- Market: June 2006 Live Cattle (LCM6)

- Tick value: 1 point = $400

- Option Expiration: 06/02/06

- Trade Description: Bull Call Spread

- Max Risk: $400

- Max Profit: $1200

- Risk Reward ratio 3:1

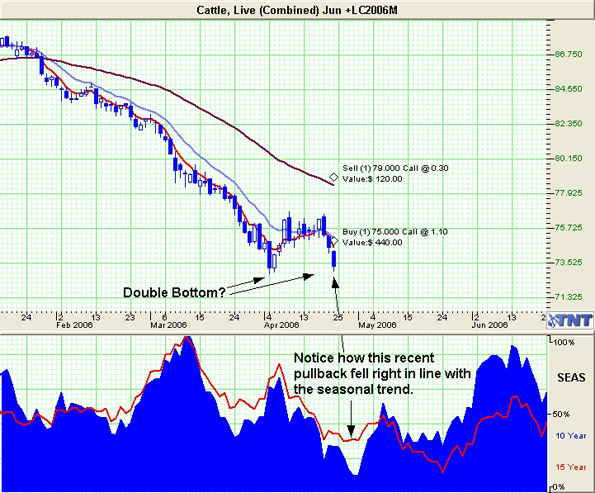

Buy one June 2006 Live Cattle 75 call, and sell one June Live Cattle 79 call, 1.00 point ($400) or less to open a position.

Technical / Fundamental Explanation

Cattle has fallen like a hot knife through butter for all of 2006. We are building what looks like a double bottom at this time. Seasonally cattle is quite strong through the month of May, as shown on the bottom of the chart below. While there has been some talk of Mad cow and other problems, we are entering the beginning of the BBQ season(especially here in the south) and that is one of the reasons we often see a seasonal pick up in demand. No mad cow scare is going to keep an American away from a burger grilled outdoors. We have been calling for this new up trend for a few weeks (reference previous O&F News & Views) and the recent sell off only provides us with a lower entry point thereby increasing probability of profits if support holds.

Profit Goal

Max profit assuming a 1 point fill is 3 points ($1200) giving this trade a 3:1 risk reward ratio. Max profit occurs at expiration with Live Cattle trading anywhere above 79. Break even point at expiration is 76.00.

Risk Analysis

Max risk assuming a 1 point fill is $400. This occurs at expiration with the Live Cattle trading below 75.00.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.