| The Wagner Daily ETF Report For September 30 |

| By Deron Wagner |

Published

09/30/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 30

The broad market averages recovered nicely from an ugly morning gap down, avoiding what could have been another nasty distribution day. By the close, most averages were down less than -0.2%, while closing in the top 20% of the day's range.

The bullish reversal action was also backed by higher volume on the NYSE and Nasdaq.

At the very least, Monday's lows must hold up over the next few days, as an immediate reversal back below those levels in the major indices would be quite bearish.

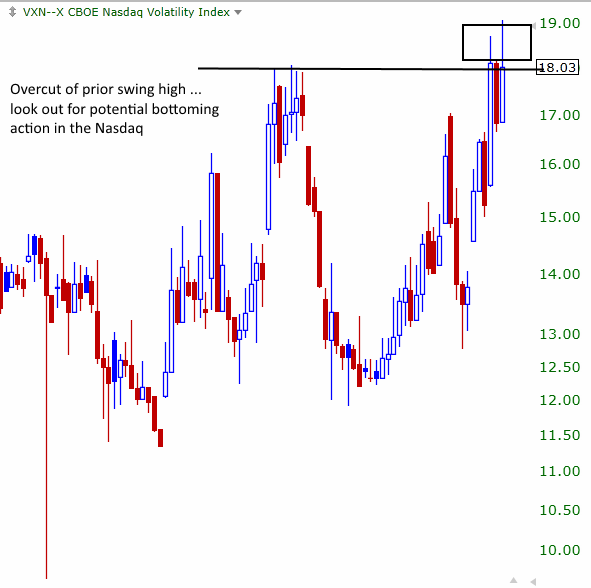

In the Live Mentorship Room (included for subscribers of our nightly stock picking report) last Friday, we discussed how we use the Nasdaq Volatility Index ($VXN) to anticipate potential reversal action in the Nasdaq.

The daily chart of $VXN below shows the price action over-cutting a significant prior swing high:

Once there is a decent drop in the stock market, along with an "overcut" of a prior swing high in $VXN, we want to be on the lookout for low-risk entry points in top relative strength stocks.

The Nasdaq Volatility Index is not a very fancy indicator, but it does allow us to measure if there has been enough fear to create a tradeable bottom.

With that in mind, we have a new stock on today's Wagner Daily watchlist for potential swing trade entry...

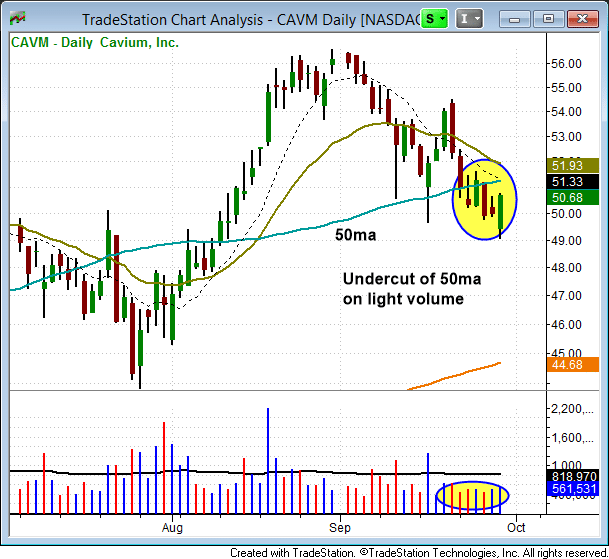

Cavium Networks ($CAVM) is still in pullback mode after failing to hold the low of a bullish reversal candle created on 9/16. However, the recent dip below the 50-day moving average has come on lighter than average volume, suggesting that there are no more sellers around:

Monday's reversal candle action off the gap down was bullish. The open was below a range low, with the close near the highs of the session and above Friday's high.

We look for $CAVM to follow through to the upside and eventually reclaim the 50-day MA. Subscribing members should note our exact buy trigger, stop, and target prices for this swing trade setup in today's newsletter.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|