- Market: May 2006 CBOT Wheat (WK6)

- Tick value: 1 cent = $50.00

- Option Expiration: 04/21/06

- Trade Description: Bull Call Spread

- Max Risk: $250.00

- Max Profit: $750.00

- Risk Reward ratio 3:1

Buy one May 2006 Wheat 360 call, and sell one May Wheat 380 call, for a combined cost and risk of 5 cents ($250.00) or less to open a position.

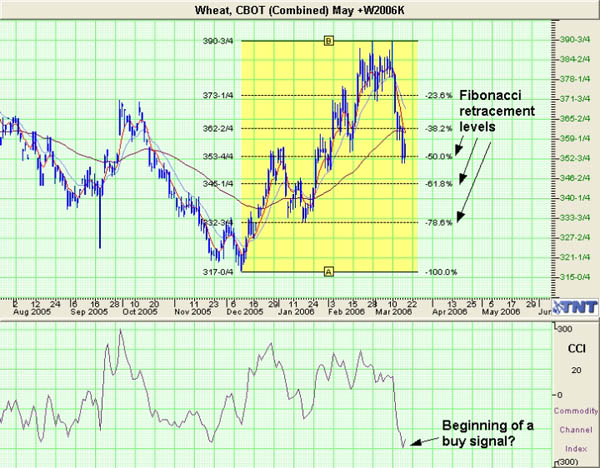

Technical / Fundamental Explanation

This is a simple bull call spread that is betting on a bounce or rebound in the Wheat market over the next 30 days. Wheat has a different crop year than the rest of the grains. Right now is harvest season for wheat. The slide we have seen in wheat prices is normal at this time of year when more and more wheat is coming to market. We typically see this trend develop at this time of year and just like other grains we usually bounce off of the " harvest lows" and begin a rally as more and more stocks of wheat are drawn down. I expect to see this play out in wheat over the next 30 days. We have strong support near the 345 level which coincidently is the 61.8% Fibonacci replacement level. I look for strong support at or near 345 to hold and a rally to begin once we test that support level.

Profit Goal

Max profit assuming a 5 cent fill is 15 cents ($750.00) giving this trade a 3:1 risk reward ratio. Max profit occurs at expiration with the Wheat trading anywhere above 380. The trade is profitable at expiration if the Wheat is trading any where above 365 (break even point).

Risk Analysis

Max risk assuming a 5 cent fill is ($250.00). This occurs at expiration with Wheat settling below 360.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.