The Fed tells us that whether or not they continue to hike short-term rates is now dependent upon the data. Since that has always been the case (I mean, has there ever been a time when they ignored the data?), what they are really saying is "We are not really sure what we are going to do at the next meeting, so we will look at the recent data and make up our minds at that point."

I actually find that rather hopeful. In the past, it has been typical for the Fed to just keep raising rates until the economy is on the way to or already in a recession or a serious slowdown. Since the economy has been doing just fine of late and, as we will discuss later, inflation is running high enough to make a Fed governor uncomfortable, then past performance would indicate that they would continue on their rate-hiking mission.

It takes 12-18 months for interest rate hikes to actually have an effect on the economy. Thus, there is a considerable amount of lag time between Federal Reserve interest rate actions and the results being seen in the economy. So, not only will the Fed be looking at current data, which reflects actions taken over a year ago, but they will be analyzing forward-looking projections as well.

With that in mind, this week we will look at some of the data the Fed will be watching over the next month to decide whether to raise rates yet again or to pause. This is of more than trivial concern, as rising rates will significantly affect the housing markets. And that affects consumer spending. And if consumer spending slows, then so will the economy.

Consumers Under Pressure

As I have written in the past, there is a very tight correlation between consumer spending and housing prices. But the recent Bank Credit Analyst shows us an even tighter correlation between consumer spending and housing activity (as measured by the National Association of Homebuilders Housing Market Index).

Notice that as the housing index falls, so does consumer spending. And we should expect the housing index to fall, as housing affordability has dropped to the lowest level since 1990. Let's look at this analysis and chart from the always insightful Paul Kasriel, chief economist of Northern Trust:

Housing Affordability Drops

"The National Association of Realtors released its monthly housing affordability index today. The April reading dropped 3.3 points from March to a level of 108.6 - the lowest since July 1990. Although rising interest rates have played a role in recent months making housing less affordable, it certainly is not the level of interest rates that has brought the April affordability index down to 1990 levels. In April 2006, the commitment rate on a 30-year fixed mortgage was 6.51%; in July 1990, the commitment rate was 10.04%. In April 2006, the median price of an existing single-family home was 5.9 times the median family income; in 1990, it was 2.7 times the median family income. So, the run-up in real estate values relative to income to record highs is the driving force behind the sharp decline in housing affordability. Interest rates are unlikely to plunge in the near term. So, either median family incomes have to rise rapidly or housing prices have to fall rapidly to make housing more affordable again. Although I am not predicting a rapid fall in home prices, I do believe that there is a better chance that home prices will be the factor improving the affordability of housing in the next couple of years rather than rising median family incomes."

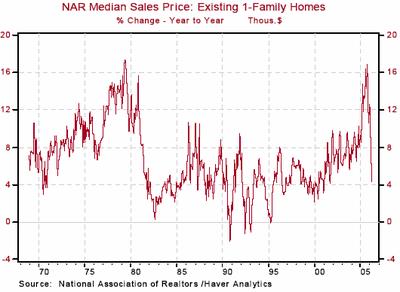

And while we are on the subject, let's look at four great graphs on the housing market from Northern Trust, brought to my attention by friend Barry Ritholtz, along with his comments:

"Median Home Sale Price: Putting aside for the moment the issue of 'median' (it gets skewed when too many high end or entry level houses are the dominant movers) the chart shows rapid deceleration of price gains. I expect to see more of this over the next few quarters, as Sellers and Buyers engage in a stare down, as Sellers continue to gradually lose pricing power.

"New Home Inventory: What can you say about this? Builders have created huge inventory. It's no surprise that the enormous increase in Supply has impacted prices (Demand). On this 45 year chart, the recent rise (since 2003) is historic!

