| The Wagner Daily ETF Report For September 17 |

| By Deron Wagner |

Published

09/17/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 17

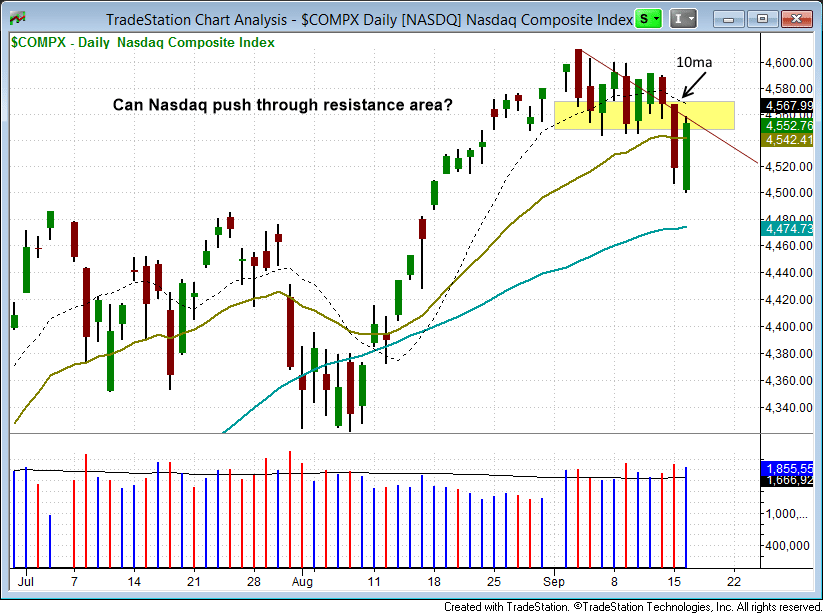

Stocks rallied higher across the board, led by the S&P 500 closing above 10-day moving average and the two-day high. The Nasdaq recovered a little over 2/3 of the prior day's loss, but must still overcome resistance from prior swing lows and a declining 10-day moving average in the 4550 - 4570 area.

Small cap stocks underperformed and continue to struggle, with $IWM stalling at the 50 & 200-day MAs (50ma is declining).

We believe the market will eventually move higher as long as relative strength stocks continue to hold key support levels. In the meantime, the market may need another week or two of chop to digest the recent run up. Although the breadth of leadership is not nearly as strong as it was in 2013, there is still plenty of strength to lift the market higher.

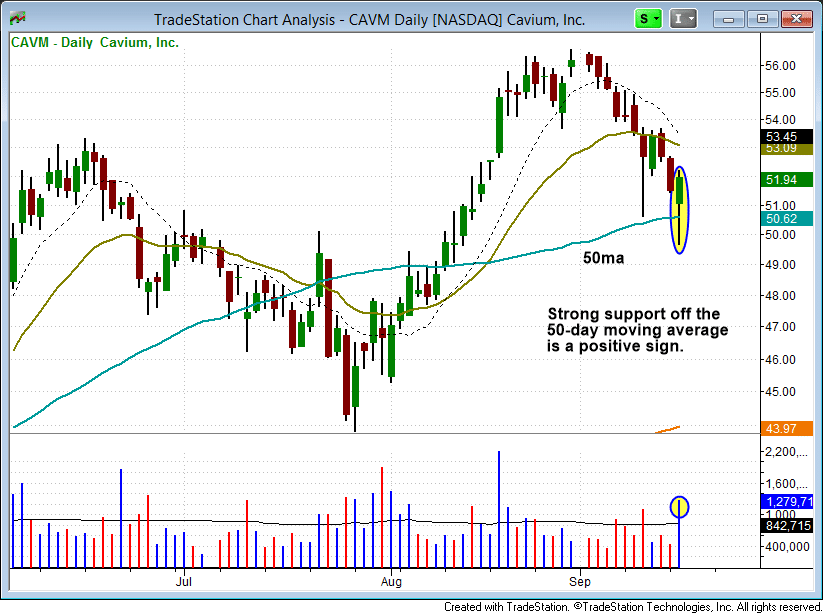

Cavium ($CAVM) put in a bullish reversal candle off the rising 50-day MA on Tuesday, which was confirmed by a strong pick up in volume. The combined price and volume action off the 50ma is a buy signal, so we are placing $CAVM on today's watchlist.

With a 96 fundamental ranking and an 87 relative strength ranking, $CAVM is both strong technically and fundamentally, so it is a potential core trade, which means we will look to hold for than a swing trade or 10-20% pop.

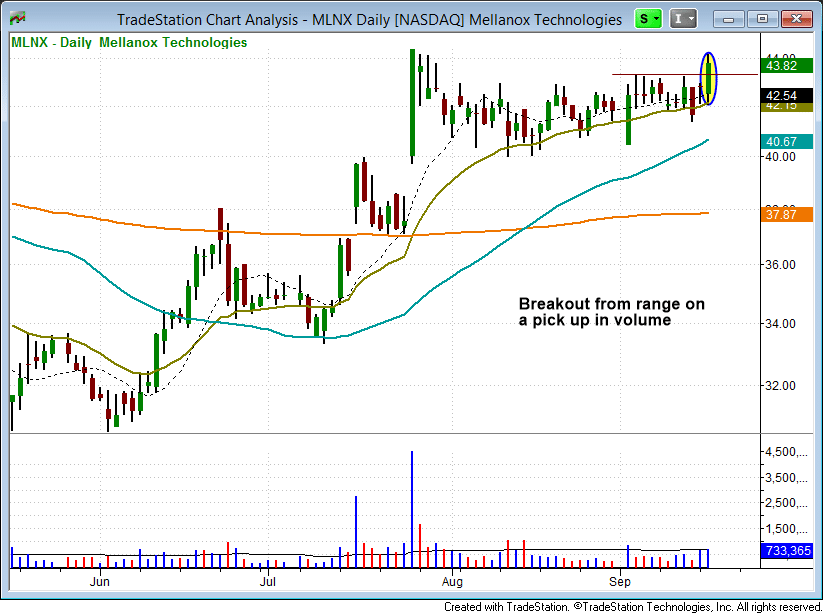

Before breaking out on Tuesday, Mellanox Tech. ($MLNX) had been in consolidation mode for nearly two months above the 50-day MA.

Tuesday's breakout was on pick up in volume, but mot much more than average. We like $MLNX for a potential pullback entry on slight weakness.

$MLNX does not have any fundamentals, but with an 88 relative strength ranking and an industry group ranking of 19 out of 197, there is enough momentum to carry the stock higher for a few weeks. This is not a core trade due to the lack of earnings.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|