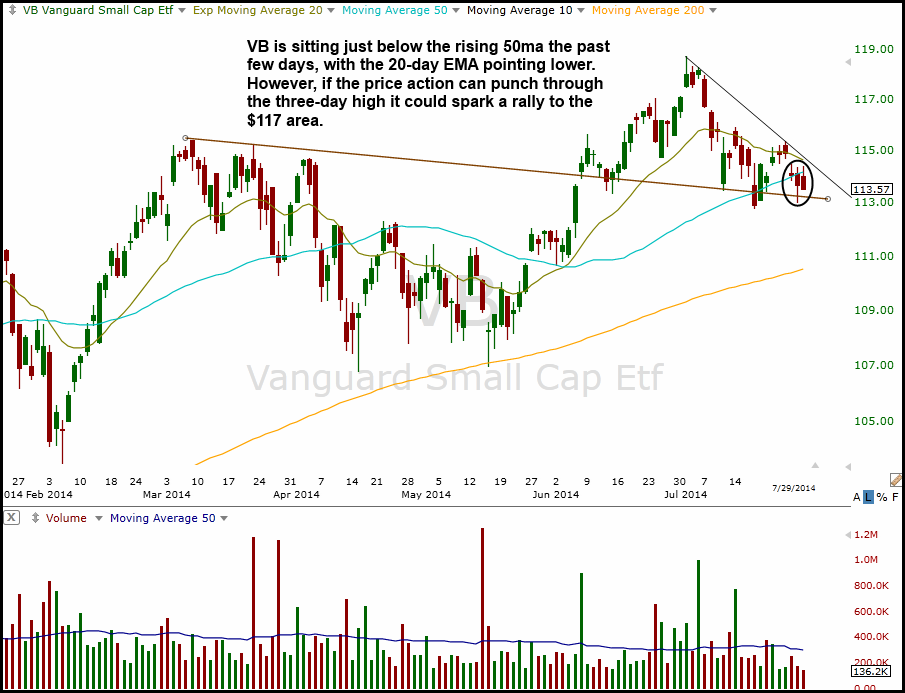

Small Cap ETF ($VB) has pulled back to the rising 50-day MA after clearing a prior base high on a breakout in June. Although it is struggling to hold the 50-day MA, a close above the three-day high could spark a short-term move to the $117 area.

Our thought process here is that we could see money rotate into beaten down small cap stocks as other extended averages pull back in for a bit:

We are placing $VB on today's watchlist for our swing trading newsletter. Subscribing members should note our exact buy trigger, stop, and target prices for this setup in today's report.

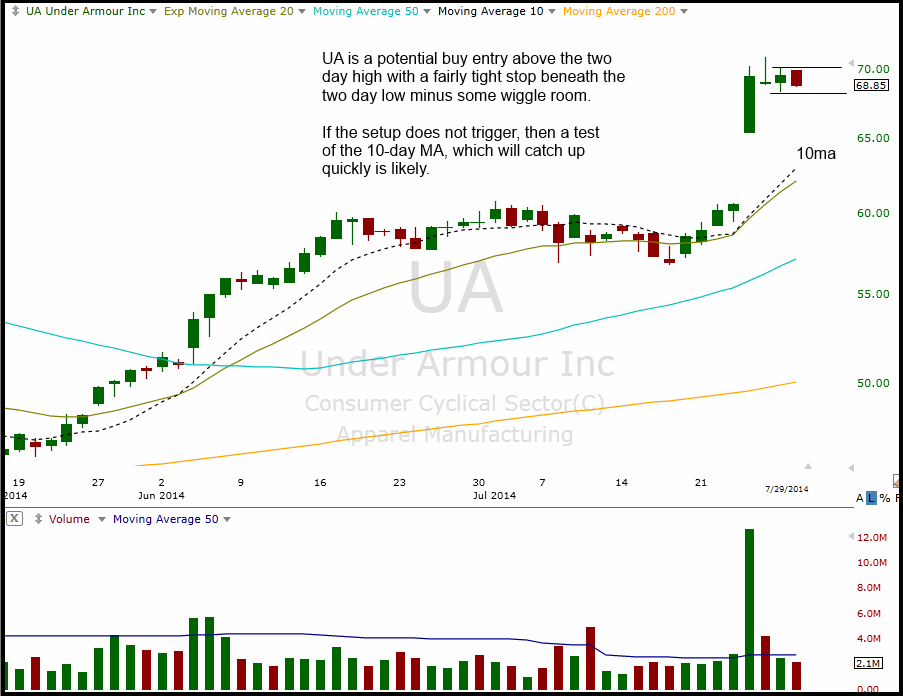

We have one new buy setup today in Under Armour ($UA), which is a recent breakaway gap up to new all-time highs on big volume.

move above the two-day high is a buy entry with a tight stop. Whenever there is tight price action after a big gap up, we usually want to take some size. Again, this buy may not work and we may have to re-enter down the road at the 10-day MA, but it is a shot we must take (much like our recent swing trade in $CMG over the two-day high).

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|