- Market: July 2006 Euro Currency (ECM6)

- Tick value: 1 point = $12.50

- Option Expiration: 07/07/06

- Trade Description: Bull Call Ladder Spread

- Max Risk: $300

- Max Profit: $950

- Risk Reward ratio 3:1

Buy one July 2006 Euro Currency 128 call, also buy one July Euro Currency 131 call, while selling one July Euro Currency 129 call, and sell one July Euro Currency 130 call. For a combined cost and risk of 24 points ($300) or less to open a position.

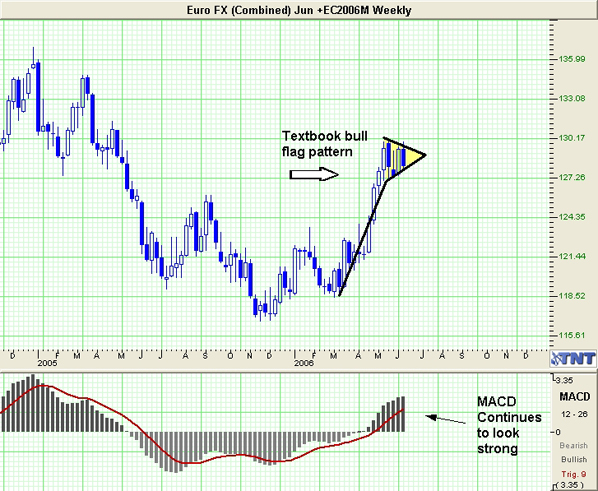

Technical / Fundamental Explanation

We just exited our June Euro put spread for a little more than a 200% return in 11 trading days. As I mentioned in the June spread, I remain a longer-term bull of this market. Today's breakdown is nothing more than a shakeout of the longs one day before June's option expiration, coincidence?...I think not. We may break down a bit more in the coming days but by then end of this month I expect to see this market back towards 1.30. Mr. Bernanke may have spooked the markets but it is nothing more than the typical over reaction that we are seeing in the Dollar. The ECB did surprise us by only raising rate by .25 point rather than the .50 point that was expected. While this story was spun as bearish, I believe that as a whole the European's financial house is in better order than here in the US and we should see that reflected in the currency exchange rates as this becomes more evident. Overall this trade offers a solid risk to reward ratio and a great low and limited risk way to buy this low in the Euro. As usual I recommend banking the profits from the June trade we exited today and reinvesting the original capital from it back into this July spread.

Profit Goal

Max profit assuming a 24 point fill is 76 points ($950) giving this trade a little more than a 3:1 risk reward ratio. Max profit occurs at expiration with Euro Currency trading between 129 and 130. The trade is profitable at expiration if the Euro Currency is trading any where between 128.24 and 130.76 (break even points) which means we have a band of 252 points in Euro Currency that we can profit in

Risk Analysis

Max risk assuming a 24 point fill is $300. This occurs at expiration with the Euro Currency trading below 128 or above 131.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.