| The Wagner Daily ETF Report For September 10 |

| By Deron Wagner |

Published

09/10/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 10

Stocks sold off across the board on higher volume, producing a distribution day in the S&P 500 and Nasdaq Composite. Over the past two weeks, we have seen an increase in volatility and heavy selling volume in the major averages, along with a failure to push higher. Although the timing model is still on a buy signal, we are not looking to add new positions right now unless a low risk pullback setup emerged in an A-rated stock.

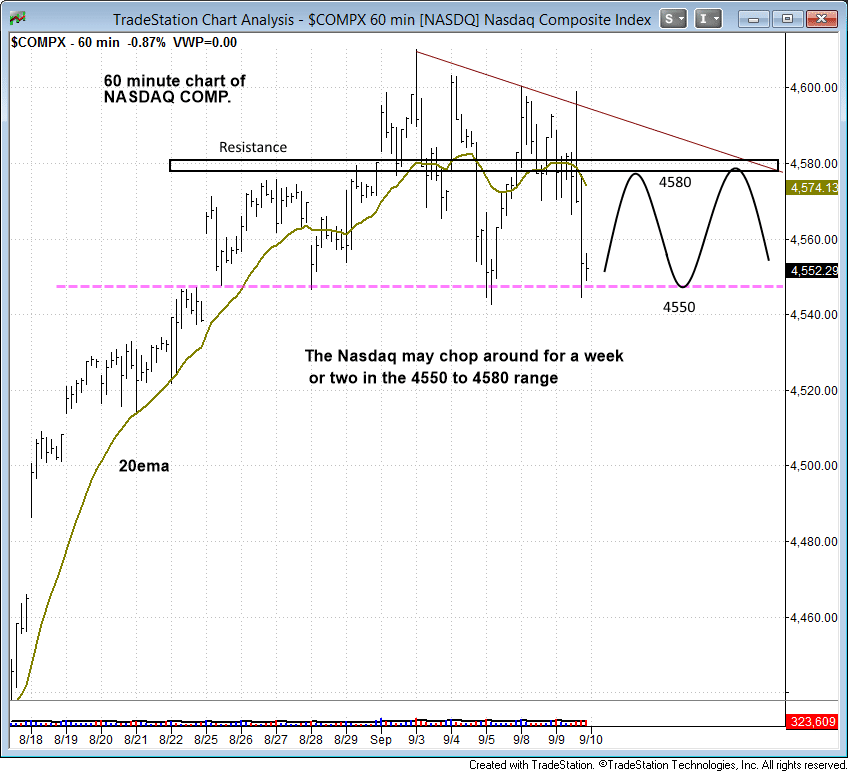

Looking at the hourly chart of the Nasdaq Composite below, we could see the price action going sideways for a week or two in the 4550 to 4580 range, minus a shakeout below the 20-EMA on a daily chart.

Should the 20-EMA not hold, then the next support level on the Nasdaq could be the prior swing highs just below 4500.

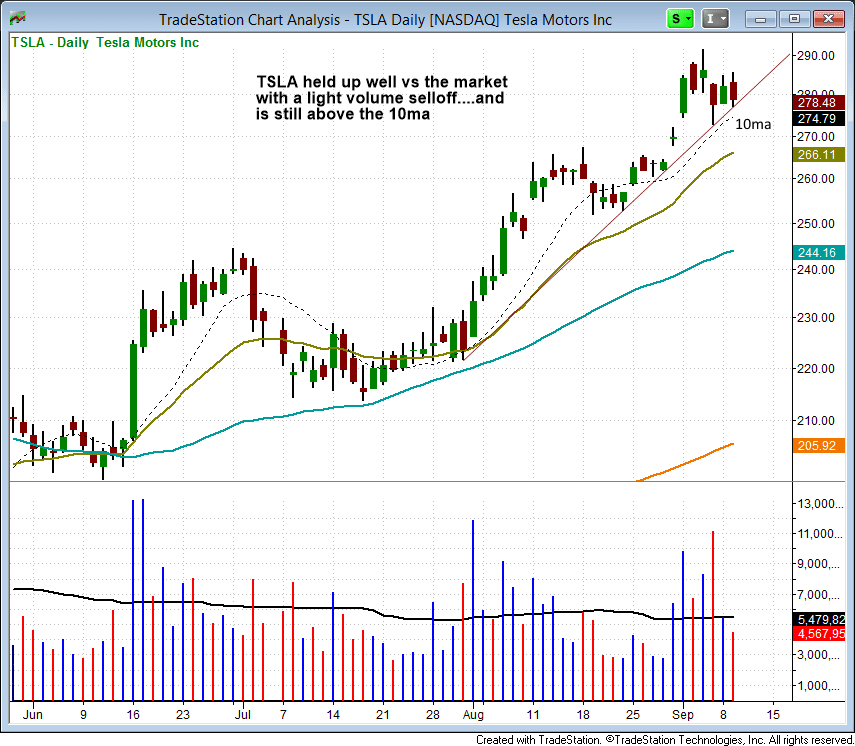

Tesla Motors ($TSLA) held up well vs the market on Tuesday, selling off 1% on light volume down to the rising 10-day MA and uptrend line. We are in no hurry to raise our stop here, as we want to give this trade plenty of breathing room.

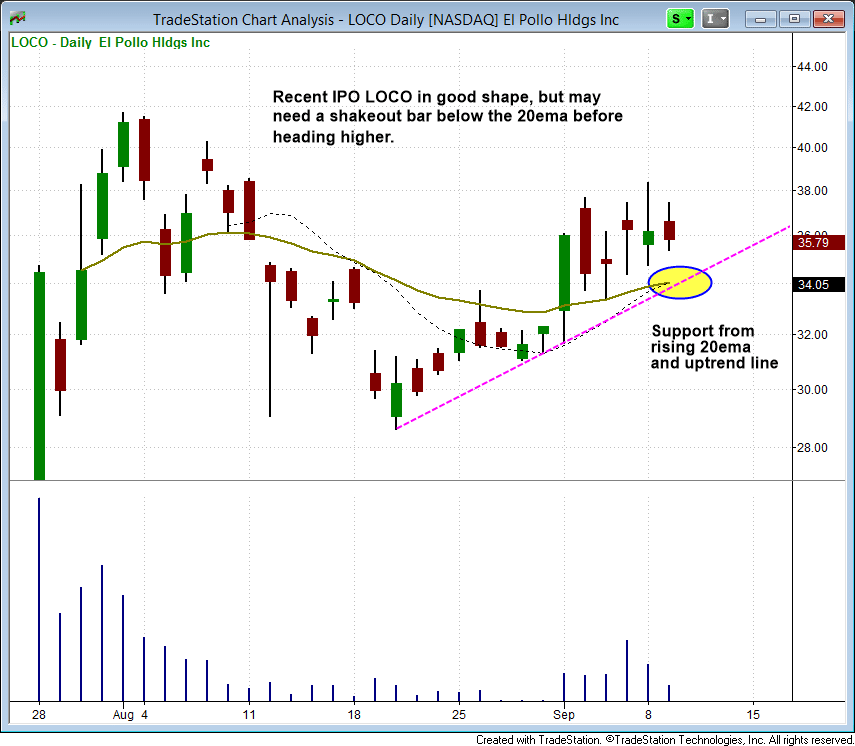

With a 98 relative strength ranking and an average daily trading volume of at least 3 million shares per day, El Pollo Loco ($LOCO) is a potentially explosive IPO forming a bullish base. A pullback to the rising 20-day EMA and uptrend line would be an ideal, low risk entry point, especially if a bullish reversal candle formed on a pick up in volume.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|