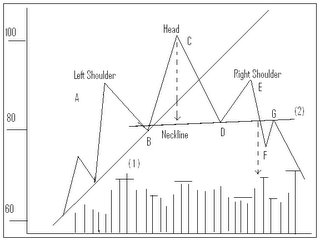

To arrive at a price objective, the trader can base his decision on the height of the pattern. Look at the head and shoulders reversal pattern graph below. Our trader starts with the vertical distance (dotted line) from the head (Point C) to the neckline. Then he projects that distance down from the point where the neckline is broken. Since the top of the head is at 100 and the neckline is at 80, there is a vertical distance difference of 20. So the trader projects down 20 from the point where the neckline is broken at 82, making the downside objective 62.

Another technique used to find a price objective is measuring the length of the first wave of decline (from Points C to D) and then double it. In both methods, the greater the height or volatility, the greater the objective. It is easily seen, as stated in our previous article about trendlines, that the measurement taken from the trendline penetration is similar to that used in the head and shoulders pattern. Prices travel about the same distance below the neckline as they do above it. Generally, most price targets on the bar charts are based on the height or volatility of the pattern. Measuring the height of the pattern and projecting that distance from a breakout point is a theme that is constantly repeated.

Remember that the objective arrived at here is only a minimum objective. In uptrends and downtrends alike, having a minimum target helps the Swing Trader, Options Trader, and Day Trader determine ahead of time if there is enough potential in the market move to take a position. Often prices move far beyond the objective which is icing on the cake. The maximum objective is the size of the prior move. So if the previous market went from 30 to 100, the maximum downside objective would be a complete retracement of the entire upmove all the way down to 30.

Andy Swan is co-founder and head trader for DaytradeTeam.com. To get all of Andy's day trading, swing trading, and options trading alerts in real time, subscribe to a one-week, all-inclusive trial membership to DaytradeTeam by clicking here.