- Market: July 2006 Silver (SIN6)

- Tick value: 1 cent = $50

- Option Expiration: 06/27/06

- Trade Description: Bull Call Butterfly Spread

- Max Risk: $500

- Max Profit: $4500

- Risk Reward ratio 9:1

Buy one July 2006 Silver 12.00 call, also buy one July Silver 14.00 call, while selling two July Silver 13.00 calls, for a combined cost and risk of 10 cents ($500) or less to open a position.

Technical / Fundamental Explanation

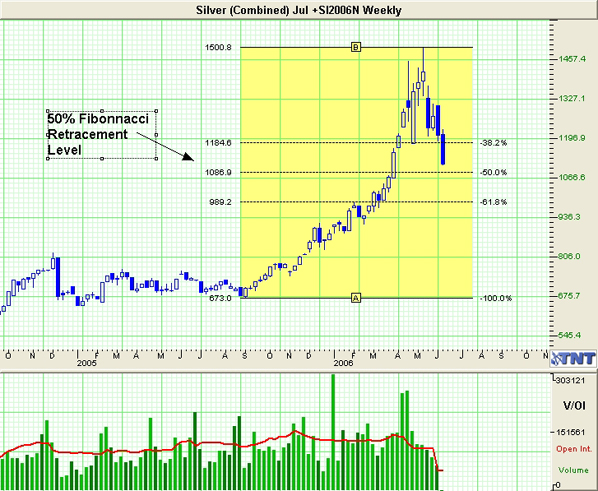

Metals have been selling off for many weeks now and we are nearing a solid support levels in many of these markets. Notice on the chart below that we have all but hit the Fibonacci 50% retracement level. Silver has, as usual, been the most volatile of the group and this volatility is expected to continue in the near term. This trade is a short-term bull trade that offers an unusually high risk to reward ratio of 9 to 1. This trade gives us a unique opportunity to buy a support level and bet on a solid bounce or recovery in metals. After the bloodbath that we saw in silver today this trade is a much "safer" way to buy this dip than outright futures. This trade is also attractive because it has a 180 cent profit range between 12.10 and 13.90.

Profit Goal

Max profit assuming a 10 cent fill is 90 cents ($4500) giving this trade a 9:1 risk reward ratio. Max profit occurs at expiration with Silver trading at 13.00. The trade is profitable at expiration if the Silver is trading any where between 12.10 and 13.90 (break even points) which means we have a band of 180 cents in Silver that we can profit in

Risk Analysis

Max risk assuming a 10 cent fill is $500. This occurs at expiration with the Silver trading below 12.00 or above 14.00.

Matt Odom is the Managing Partner and Energy Analyst and Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.