- Market: July 2006 Dow (DJN6)

- Tick value: 1 point = $10

- Option Expiration: 07/21/06

- Trade Description: Bear Put Butterfly Spread

- Max Risk: $500

- Max Profit: $2500

- Risk Reward ratio 5:1

Buy one July 2006 10,800 Dow put, also buy one July 2006 10,200 Dow put, while selling two July 2006 10,500 Dow put, for a combined cost and risk of 50 points ($500) or less to open a position.

Technical / Fundamental Explanation

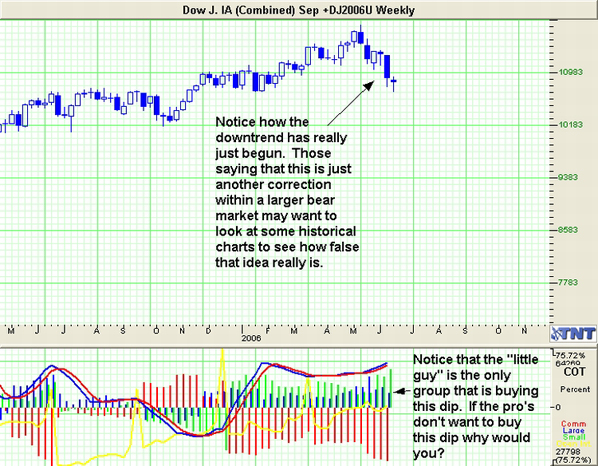

We just exited our June Dow put spread for a 400% return in about three weeks. As we did with the Euro trades last week, I recommend banking the profits and reinvesting the principle back into this put spread. I continue to be bearish the stock market as a whole. We are now in a very bearish environment for stocks. The path of least resistance remains down. While we are seeing a bounce today I am using it as an opportunity to enter this spread. We may bounce a bit more in the short term but this is nothing more than the classic "dead cat" bounce that I have mentioned before. I am not expecting this market to free fall but rather a slow grinding action that builds a bear flag on the daily charts over the next few weeks. This trade also carries us through the next Fed. meeting which is sure to set off some fireworks no matter what Mr. Bernanke decides to do. Also notice that the small spec. position on the Commitments of traders report is showing that the "little guy" has been buying this market all the way down. Is there anyone left who thinks the little guy knows something that the rest of us don't? This is also a great trade for all of you still holding long stocks or mutual funds. Please head this second warning and protect yourself with some "cheap" insurance.

Profit Goal

Max profit assuming a 50 point fill is 250 points ($2500) giving this trade a 5:1 risk reward ratio. Max profit occurs at expiration with the Dow trading at 10,500. The trade is profitable at expiration if the Dow is trading any where between 10,750 and 10,250 (break-even points) which means we have a band of 500 Dow points that we can profit in! * Contact us for more details.

Risk Analysis

Max risk assuming a 50 point fill is $500. This occurs at expiration with the Dow trading below 10,200 or above 10,800.

Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.