- Market: May 2006 Natural Gas (NGK6)

- Tick value:1 point = $10.00

- Option Expiration: 04/25/06 Note: this trade is short term on purpose.

- Trade Description: Bull Call Ladder Spread

- Max Risk: $400

- Max Profit: $1600

- Risk Reward ratio 4:1

Buy one May 2006 Natural Gas 7.70 call, also buy one May Natural Gas 8.30 call, while selling one May Natural Gas 7.90 call, and also selling one May Natural Gas 8.10 call, For a combined cost and risk of 40 points ($400) or less to open a position.

Technical / Fundamental Explanation

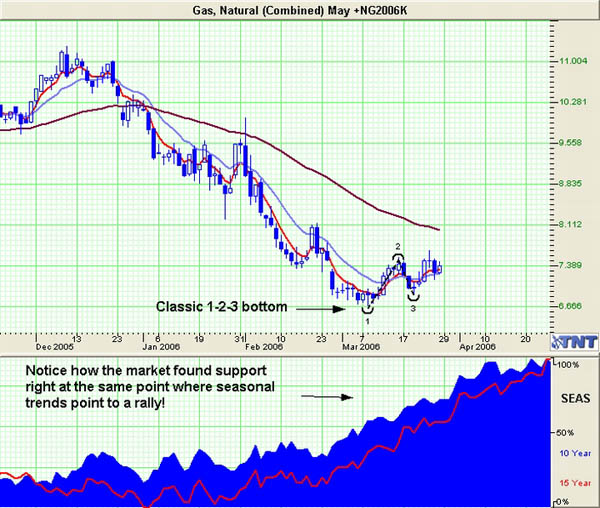

Natural Gas has supported out above 6.70 over this past month and has begun clawing its way out of an oversold condition. This market is finally coming out of a bear phase that began in early December 2005 when the market began selling off from its highs that topped out above 11.00. Natural Gas is trading just above where it was last year at this time. With substitutive commodities trading much higher at this time and the overall sensitivity of the energy markets, the likelihood of Natural Gas trading higher over the next month is greatly increased. We are headed into Spring and supply concerns will once again be the topic of the day as the air-conditioners begin to hum in the Midwest and the chatter about the next Hurricane season starts to litter the airwaves.

Profit Goal

Max profit assuming a 40 point fill is 160 points ($1600) giving this trade a 4:1 risk reward ratio. Max profit occurs at expiration with Natural Gas trading between 8.10 and 8.30. The trade is also profitable at expiration if the Natural Gas is trading any where between 7.74 and 8.26 (break even points) which means we have a band of 520 points in Natural Gas that we can profit in.

Risk Analysis

Max risk assuming a 40 point fill is ($400). This occurs at expiration with the Natural Gas trading below 7.70 or above 8.30.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.