- Market: July 2006 Gold (GCN6)

- Tick value: 1 dollar move = $100

- Option Expiration: 06/27/06

- Trade Description: Bull call butterfly spread

- Max Risk: $900

- Max Profit: $4100

- Risk Reward ratio 4:1

Buy one July 2006 Gold 650 call, also buy one July Gold 750 call, while selling two July Gold 700 calls, for a combined cost and risk of 9 dollars ($900) or less to open a position.

Technical / Fundamental Explanation

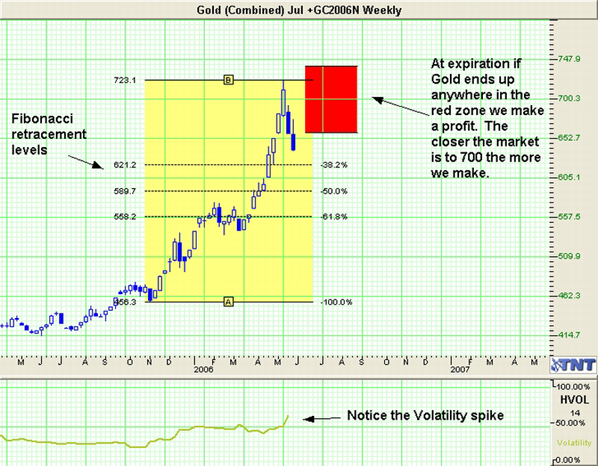

Gold has been grabbing headlines for months now. This bull market is on fire and the correction we saw today only strengthens that case. Today's slide happened the day before June options expiration. Anyone who thinks this is a coincidence has not been around these markets for very long. This is a typical move for any market that is facing options expiration, that is why they call option expiration "witching day" in the stock market. This bull is far from finished. Continued unrest around the world coupled with stock markets that could very likely be entering a new bearish phase could push this metal back above the Hunt Brothers highs before the end of the year. This trade is a short term long trade that has a very large range in which it can profit. We may slide a bit more in the near term but the reversal, when it comes, will be very strong and fast. A move back to 620 would be a 38.2 fib retracement on the weekly chart. If at expiration the gold market is anywhere between $659 and $741 we would make at least some profit. How often can you put a bull trade on that gives you a profit range that is 82 dollars wide? This is one of the only ways we could find that allows you to be long a near the money call while at the same time keeping overall risk below $1000. Volatility is extremely high right now due to these violent swings and simple bull call spreads are costing too much while offering too low of a delta and risk to reward ratio to be attractive at this time.

Profit Goal

Max profit assuming a 9 dollar fill is 41 dollars ($4100) giving this trade a little more than a 4:1 risk reward ratio. Max profit occurs at expiration with Gold trading at 700. The trade is profitable at expiration if Gold is trading any where between 659 and 741 (break-even points) which means we have a band of 82 dollars that we can profit in

Risk Analysis

Max risk assuming a 9 dollar fill is $900. This occurs at expiration with the Gold trading below $650 or above $750.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.