"Single Family Home Sales: The long uptrend in Sales has broken; I do not know how far it retraces, but I imagine it will continue to do so as mortgage rates tick higher or the economy cools (or both)." [or because housing is less affordable -JM]

"Mortgages Apps: Another long uptrend broken; Same story as above: Higher rates mean less sales and refinancing. The one mortgage bright spot I see is the refinancing of ARMs into fixed rate loans."

David Berson from Fannie Mae Economics notes:

"Housing continues to weaken, although it's not collapsing. Most of the latest data on housing activity show that this sector continues to weaken, with starts and existing sales both falling in April (and even the rise in new home sales last month wasn't a sign of significant strength). With mortgage rates edging upward, economic growth moderating, and home price appreciation slowing (and in some areas falling, thus reducing investor demand), the prospects of a bounce-back for the housing market this year appear to be dim. Still, the decline in housing activity over the first third of the year, and projected by us for the remainder of 2006, suggests that this will still be one of the strongest years ever for home sales."

While there will be other housing data to come out between now and the June 28-29 Fed meeting, it is unlikely to show anything other than what we can see above. The housing market is clearly starting to slow down. Home price increases are moderating in most areas and falling in others.

I wrote last August 26 about Alan Greenspan's speech at Jackson Hole. It is worth revisiting briefly. The first paragraph is a direct quote from Greenspan's speech, and the next two paragraphs are my comments:

" 'The determination of global economic activity in recent years has been influenced importantly by capital gains on various types of assets, and the liabilities that finance them. Our forecasts and hence policy are becoming increasingly driven by asset price changes.'

"Read that last sentence again. I have been writing for months that I think the Fed is targeting asset prices, and specifically home prices. They are worried about a bubble creating problems in the economy.

"And now, Greenspan says above they are targeting asset prices. Can it be any clearer? You think they are worried about a stock market bubble? Commodity or gold prices? What other asset price is driving Fed policy? I think they perceive the greatest risk to be a continued housing bubble, and they are going to move to do what they can to slowly let the air out of the bubble."

If the housing market as an asset bubble was of concern last summer, it should not be this summer. The concern should be that it does not break. As Fannie Mae noted, the market is softening but is not collapsing. For the Fed, that should be exactly where they want things. Here we can take some comfort in the fact that in Australia and England, which had even crazier housing markets than the US, both had very soft landings in their housing markets in terms of prices. The Fed is not on a mission to lower home prices, just to slow the growth in them. I think we can say on that front, "mission accomplished."

Who Stole My Job Growth?

Headline job growth for May came in at just 75,000 jobs, substantially less than the 175,000 new jobs expected. And a worrisome trend is starting to develop. This is the fourth month in a row that we have seen downward revisions to previous months. Construction added just 1,000 jobs, manufacturing was down 14,000. Health care and private educational services each added about one-quarter of the job growth.

Buried in the data was news that earnings were quite weak as well. Hourly earnings were only up 0.1%, but the average work week was down 0.2%, so actual weekly earnings were down by 0.2%.

This highlights a problem that was also the subject of another graph from Bank Credit Analyst. (Thanks to Martin Barnes for permission to use this, as well as his insights. BCA is something I consider essential reading.)

Spending on essential items is rising rapidly in recent years, as energy prices and housing costs are rising. This means there is less money for discretionary items. Look at the charts:

Slower wage growth. Less discretionary money available. A slowing housing market. The saving rate already so low that there is not much room for it to drop. It all sounds like there is the serious potential for a consumer spending slowdown that could lead to an economic slowdown later this year.

There are other pieces of data that suggest the economy is due to slow down. The ISM (Institute of Supply Management) manufacturing data came out on Thursday and was much lower than expected. The manufacturing sector grew once again in May, but the rate of growth as measured by the PMI slowed somewhat during the month. The slower growth is evidenced by a significant loss of momentum in the last four months, as the New Orders Index has slipped from 61.9% in February to 53.7% in May. Prices, driven by raw materials costs, are a concern that was expressed by many of those surveyed. Prices have risen for ten months and are rising at an even faster pace. 56% of those surveyed said prices were higher than the previous month. The index is up to 77 from an already high 62.5 in just the last four months, indicating some potential inflationary pressure building up. (More on prices and inflation below.)

