- Market: September 2006 Cotton (CTU6) *September options trade based on the December Futures price.

- Tick value: 1 point = $5

- Option Expiration: 08/17/06

- Trade Description: Bull call Spread

- Max Risk: $500

- Max Profit: $1500

- Risk Reward ratio 3:1

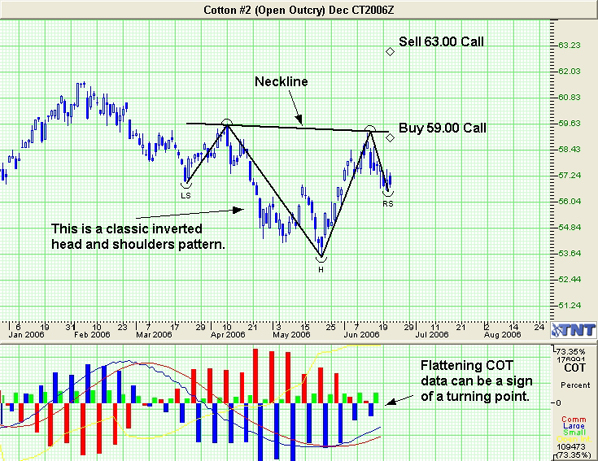

Buy one September 2006 59.00 Cotton call, and sell one September Cotton 63.00 call, for a combined cost and risk of 100 points ($500) or less to open a position.

Technical / Fundamental Explanation

Cotton has been a tough market to trade so far this year. This market has recently completed a classic inverted head and shoulders bottom formation and a bull call spread is the simplest way to position for the rally that we expect to be coming. Cotton has not participated in the overall rally in commodities and I believe this market will want to play along with the rest of us here before too much longer. Overall this trade positions us long for a break out above the neckline as shown on the chart below while keeping risk and costs defined and low.

Profit Goal

Max profit assuming a 100 point fill is 150 points ($1500) giving this trade a 3:1 risk reward ratio. Max profit occurs at expiration with the Cotton trading anywhere above 63.00. The trade is profitable at expiration if the Cotton is trading any where above 60.00 (break-even point).

Risk Analysis

Max risk assuming a 100 point fill is $500. This occurs at expiration with the Cotton trading below 59.00.

Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.