- Market: September 2006 Dollar Index (DXU6)

- Tick value: 1 point = $10

- Option Expiration: 09/08/06

- Trade Description: Bear Put Spread

- Max Risk: $500

- Max Profit: $2500

- Risk vs. Reward Ratio 5:1

Buy one September 2006 Dollar Index 85 put, while selling one September 2006 Dollar Index 82 put, for a combined cost and risk of 50 points ($500) or less to open a position.

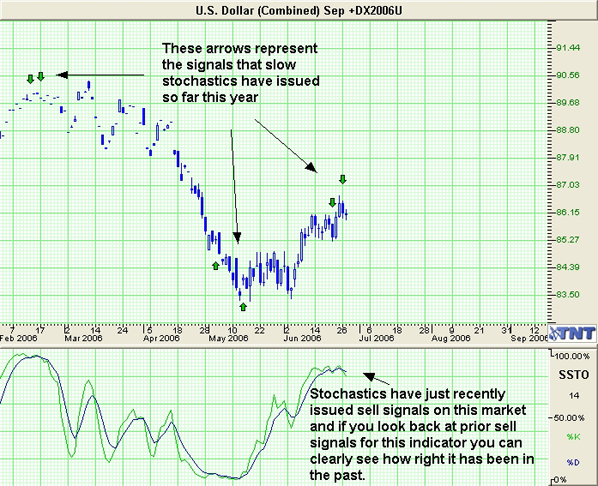

Technical / Fundamental Explanation

The Dollar index has been on a prolonged dead cat bounce for about two months now and we are seeing signs that the old buy the rumor and sell the fact idea is playing out here in perfect form. Traders have bid the dollar up in anticipation of tomorrows rate hike and like most markets we will likely see a counterintuitive move after we get the announcement. So people have bought the "rumor" of a rate hike and once the "rumor" become "fact" we will see traders begin to unwind the position in anticipation of the next meeting. Overall the prognosis of the Dollar, much like the stock market, is not good. With ballooning Debt and a Government desperate to deflate there way out of this huge problem the path of least resistance for the Dollar continues to be down over the longer haul. This is a simple bear put spread that give us the opportunity to be short the Dollar through the summer while keeping risks and cost low and defined.

Profit Goal

Max profit assuming a 50 point fill is 250 points ($2500) giving this trade a very attractive 5 to 1 risk reward ratio. the break even point on the trade at expiration is 84.50. We can profit on this trade no matter how low it goes as long as it finds its way below 85.00 over then next few months

Risk Analysis

Max risk assuming a 50 point fill is $500. This occurs at expiration with the Dollar Index trading above 85.00.

Derek Frey is Head Trader at Odom & Frey Futures & Options.

Disclaimer

Past performance is not indicative of future results. Trading futures and options is not suitable for everyone. There is a substantial risk of loss in trading futures and options.