You can look at the chart of Leading Economic Indicators from the Conference Board and see that it is trending down. Dennis Gartman has brought to our attention another statistic that he thinks is even more useful as a predictor of future slowdowns and recessions. The Conference Board tracks leading, coincident, and lagging indicators. Dennis has found a close correlation between recessions and the ratio of the coincident to lagging indicators. (I have written about this in past letters.)

Noting the weak ISM numbers, he writes:

"We've said many times regarding the ISM that as long as it remains above 50 we shall tend to be optimistic about the future prospects for the US economy; however, we wish to revise that somewhat this morning. Now, not only must the ISM remain above 50, but it must hold this uptrend line. We fear that it won't.

"This is all the more important in light of the fact that the Ratio of the Coincident to Lagging Indicators topped out months ago, requiring that we go on record as stating that the US economy shall reach its peak and move into a quiet recession sometime in the last 3rd quarter or early 4th quarter of this year. We've said this many times previously. We stand by that statement. The relative 'weakness' of the ISM report serves only to strengthen our view."

With all of the above, it should be no surprise that consumer confidence is down in a number of surveys. The stock market has been down. So when the poor jobs report came in today, the bond market immediately moved huge on the news, as the assumption is "How can the Fed raise rates with a slowing job market, not to mention all the other problems noted above?" Ten-year interest rates dropped to 4.99%. The yield curve once again starts to flatten.

Who's Afraid of Inflation?

Is it all over? Is the Fed finally ready to pause or even stop in its rate-hiking pursuits? Maybe. And maybe not. Before we close for the day, there are a few more statistics we need to look at.

Contrary to rumors, inflation is not yet dead. The latest data released May 17 shows inflation to be running at 3.55%. "Core" inflation, which is inflation without food or energy, is 2.3%. However you slice it, that is above the Fed's comfort zone.

The problem is that most of the growth in inflation has been since the first of the year. If you take the first four months of 2006 and annualize core inflation, it is hovering around 5%. Total inflation on the same annualized basis would be over 7%. These are not trends that a central banker likes to see on his watch, let alone a new Fed chairman who has yet to prove his inflation-fighting mettle.

Why has inflation risen so much of late? Part of it is how they calculate the housing component. Rather than use actual housing prices, they use "equivalent rent." VERY roughly speaking, since fewer people can afford to buy homes, we are seeing more people rent and apartment vacancies drop. This means the rent people pay is actually rising. Since this is 39% of the CPI, it makes a difference. Look at this chart from Gary Shilling:

Gary notes that the Fed's favorite inflation indicator, the personal consumption deflator, uses housing prices and not equivalent rents and thus did not spike in April. But it is still at just under 3%, with the "core" hovering at 2%.

The next Fed meeting is June 28-29. On June 14 we will see the May inflation numbers (8:30 AM). Given the significant rise in the ISM prices data (see above), there is reason to think the recent trend in inflation may persist. We will know in 11 days.

If we see an inflation number for May that continues the recent rapid rise in inflation, the Fed may feel they have no choice but to raise rates yet again, even in the face of data which suggests the economy is slowing. A central bank is nothing more than its inflation-fighting reputation. If they fail to raise rates and inflation continues to rise, they will soon find themselves in a position of having to raise more than they would really like, and risk putting the economy into a real recession.

Or, they could pause and see if a slowing economy will naturally lower the inflation rate. I personally think we will see inflation trend back down during what I think will be a slowdown in the latter part of this year and the first part of next year.

For what its worth, and it's not worth much, I think the Fed will raise rates in June once again. The inflation data will give them the impetus to do so, and then they have six weeks to sit back and watch until the August 8 meeting. Stay tuned.

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. Contact John at John@FrontlineThoughts.com.

Disclaimer

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions.