| The Wagner Daily ETF Report For July 31 |

| By Deron Wagner |

Published

07/31/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 31

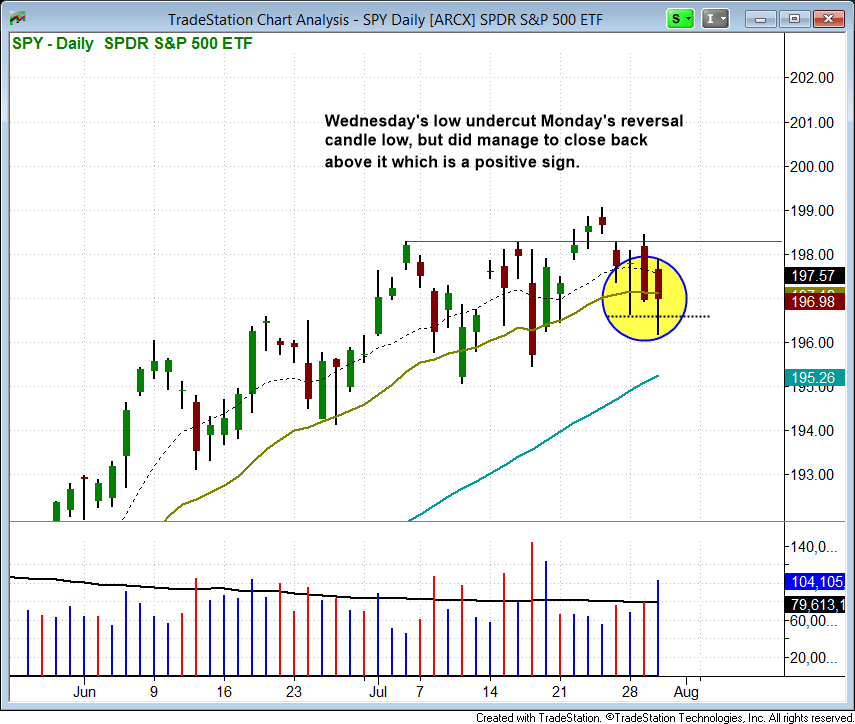

Although the S&P 500 undercut Monday's reversal candle low, it did manage to hold that low by closing near the middle of the day's range. Wednesday's close was right around the prior day's close on a pick up in volume, which suggests accumulation (higher volume with no further downside is usually bullish at the lows of a range).

However, the pick up in volatility of late makes it tough to expect any follow through. A close below Wednesday's low would most likely send the S&P 500 to its 50-day MA:

The story is quite a bit different in the Nasdaq Composite, which continues to consolidate in a tight range above the rising 20-day EMA.

The Nasdaq also has support from the rising 10-week moving average around 4,388.

http://www.morpheustrading.com//~rick//charts/2014/140731COMP.png">

Tesla Motors ($TSLA) reports earnings after the close on Thursday (July 31), so a big breakout or breakdown could spark the market in either direction.

We still have three open setups on the ETF side in $PIN, $IWS, and $VB.

On the stock side, we tightened up stops in $LIOX and $LEAF as both report earnings next week.

A ton of companies report next week as well, so once earnings are out of the way we should have a better idea of what is out there in terms of actionable buy setups.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|