Energies

Strength in energies persisted this week despite a new UN proposal to Iran to potentially resume talks for stopping uranium enrichment. While several political analysts suggest this is a substantial effort with a high probability of success, Iran has yet to offer a shred of evidence to support the idea that monetary incentives or penalties will override their nuclear ambitions. The mere idea that this proposal has been given a rough timeline of a few weeks puts psychological pressure on the energy complex and sets up a potential break to new highs. Long time readers of the WCR know that I am a long term bear in energies, as I do not see the permanent fundamental shift that would sustain these prices indefinitely. However, the technical and short term seasonal and fundamental setup suggests a new high will be seen if the July crude contract sees a price break through 72.05. With that resistance level broken, only the highs at 76.40 stand in the way of this market seeing further upside given past breakout moves (see WCR 4/21). I remain long with a reversal coming between $77-$82 (albeit a wide range). The market will likely offer excellent call premium collection on a quick move to $78 or so and I would recommend short 85 calls for August or even September on such a move.

Financials

My 1257.50 support was temporarily broken on an intraday basis, but the overall technical support in the market has held up and suggests consolidation once again in the stock market. Key resistance just above 1285 and key support at 1255 will be significant indicators in the weeks ahead. The bond market surged this week on the employment data and views that the likelihood of a June hike is now around 50%. I have two issues here. First, the flattening of the yield curve gives the Fed what they truly desire ââ,¬â€ś a rising interest rate without significant exposure on the 30yr. to hold back a housing crash. Second, while Bernanke is no Greenspan, we have seen no true sign of an end hikes through any recent Fed speak. In fact, the Fed has actually made mention of significant concerns in several key areas that would not necessarily be fixed by any one economic report. I fade this bounce and look for the lows to be tested ââ,¬â€ś the Fed may be one and done but the gut says 50 basis points before it is all over. That means bonds at 102. The dollar choppiness falls in line with expectations that the straight to a triple test of 80.50 is unlikely, and the early support is likely to bounce this market to at least 87. This is a great opportunity for a defined risk put play in the euro. The Canadian needs to break 8997 to turn bearish, but the potential for a head and shoulders is looking better by the day.

Grains

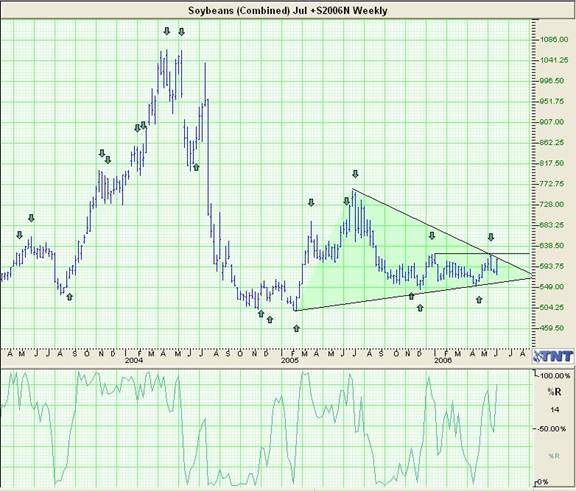

A warm and dry 6-10 day forecast sent grains surging on Friday. Weather rallies like this should be expected, but strong Monday failures should as well. Regardless of my technical view of lower prices in the near term, good trade logic says expanding volatility in grains combined with discounted option premiums makes for a great long strangle play across the grain spectrum (beans in particular). The crop production and WASDE reports on Friday will be significant, but the weather is the issue here. Everyone knows the wheat crop is garbage and that the entire grain market is exposed to a dry summer. What matters is whether we are actually going to get the dry summer.

Meats

Live cattle continues to push higher on lighter than expected volume, but a short covering run is not out of the question. I stay long with trailing stops until the market pushes me out. Monday will be a key indicator after the fresh high were set Friday, as June option expiration and first notice may have offered a false indicator ââ,¬â€ś but the gut says higher prices in the near term. Hogs are approaching a couple of key resistance points and I would pull futures and replace them with OTM calls to hedge risk and continue the volatility play to the upside.

Metals

Metals have begun a major technical failure, but the inability for the market to close near intraday lows on big down surges and high volume buying on these dips means (as much as it pains me to suggest it) funds are holding this market up. The longer you see this pattern without a major rally, the greater the potential for a long liquidation fallout if and when it fails. A dollar surge could ruin metals traders in the near term ââ,¬â€ś watch out.

Softs

OJ prices have sustained themselves near the highs. Logic would tell you that the market is wholly dependant on the timing and relevance of the hurricanes and hurricane warnings in the upcoming season. Long strangles or ratio breakout spreads are recommended now. Coffee is at a critical price area, and the gut is screaming to buy Sept. bull spreads and some OTM puts (as a cheap hedge) to play the impending volatility. Cocoa prices are a value buy, with the break through 1550 last month key to confirming a long term bull trend here. Cotton has some changing fundamentals, but bottom line is the bear view is more probable. Sugar prices fell through key support and any repeat move below 15 would be a serious indicator of pending failure. I am a technical buyer above 15 with a double stop reversal below. Lumber is so technically ugly that it is due for a dead cat bounce, but jump short if that opportunity arises.

James Mound is the head analyst for www.MoundReport.com, and author of the commodity book 7 Secrets. For a free email subscription to James Mound's Weekend Commodities Review and Trade of the Month, click here.