|

The Wagner Daily ETF Report For August 14

The Nasdaq Composite rallied 1.0% higher on a pick up in volume, producing a follow-through like day and generating a buy signal in our timing model. The follow through day comes on day 5 of the rally off the lows, which is also a good sign (within 4 to 10 days of a swing low is ideal).

Although our timing model now shifts from neutral to buy, our thought process does not change much, as we were already prepared to buy stocks this week and posted 8 buy setups in last night's report.

From here on out, we'll be looking for new setups to emerge to confirm the recent buy signal, and for the to avoid distribution within the next few days.

We have one new buy setup on the ETF watchlist tonight in iShares MSCI Frontier 100 ETF ($FM), which has 55% of its exposure to top equities from Kuwait, Nigeria, Qatar, and UAE.

After an ugly undercut of a prior swing low in late June, $FM has recovered nicely and formed a tight trading range above the 50-day MA, with momentum starting to build (the 20-day EMA crossed above the 50ma).

Note the dry up in volume, especially over the past few weeks which is bullish.

Subscribing members of The Wagner Daily should note our exact buy trigger, stop, and target prices for this trade setup in today's report.

First Trust DJ Internet Index ($FDN)is also on the list, but has been changed from a buy limit order to a buy stop due to Wednesday's downtrend line breakout on a pick up in volume.

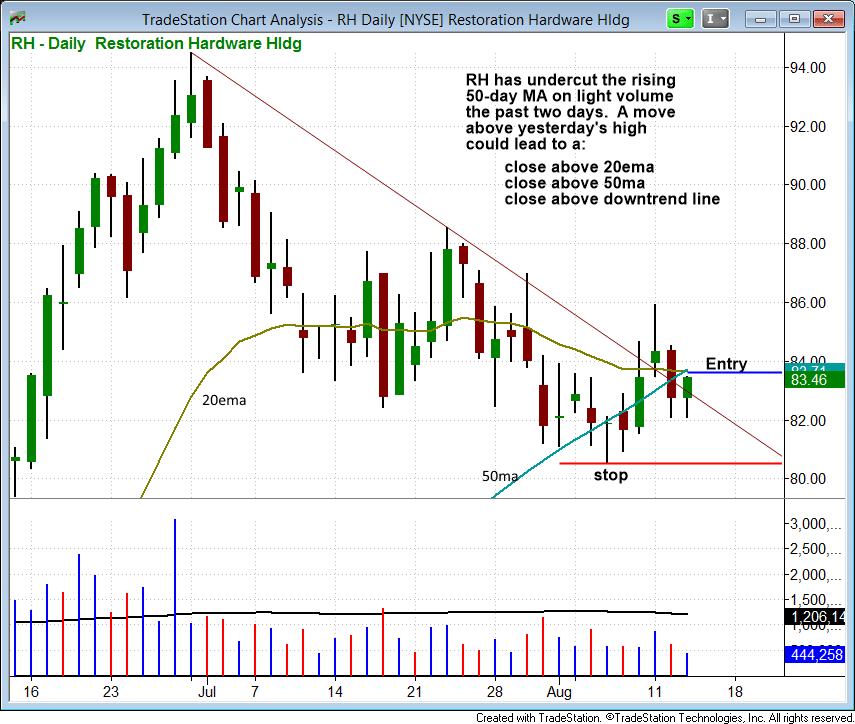

On the stock side, we have a few buy setups on the watchlist. With $RH printing an inside type day on lighter volume Wednesday, a move above yesterday' high and the 50-day MA could spark some buying interest.

RH has pulled back in orderly fashion and on light volume since topping out in late June/early July.

This is a core position, so we will look to add on the way up if/when low risk buy points develop.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|