- Market: April 2006 E-mini S&P (ESJ6)** April Options trade based on the June futures price (ESM6)

- Tick value: 1 point = $50.00

- Option Expiration: 04/21/06

- Trade Description: Buy a Put and turn it into a "Free Trade"

The "free trade" is a trade design that was made popular in the 1980's and 1990's by David Caplan. He has written a number of books on the subject over the years.

Buy one April 2006 E-Mini S&P 1300 put for 10 points ($500) or less to open a position. Then within the next 7 trading days sell a further out of the money put for the same 10 points after the market has moved in the expected direction. For example: if the S&P moves down to roughly 1290 then you should be able to sell a 1270 put for at least the same 10 points that the 1300 was bought for. This would then leave you with a 30 point spread with no risk! If the on the other hand the market does not move in the expected direction, close the trade out when the value of the put that was purchased equals 5 for a $250 loss.

Technical / Fundamental Explanation

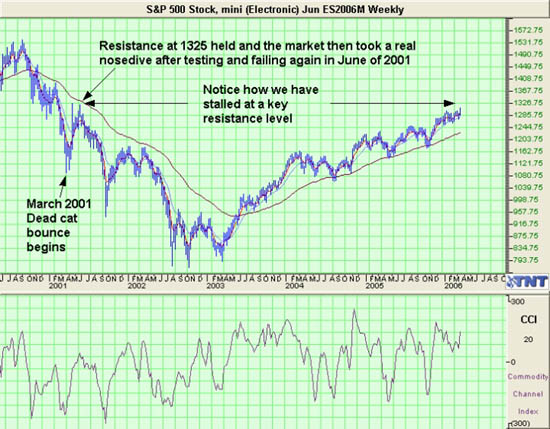

Stocks continue to try to push higher. Friday's expiration looked and felt like a market that was at least temporarily topping. So far the market has been unable to break out above 1325. This was a significant point back in 2001. For those who don't remember, 1325 was the top of the "dead cat bounce" that began in March of 2001. This bounce carried the S&P from a low of 1088 in March to a high of 1325 in April. It then spent the rest of the spring trying to get back above 1325. When in June it failed to make it to 1320 the market turned and really broke down from there. This trade is designed to catch a pull back below 1300 on the S&P while keeping costs and risk low and limited.

Profit Goal

Max profit assuming that the the "free" trade was completed is the spread between the option that was bought and sold. (Using the above example again it would be a 30 point spread--> 1300-1270=30). 30 points is $1500. So if the free trade is completed you should have a trade that is risking zero that can make $1500 if the S&P is below 1270 at expiration.

Risk Analysis

Max risk assuming that the free trade is NOT completed is $500 but as I mentioned above, should the value of the option that is purchased fall to 5 points ($250) or below close out the trade.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.