| The Wagner Daily ETF Report For September 19 |

| By Deron Wagner |

Published

09/19/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 19

Stocks pushed higher for the third day in a row, with the S&P 500 setting a new high for the year and the Dow Jones adding to its recent breakout as well. Although the Nasdaq Composite and Nasdaq 100 are still range-bound, both averages have pushed through resistance this week and are less than 0.5% off the 52-week high.

Distribution during a rally can be healthy as long as money rotates out of extended names and into stocks with bullish patterns. Distribution without rotation is a bad sign, as investors simply want out of the market and are more comfortable in cash. Earlier in the week there was clear divergence between the Nasdaq and S&P 500, pointing to money rotating out of extended, higher beta names and into slower moving names of the Dow and S&P 500, which is normal action.

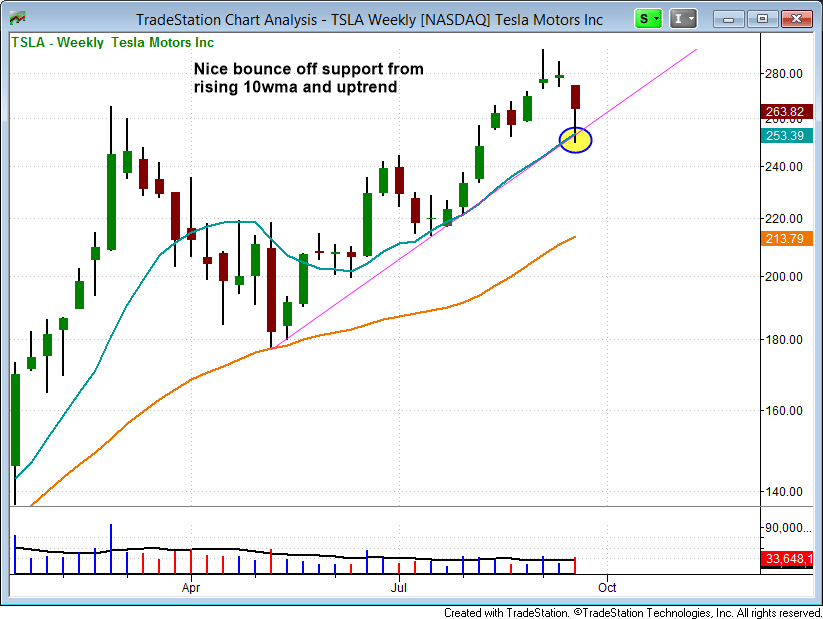

The weekly chart of Tesla Motors ($TSLA) has done a pretty good job of defending a key support level this week around $250, which is where the rising 10-week MA and uptrend line converge. Should support hold this week, then we could potentially see a pullback entry emerge next week on any test of the $255 area.

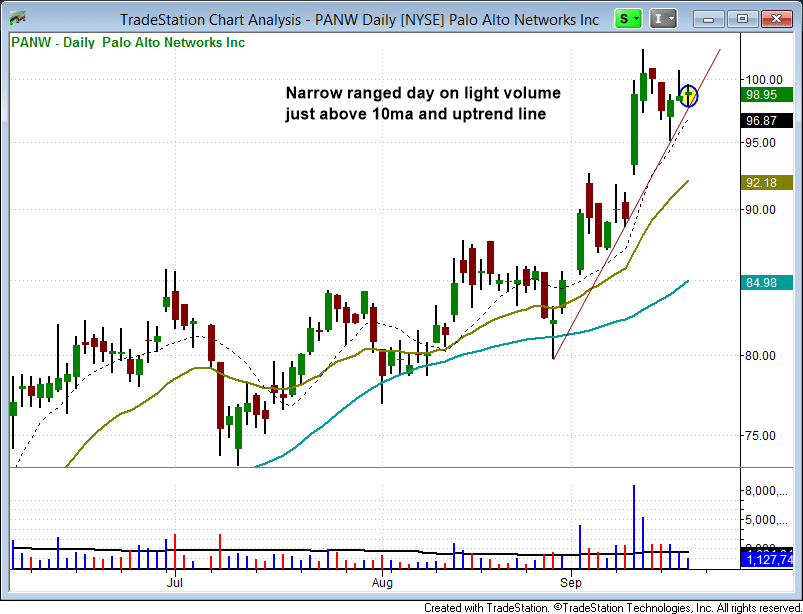

Palo Alto Networks ($PANW) is in pullback mode after a strong breakout to new highs in early September. Thursday's tight-ranged day on light volume held the steep uptrend line on the daily chart below. With the 10-day MA just below, we are looking for a quick swing trade to new highs.

Regular subscribers should note the "Watchlist" section of today's report for our exact buy trigger, stop, and target price

Regular subscribers should note the "Watchlist" section of today's report for our exact buy trigger, stop, and target price of the $PANW setup.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|