| The Wagner Daily ETF Report For August 19 |

| By Deron Wagner |

Published

08/19/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 19

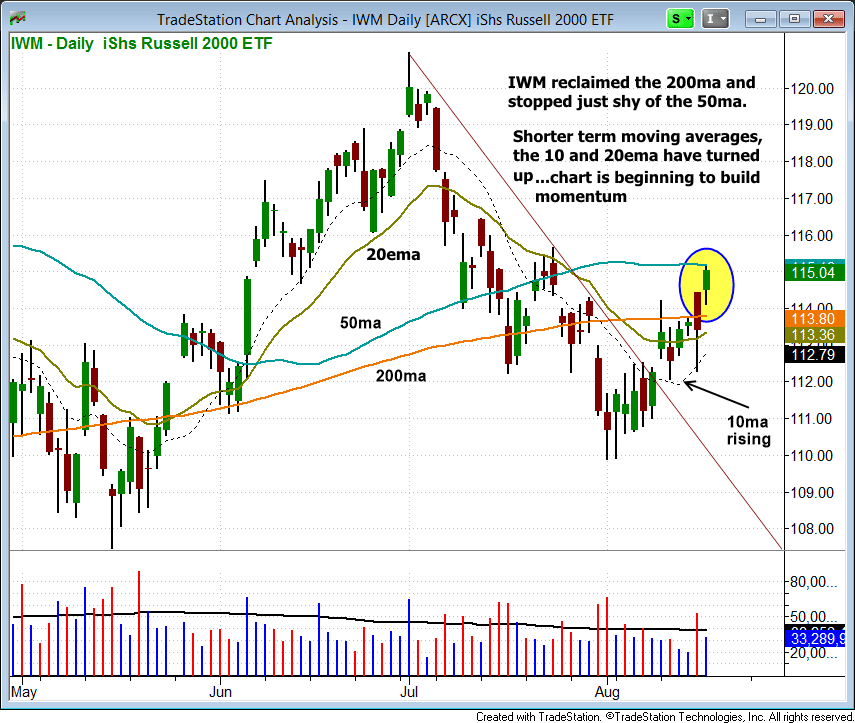

The small-cap Russell 2000 Index, which has lagged the other major averages for several weeks, is finally beginning to build momentum on the daily chart. Last week's rally cleared the downtrend line of the pullback, forcing the 10-day MA and 20-day EMA to turn up. The 20-day EMA is still below the 50-day MA, and the 50-day MA has yet to turn up, so there is still plenty of work ahead.

On the individual stock side, we are monitoring a few "A-rated" stocks for pullback entries ($AMBA $TSLA $PANW).

We have one new buy setup in China Bak Battery ($CBAK). This is a "blast off" trade setup (click here for a detailed explanation).

The blast off is a very simple concept. We look for a monster move in terms of price and volume action through the 50-day MA, which is normally going sideways (the stock is in consolidation mode). Once the initial surge is over, we wait for the price and volume action to settle down for a few weeks to produce a reliable entry point.

Since the volume in $CBAK is light, we are keeping share size down. Regular subscribers to our nightly trading report should note our exact trigger, stop, and target prices for the $CBAK setup in today's letter.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|