| The Wagner Daily ETF Report For September 5 |

| By Deron Wagner |

Published

09/5/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 5

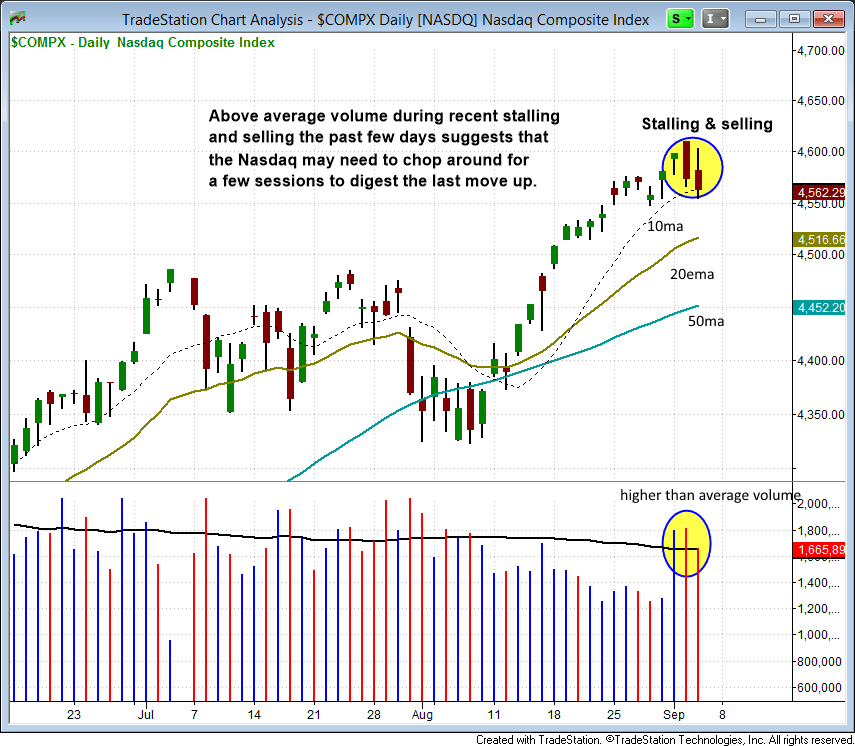

The current market rally has lost some steam the past few days, with all major averages failing to extend above last week's high on several attempts.

The market-leading Nasdaq Composite has sold off the past two days on higher than average volume after pushing higher on Monday and Tuesday. We expect the Nasdaq to chop around for a bit to digest the recent run up, unless it can reclaim 4750 and push through the 20ema on the 60-minute chart within the next day or two:

We have been laying low all week with regard to new buy setups due to the lack of low-risk entry points from our daily scans.

As mentioned yesterday, our scans are extremely important to what we do. When our scans produce many setups, it is easy to be aggressive. When the setups run dry, there isn't much we can do without forcing the issue (which we never want to do).

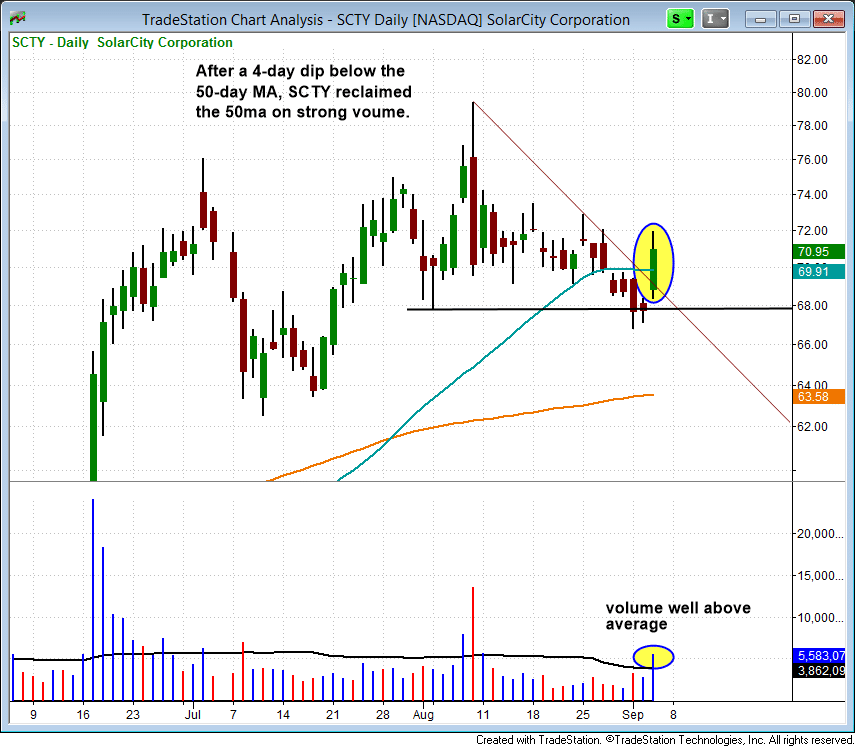

We do have one new official buy setup on today's watchlist, which is Solar City ($SCTY). The price action reversed higher and reclaimed the 50-day MA on strong volume yesterday:

With $SCTY closing back above the 50-day MA on volume, we now have a legit buy signal in place for partial size. We are looking for a slight pullback to the 50-day MA within the next day or two as a low-risk entry point.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|