| The Wagner Daily ETF Report For August 13 |

| By Deron Wagner |

Published

08/13/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 13

Broad market averages continue to digest the last move off the lows, with most averages pulling back into the 10-day moving averages, but closing near the middle of the day's range. The late bounce allowed the Nasdaq Composite to close above the 50-day MA for the second day in a row.

The S&P 500 held on to the rising 20-period EMA on the 60-minute chart, which is good news in the short-term, but there is plenty of resistance above in the 1,955 to 1,965 area.

Both of our gold and silver miner ETF swing trade setups triggered for buy entry in The Wagner Daily yesterday, and we are now long.

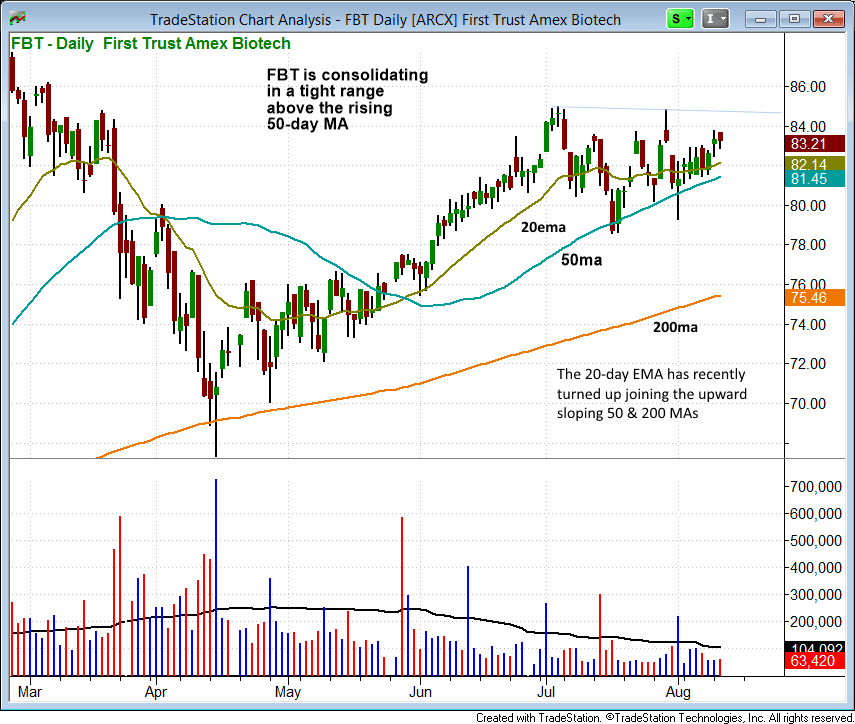

Going into today, we are stalking a potential buy entry in a Biotech ETF ($FBT), which has formed a tight consolidation above the rising 50-day MA the past six weeks. Note the declining volume during the consolidation, which is a bullish sign:

The price action has closed above last week's high ($83) the past two days, so a move above the two-day high should lead to a test of $85.

On the individual stock side, we are still looking to enter Facebook ($FB), but wouldn't mind a shakeout below Tuesday's intraday low to produce a decent reversal candle.

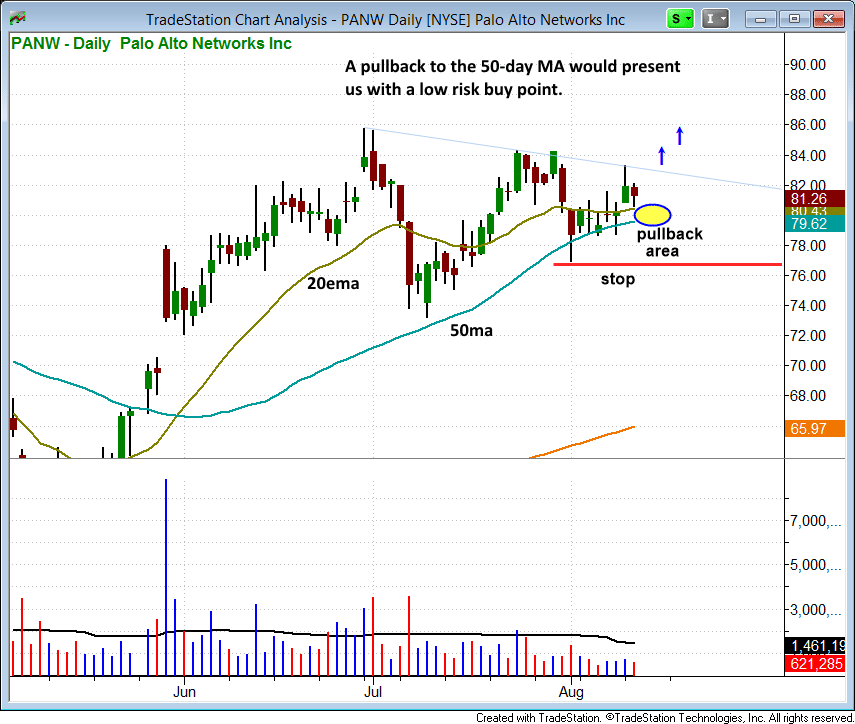

Palo Alto Networks ($PANW) is a fairly recent IPO from 2012, with strong quarterly EPS and revenue growth, and a powerful 97 relative strength ranking. Because of this, it is a core setup, meaning we are comfortable holding the stock for a longer period of time (as long as price and volume action remains strong).

Subscribing members should note the "Watchlist" section of today's report for our exact entry, stop, and target prices for the $PANW setup above.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|